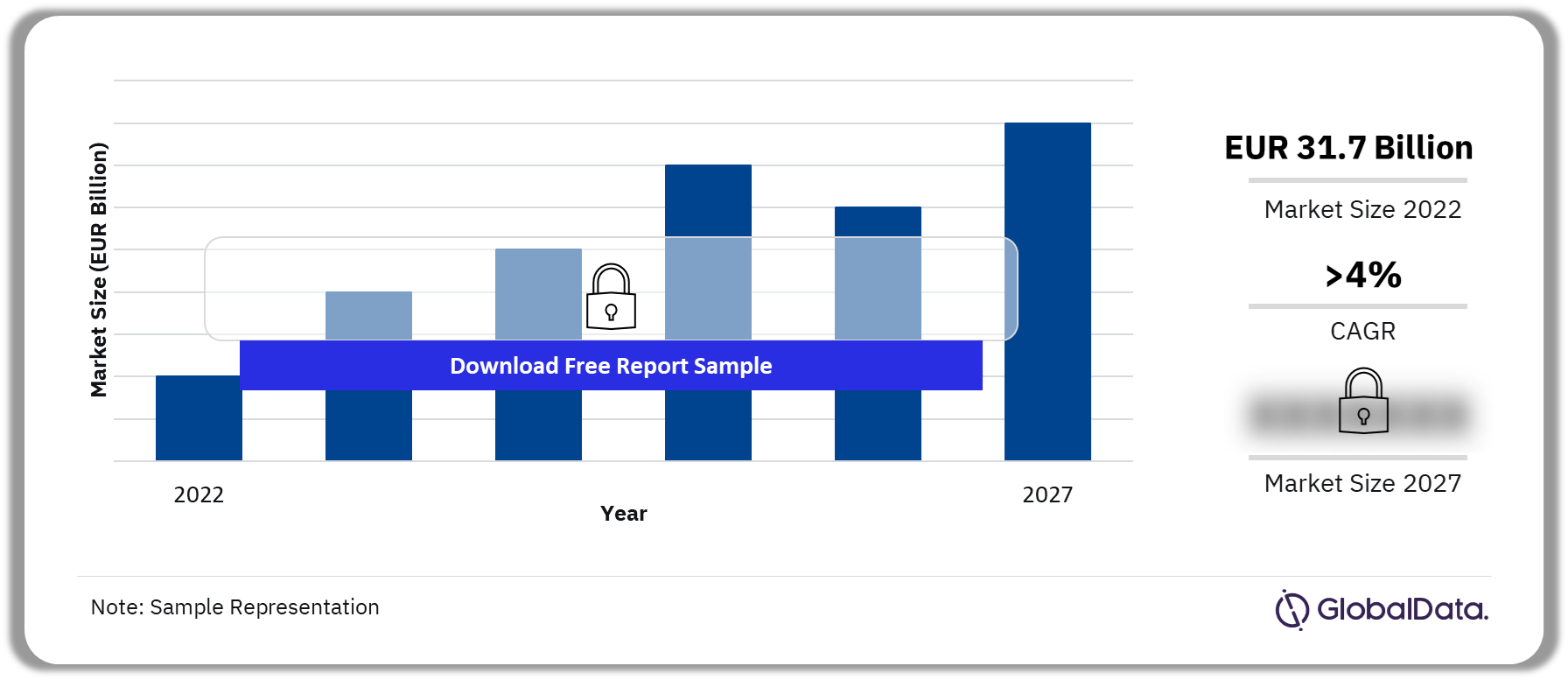

The Slovakia retail market has seen remarkable transformations in recent years, driven by evolving consumer preferences, technological advancements, and the country's growing economy. As one of the emerging retail sectors in Central Europe, Slovakia's retail market presents numerous growth opportunities for both local and international players. With increasing disposable income, rapid urbanization, and an expanding e-commerce landscape, the retail sector in Slovakia is poised for sustained growth.

