Managing accounts payable can be a time-consuming task. Businesses often find it challenging to maintain accuracy and efficiency. That’s why many companies choose to outsource accounts payable to professional service providers.

Why Should You Outsource Accounts Payable?

Outsourcing accounts payable allows businesses to streamline processes. It reduces manual errors, improves payment cycles, and provides real-time reporting. By partnering with AR AP services, companies benefit from specialized knowledge and technology without hefty investments.

Benefits of Outsourcing Accounts Payable

Cost Savings: Outsourcing eliminates the need for in-house resources. It reduces operational costs while ensuring accuracy.

Expert Management: Professional AR AP services handle everything from invoice processing to vendor communication. This ensures compliance with financial regulations.

Improved Cash Flow: Timely payments and better tracking improve cash flow management, helping businesses stay financially healthy.

Choosing the Right AR AP Services

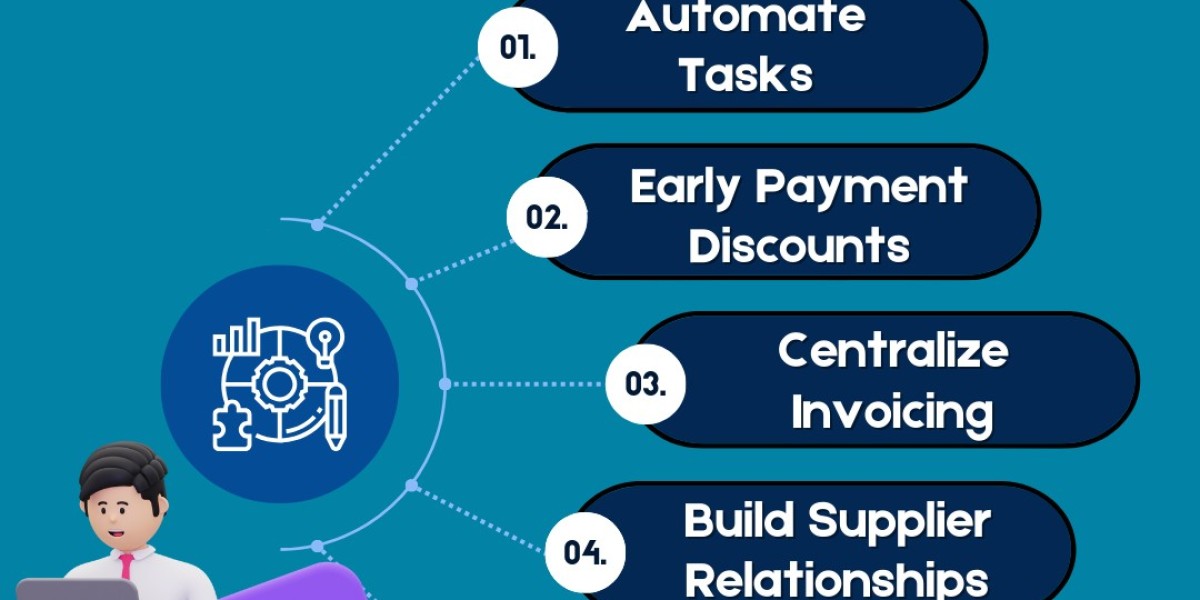

When selecting a service provider, focus on their experience and technology. Ensure they offer comprehensive accounts payable services, including automation tools and real-time reporting features. These aspects make sure your business operates efficiently while reducing overhead costs.

Conclusion

Choosing to outsource accounts payable gives businesses the flexibility and expertise they need. By leveraging AR AP services, companies can focus on growth while ensuring financial tasks are professionally managed.