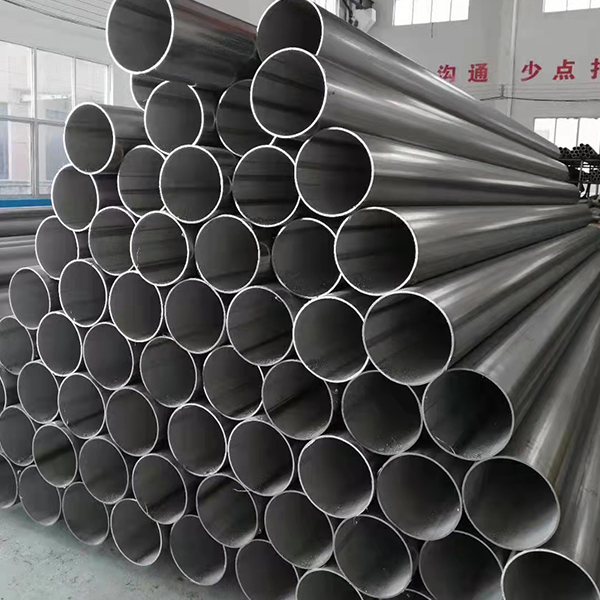

The medical and automotive industries demand materials that meet exacting standards of precision, reliability, and performance—requirements that precision-crafted stainless steel tubes consistently fulfill. In these mission-critical applications, there is zero tolerance for material failure, making stainless steel the material of choice for components where safety and performance are paramount. Advanced manufacturing techniques have elevated stainless tubing to meet the increasingly sophisticated needs of these sectors.

Medical applications represent perhaps the most stringent use of stainless steel tubing. Surgical instruments, implantable devices, and diagnostic equipment all rely on ultra-precise tubing manufactured to micron-level tolerances. The material's biocompatibility ensures safe contact with human tissue, while its ability to withstand repeated sterilization makes it indispensable in healthcare settings. Hypodermic needles, endoscope components, and fluid delivery systems all utilize specially processed stainless tubes that maintain integrity under stress while preventing bacterial adhesion. Some medical device manufacturers employ laser-cut micro-tubing with intricate patterns for minimally invasive surgical tools, demonstrating the material's adaptability to cutting-edge medical technology.

The automotive industry has similarly embraced high-performance stainless steel tubing across multiple systems. Fuel injection systems utilize precision tubes that maintain seal integrity under high pressure and vibration. Exhaust systems benefit from stainless's heat resistance and corrosion protection, especially in regions where road salts accelerate corrosion. Emerging electric vehicle designs incorporate stainless tubing in battery thermal management systems, where consistent performance ensures optimal battery life and safety.

Manufacturing processes for these specialized tubes involve extraordinary precision. Cold-drawing techniques produce seamless tubes with wall thickness variations of less than 0.01mm, critical for fuel injector components. Electropolishing creates microscopically smooth surfaces needed for medical gas delivery systems. Some automotive applications require tubes with varying diameters along their length, achieved through sophisticated hydroforming processes.

Quality control measures exceed standard industry practices for these applications. Medical-grade tubing undergoes rigorous testing for surface defects, dimensional accuracy, and material purity. Automotive components are subjected to pressure cycling tests that simulate years of service in just days. These exhaustive validation processes ensure stainless steel tubes perform flawlessly in life-critical and safety-critical applications.

As both medical technology and automotive engineering continue advancing, stainless steel tubing evolves in parallel. New alloys with enhanced properties and innovative fabrication techniques will further expand its role in these demanding fields, maintaining its position as an essential component in technologies that shape modern life.