Buy Full Report for More Insights into the Slovak Republic Retail Market Forecast

Key Trends Shaping the Slovakia Retail Market

Rapid Growth in E-commerce

E-commerce has emerged as one of the most significant trends in the Slovakia retail market. Consumers are increasingly turning to online platforms for their shopping needs, driven by convenience, competitive pricing, and the availability of a wide range of products. The COVID-19 pandemic further accelerated this shift as consumers preferred contactless shopping options. Online sales of consumer goods, fashion, electronics, and groceries have surged, creating new opportunities for online retailers.The rise of e-commerce is supported by the increasing internet penetration rate in Slovakia. A large portion of the population now has access to smartphones and high-speed internet, making online shopping easier and more accessible than ever. The government’s investment in digital infrastructure and the growth of secure payment systems have further contributed to the expansion of the e-commerce sector.

Changing Consumer Preferences

Slovak consumers are becoming more discerning and value-conscious. They are increasingly opting for products that offer better quality and reflect ethical values, such as sustainability and local sourcing. This shift is evident in the growing demand for organic products, environmentally friendly packaging, and locally produced goods. Retailers that cater to these changing preferences are better positioned to capture market share.Additionally, there is a growing focus on health and wellness among Slovak consumers. Health-conscious shoppers are gravitating towards products that promote wellness, such as natural foods, vitamins, and dietary supplements. Retailers are adapting their product offerings to meet these new consumer demands.

Expansion of Modern Retail Formats

The rise of modern retail formats, such as shopping malls, hypermarkets, and supermarkets, has played a crucial role in the development of the Slovakia retail market. Large retail chains continue to expand their footprint across the country, offering consumers a diverse range of products under one roof. These modern retail formats are increasingly replacing traditional brick-and-mortar stores, which struggle to compete with the variety and convenience offered by large retail chains.Additionally, the development of retail infrastructure, particularly in urban areas, has been a key driver for growth. As cities like Bratislava and Košice witness significant urbanization, the demand for modern retail outlets has grown, and with it, opportunities for real estate development.

Rise in Disposable Income

One of the critical drivers of the retail market in Slovakia is the rise in disposable income. Over the past decade, the country's economy has experienced steady growth, which has led to improved living standards and higher purchasing power. With more money to spend, consumers are seeking higher-quality products, contributing to the expansion of the retail sector.This increase in disposable income has been accompanied by a growing middle class, which is particularly interested in premium and branded products. Retailers offering luxury and mid-range products have seen rising demand, reflecting changing consumption patterns.

Growth Drivers in the Slovakia Retail Market

Foreign Investment in Retail

Slovakia's retail market is attractive to foreign investors due to its strategic location in Central Europe, stable economic environment, and access to neighboring markets like Austria, Hungary, and the Czech Republic. Global retail giants such as Tesco, Lidl, and Metro have established a strong presence in the country, offering a range of products from groceries to consumer electronics.The government's pro-business policies and efforts to simplify foreign investment procedures have further enhanced Slovakia’s appeal to international retailers. This influx of foreign investment has boosted competition, leading to improved retail offerings and better pricing for consumers.

Urbanization and Infrastructure Development

Urbanization is one of the major factors contributing to the growth of the Slovakia retail market. As more people move to urban centers, the demand for retail outlets, supermarkets, and shopping malls has increased. Retailers are investing in new stores and expanding their presence in urban areas to cater to this growing urban population.Additionally, infrastructure development, including better road networks and transportation systems, has made it easier for retailers to establish supply chains and distribute products efficiently. This has led to greater retail penetration even in remote areas, making consumer goods more accessible to a larger population.

Evolving Payment Systems

The adoption of modern payment systems has played a crucial role in the development of the retail sector in Slovakia. The rise of contactless payments, mobile wallets, and digital payment gateways has made it easier for consumers to make purchases, both online and in physical stores. Retailers that offer flexible payment options are likely to see higher conversion rates, particularly among tech-savvy younger consumers.