Finding the perfect gift can be difficult, especially if you’re looking for something that is both thoughtful and not just another cheap and tacky t-shirt or pair of socks. Christian gifts are a great way to show someone you care about them and that you appreciate their beliefs. If you’re struggling to find the right present for a friend or family member who follows Christianity, why not give them a gift they can use to continue their practice of faith? There are so many different types of gifts you could give that aren’t just t-shirts with Bible verses on them, which is good news. Here we’ll take a look at some ideas for giving Christian gifts.

Bibles

Bibles are great gifts for both religious and non-religious people alike. They are timeless and offer endless content for reading, study, and meditation. If you have a friend who is just beginning to explore Christianity, giving them a Bible can be a great way to help them get started. If you want to give a more special type of Bible, you can always look for a vintage or rare edition. You can also look for one that is specially designed for a certain type of person. There are Bibles for children, teenagers, adults, and more. If you’re looking for something a little more special, there are also Bibles that include beautiful artwork, fancy designs, and special features like built-in dictionaries, maps, and timelines.

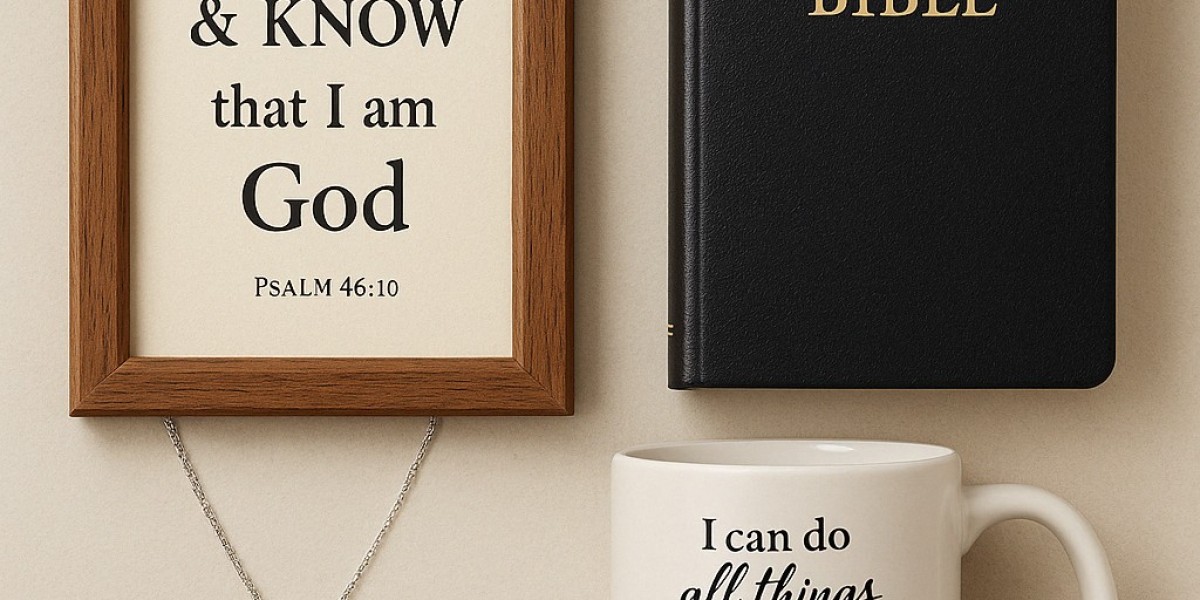

Christian Mugs and Coasters

If the person you’re looking to buy a gift for likes to pray but doesn’t always have a surface they can use to do so, a Christian mugs or a coaster set is a great way to help them out. These types of mugs or coasters are stylish, but they also have special designs and words on them to let people know that the person using them is a Christian. This is a great gift for people who like to pray in public but don’t want to offend anyone with their practices. You can find Christian mugs and coaster sets in all different types of materials, including ceramic, stainless steel, and even bamboo. There are also a variety of designs to choose from, so you can find the perfect set for anyone.

Artwork and Scripture Prints

People love to decorate their homes with art, and religious artwork is no exception. There are a ton of different types of artwork you can give to friends and family members as Christian gifts this holiday season. To start, you can look for paintings and drawings that depict Christian scenes and iconography, such as The Last Supper, The Nativity, or the story of Adam and Eve. Once you’ve found a type of artwork you like, you can then look for different variations and examples of that artwork, so you can find the perfect piece for your gift recipient.

Christian Jewellery

Jewellery is one of the best types of gifts you can give anyone, and there is a huge variety of Christian jewellery available. Once you figure out what type of jewellery you want to give, you can then look for different variations of that type of jewellery. You can also look for jewellery that has symbols of Christianity on it, like crosses, the Star of Bethlehem, or other religious images. If you find a piece of jewellery that is made with a precious metal like gold or silver, that is a great gift because it will last for years to come.

Conclusion

Gifts are a great way to spread joy and love during the holiday season, and Christian gifts are even better because they help spread the word of God. Once you find the perfect gift for your friend or family member, you can then wrap it up and give it to them. This will show them that you put a lot of thought and effort into the gift you chose for them. There are so many different types of gifts you can give to people this holiday season. Once you find a gift that you love, share the joy of the season by giving it to those you love.