Are you constantly wondering whether the stock market is “too high” or “too low” to start investing? Are you looking to start a SIP on the 'perfect time'? You’re not alone. Many first-time investors wait for the “perfect” time to begin a Systematic Investment Plan (SIP). But here’s a secret told by Golden Mean Finserve, a Certified Mutual Fund Advisor in Pune: the best time to start is now.

SIPs are designed to work for you, not against you, no matter the market conditions. Whether you're planning for retirement, your child’s education, or just building a corpus, this post will help you understand how SIPs simplify and strengthen your investment journey.

What is an SIP and why does it matter?

A Systematic Investment Plan (SIP) lets you invest a fixed amount in mutual funds every month. Instead of putting in a large lump sum, you spread your investments over time. This helps you avoid the stress of market timing and builds good money habits.

Rupee Cost Averaging

Markets go up and down. That’s a fact.

With SIPs, this volatility works in your favor through rupee cost averaging. You buy more units when the price is low and fewer when the price is high. Over time, your average cost per unit comes down.

This strategy removes the guesswork. You no longer need to worry about catching the market at the “right moment.”

The Power of Compounding

One of the biggest benefits of starting early is compounding.

Let’s say you invest ₹5,000 per month for 10 years at a 12% annual return. Your investment can grow to nearly ₹11.6 lakhs. But if you wait 5 years and then start, you’d have just ₹4 lakhs for the same monthly amount.

Time is more valuable than money—the earlier you start, the bigger your returns.

Partnering with the Agents

Getting started can be confusing, especially if you’re new to mutual funds. That’s where the best mutual fund agents in Pune come in.

They help you:

Understand your risk profile

Stay invested through market cycles

Automate your SIP investments

Discipline Made Easy

One of the biggest challenges investors face is sticking to a plan.

SIPs solve this problem by automating your investments. A fixed amount is deducted from your bank account every month. You invest without even thinking about it.

This creates a powerful savings habit and helps you meet your long-term goals without stress.

Start Small, Grow Big

You don’t need lakhs to begin investing.

Start with as little as ₹500 per month. As your income grows, increase your SIP amount. You can also modify, pause, or stop your SIP anytime. It’s a low-commitment, high-reward strategy.

And because you’re investing regularly, you’re building corpus slowly but surely.

Why SIPs Are Perfect for Long-Term Goals?

Planning to retire early? Save for your child’s education? Buy a home?

SIPs help you achieve these goals step by step. They align your investment with specific financial milestones. And over the long run, they offer better returns than fixed deposits or gold.

Patience pays. SIPs work best when you give them time to grow.

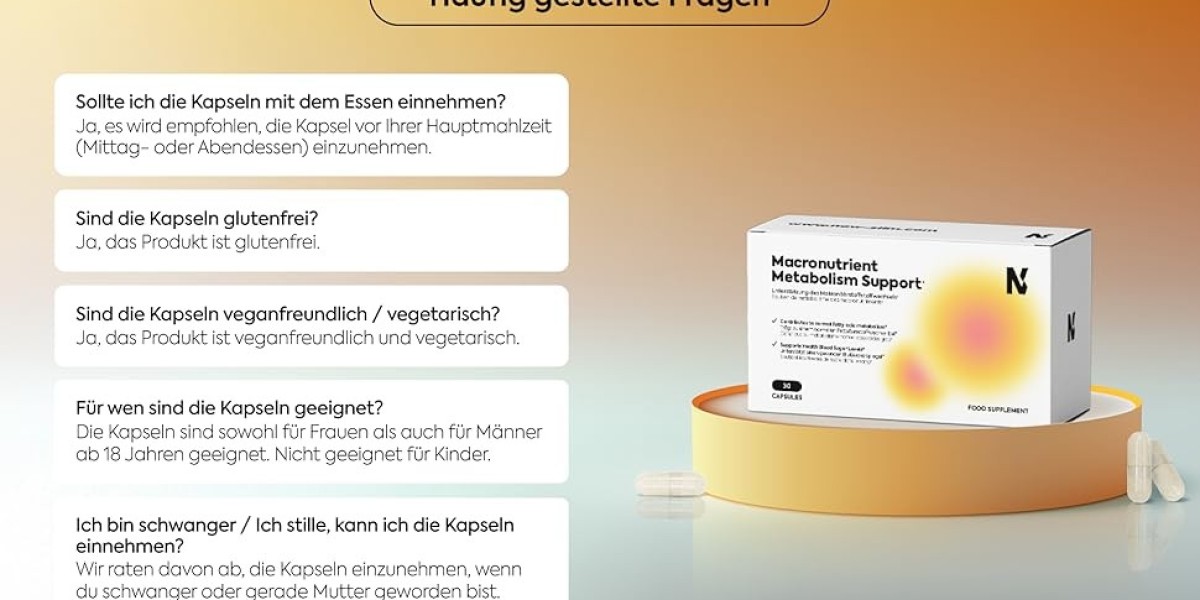

Tax Benefits Make SIPs Even Smarter

If you invest in ELSS (Equity Linked Savings Schemes) through SIPs, you can claim tax deductions under Section 80C. This means you save on taxes while building a corpus for your financial goals.

It’s like getting rewarded twice, once through returns and again through tax benefits.

Conclusion

Here’s the truth, there is no “perfect” time. The markets may never feel right. But SIPs don’t need the right time, they just need your commitment. The longer you wait, the less you earn. The more consistent you are, the more wealth you build. The sooner you start, the faster you reach your goals. So instead of trying to time the market, give time to the market.

SIPs are one of the most beginner-friendly and effective investment strategies available today. They offer: Simplicity, Flexibility, Tax benefits, Corpus Creation and Risk management.

Whether you’re just starting or thinking of getting back on track, don’t delay. Talk to a trusted professional, set your goals, and start your SIP today.

Ready to invest smarter, not harder? Let SIPs make your financial future stress-free and secure.