Executive Summary Industrial Hemp Market :

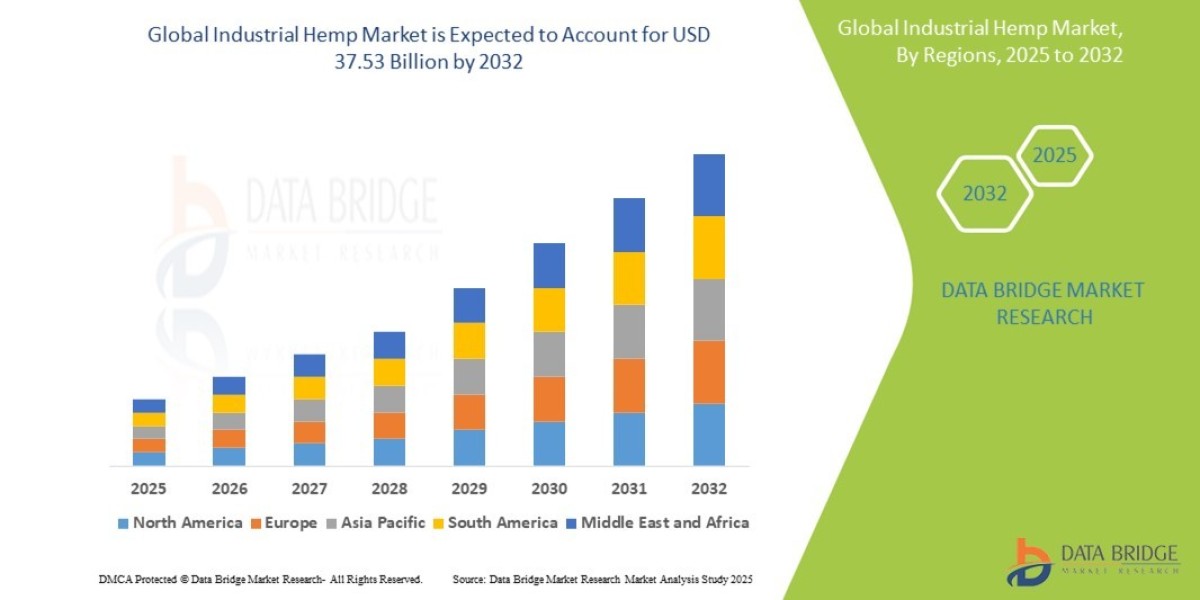

The global industrial hemp market was valued at USD 8.16 billion in 2024 and is expected to reach USD 37.53 billion by 2032, During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 21.02%.

Industrial Hemp Market report brings together a detailed study of the present and upcoming opportunities to elucidate the future investment in the industry. . Industrial Hemp Market segmentation aspect in this document provides a clear idea about the product consumption based on numerous factors ranging from type, application, deployment model, end user to geographical region. The Industrial Hemp Market report consists of reviews about key players in the market, major collaborations, mergers and acquisitions along with trending innovation and business policies.

Being a valuable market report, Industrial Hemp Market report provides industry insights so that you certainly don’t neglect anything. The report takes into account the market type, organization size, accessibility on-premises and the end-users’ organization type, and accessibility at global level in areas such as North America, South America, Europe, Asia-Pacific, Middle East and Africa. To produce such best market research report, an array of objectives is required to be kept in mind. The report also identifies and analyses the intensifying trends along with major drivers, challenges and opportunities in the market. The most suitable method for the distribution of certain products can also be analysed with this market research study.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Industrial Hemp Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-industrial-hemp-market

Industrial Hemp Market Overview

**Segments**

- **Product Type**: The industrial hemp market can be segmented based on product type into hemp seed, hemp seed oil, hemp fiber, hemp hurd, and others. Hemp seed and hemp seed oil are commonly used for their nutritional benefits and are gaining popularity in the health food industry. Hemp fiber is used in various industries such as textiles, automotive, construction, and more. Hemp hurd, also known as shives, is the inner woody core of the hemp stalk and is used in applications like animal bedding, construction materials, and biofuels.

- **Application**: Another key segmentation of the global industrial hemp market is by application, including food and beverages, personal care products, textiles, pharmaceuticals, construction materials, automotive, paper, and more. The versatility of industrial hemp allows it to be utilized in a wide range of industries, driving its demand and market growth.

- **Region**: Geographically, the industrial hemp market can be segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Each region has its regulations and market dynamics impacting the production, consumption, and trade of industrial hemp products.

**Market Players**

- **Canopy Growth Corporation**: A leading player in the industrial hemp market, Canopy Growth Corporation is a Canadian company focusing on hemp and cannabis products for medical and recreational use. They have a strong global presence and are actively expanding their hemp-related offerings.

- **HempFlax BV**: HempFlax BV is a Netherlands-based company specializing in industrial hemp products, including fibers, shives, seeds, and hemp-based construction materials. They are known for their sustainable practices and high-quality hemp products.

- **MH medical hemp**: MH medical hemp is a German company focused on the production and distribution of hemp-based pharmaceuticals and wellness products. They have established a reputation for producing organic and high-grade hemp extracts.

- **Hemp, Inc.**: Hemp, Inc. is a U.S.-based company involved in various aspects of the industrial hemp industry, including cultivation, processing, and distribution of hemp products. They have positioned themselves as a key player in the growing hemp market in the United States.

The global industrial hemp market is witnessing significant growth driven by increasing awareness about the benefits of hemp products, the expanding legalization of hemp cultivation in various countries, and the growing demand for sustainable and eco-friendly alternatives. With a wide range of applications and products, industrial hemp is poised to become a key player in various industries globally.

