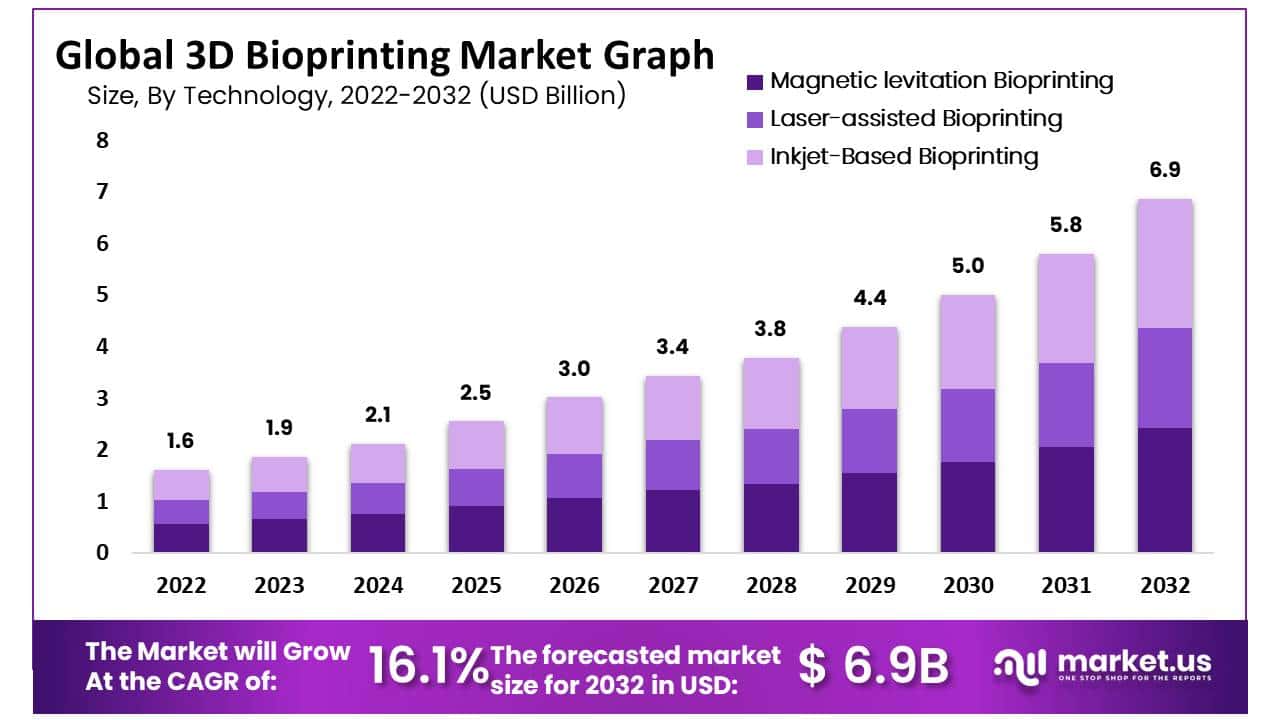

The global 3D Bioprinting Market size is expected to be worth around USD 6.9 Billion by 2032 from USD 1.6 billion in 2022, growing at a CAGR of 16.1% during the forecast period from 2022 to 2032.

In 2025, the 3D Bioprinting Market is accelerating as life sciences companies adopt bioprinted tissue models for drug development and precision medicine. Pharma and biotech firms are utilizing printed liver, heart, and tumor tissues to run preclinical toxicity and efficacy tests, reducing reliance on animal models. These platforms enable patient-derived cell cultures to predict treatment response more accurately.

Advances in multi-cell bioinks and vascularization printing support 3D models mimicking human physiology. With regulatory agencies encouraging alternative methods to animal testing, bioprinted models are moving from pilot labs to core platforms—delivering faster, more predictive preclinical insights and reducing time to clinic.

Click here for more information: https://market.us/report/3d-bioprinting-market/

Key Market Segments

By Technology

- Magnetic levitation Bioprinting

- Laser-assisted Bioprinting

- Inkjet-Based Bioprinting

By Materials

- Living Cells

- Extracellular Matrices

- Hydrogels

By Applications

- Medical

- Dental

- Bioinks

- Biosensors

Emerging Trends

- Adoption of vascularized bioprinted tissues for realistic organ-level drug screening.

- Use of patient-derived bioinks to personalize oncology and cardiac toxicity testing.

- Integration of 3D tissue platforms into pharma pipelines as standard preclinical assays.

- Collaborative development of standardized bioprinting protocols for regulatory acceptance.

Use Cases

- A biotech firm bioprints vascular liver tissue to test hepatotoxicity of new compounds.

- An innovative startup uses patient tumor organoids to screen chemo regimens before treatment.

- A pharmaceutical giant embeds cardiac tissue chips in compound libraries for arrhythmia risk assessment.

- A regulatory consortium pilots shared tissue standards to validate bioprinted models for widespread use.