The industrial hemp market continues to show promising growth prospects as consumers increasingly seek out sustainable and eco-friendly alternatives in various industries. One notable trend shaping the market is the rising popularity of hemp-based products in the health food industry, driven by the nutritional benefits of hemp seed and hemp seed oil. These products are gaining traction among health-conscious consumers looking for plant-based sources of protein and essential fatty acids. Additionally, the use of hemp fiber in industries such as textiles, automotive, and construction is creating new opportunities for market players to tap into the eco-friendly and versatile nature of industrial hemp.

Another significant driver of market growth is the diverse range of applications for industrial hemp across multiple industries. From food and beverages to personal care products, textiles, pharmaceuticals, construction materials, automotive, and paper, industrial hemp offers a wide array of possibilities for product development and innovation. This versatility not only expands the market potential for industrial hemp but also contributes to the increasing demand for sustainable and environmentally friendly raw materials.

On a regional level, the industrial hemp market exhibits distinct dynamics in different geographical areas. North America and Europe have traditionally been key regions for industrial hemp production and consumption, with well-established regulatory frameworks supporting the industry. In contrast, Asia-Pacific, Latin America, and the Middle East & Africa are emerging markets where evolving regulations and growing awareness about the benefits of industrial hemp are driving market expansion. As these regions continue to adopt more hemp-friendly policies, opportunities for market players to expand their footprint and access new consumer bases are likely to increase.

In conclusion, the global industrial hemp market is experiencing a significant uptrend fueled by changing consumer preferences, regulatory developments, and the increasing recognition of hemp as a versatile and sustainable resource. With a focus on product innovation, market expansion, and sustainability, industrial hemp is poised to play a pivotal role in shaping the future of various industries worldwide. As market players continue to explore new applications and business opportunities, the industrial hemp market is set to witness continued growth and transformation in the coming years.The industrial hemp market's segmentation based on product type, application, and region provides valuable insights into the diverse opportunities and growth potential within the industry. Hemp seed and hemp seed oil are gaining popularity in the health food sector due to their nutritional benefits, attracting health-conscious consumers looking for plant-based alternatives. Hemp fiber's utilization across industries like textiles, automotive, and construction underscores its versatility and eco-friendly nature, contributing to its increasing demand. Similarly, hemp hurd's applications in animal bedding, construction materials, and biofuels showcase the broad spectrum of uses within the market.

The market's segmentation by application highlights the wide range of industries that industrial hemp serves, including food and beverages, personal care products, textiles, pharmaceuticals, construction materials, automotive, and paper. This diversification not only expands the market's potential but also underscores the sustainability and eco-friendliness of hemp-based products, aligning with consumer preferences for environmentally conscious goods. The global market players like Canopy Growth Corporation, HempFlax BV, MH medical hemp, and Hemp, Inc. are instrumental in driving innovation, sustainability, and market growth through their diverse product offerings and sustainable practices.

Regionally, the industrial hemp market exhibits varied dynamics, with North America and Europe leading in production and consumption, supported by established regulatory frameworks. In contrast, emerging markets like Asia-Pacific, Latin America, and the Middle East & Africa are witnessing market expansion driven by evolving regulations and increasing awareness of hemp's benefits. As these regions embrace hemp-friendly policies, market players have opportunities to expand their reach and cater to growing consumer demand for sustainable alternatives.

The rising popularity of hemp-based products in the health food industry, coupled with the diverse applications of industrial hemp across multiple sectors, indicates a positive growth trajectory for the global market. Market players' focus on innovation, sustainability, and market expansion will be instrumental in shaping the industry's future and driving further growth and evolution. The industrial hemp market's adaptability, eco-friendly nature, and diverse applications position it as a key player in the transition towards a more sustainable and environmentally conscious global economy.

The Industrial Hemp Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-industrial-hemp-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

This Comprehensive Report Provides:

- Improve strategic decision making

- Research, presentation and business plan support

- Show emerging Industrial Hemp Marketopportunities to focus on

- Industry knowledge improvement

- It provides the latest information on important market developments.

- Develop an informed growth strategy.

- Build technical insight

- Description of trends to exploit

- Strengthen competitor analysis

- By providing a risk analysis, you can avoid pitfalls that other companies may create.

- Ultimately, you can maximize your company's profitability.

Browse More Reports:

Global Electrical Discharge Machine (EDM) Market

Global Electric Orthopedic Screwdriver Market

Global Elastomeric Foam Insulation Market

Global Eggshell Membrane Powder Market

Global Egg Protein Market

Global Dysphagia Market

Global Dupuytren’s Disease Market

Global Dome Security Market

Global Diuretic Drugs Market

Global Disposable Tea Flask Market

Global Disinfection Equipment Market

Global Digital Storage Devices Market

Global Digital Signage in Healthcare Market

Global Digital Shipyard Market

Global Digital Inverter Market

Global Digital Holographic Display Market

Global Difficile-Associated Diarrhea Treatment Market

Global Differentiated Thyroid Cancer Therapeutics Professional Market

Global Desmutting Agent Market

Global Dental Sterilization Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Tag

Industrial Hemp Market Size, Industrial Hemp Market Share, Industrial Hemp Market Trend, Industrial Hemp Market Analysis, Industrial Hemp Market Report, Industrial Hemp Market Growth, Latest Developments in Industrial Hemp Market, Industrial Hemp Market Industry Analysis, Industrial Hemp Market Key Player, Industrial Hemp Market Demand Analysis