Vietnam Logistics Market Overview

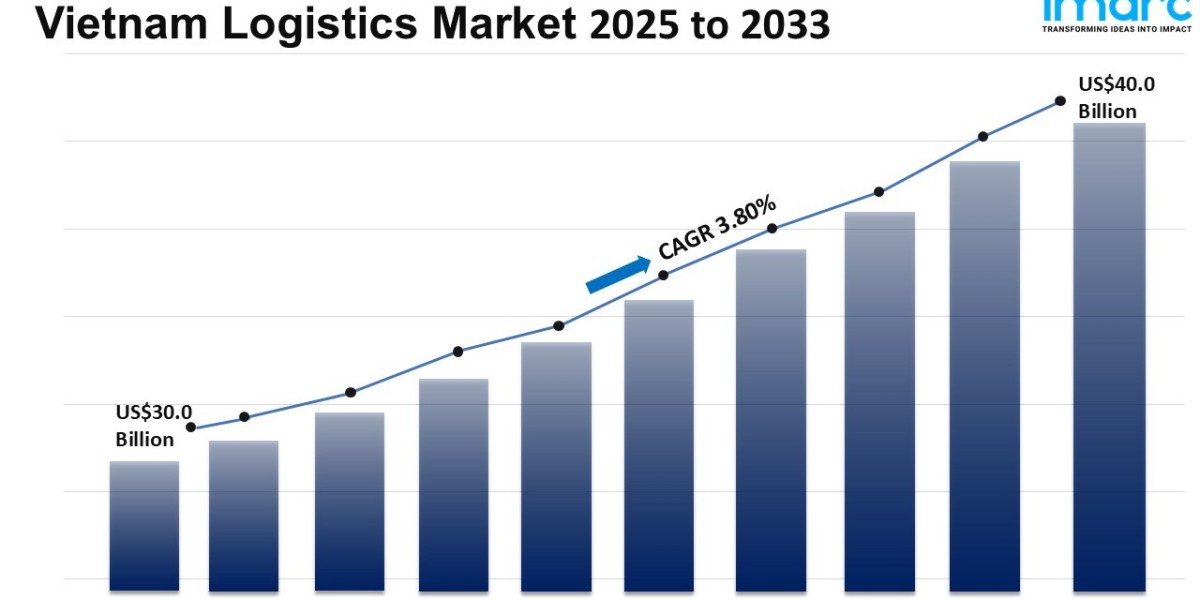

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 30.0 Billion

Market Forecast in 2033: USD 40.0 Billion

Market Growth Rate (2025-33): 3.80%

Vietnam logistics market size reached USD 30.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 40.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is witnessing strong growth, driven by rising investments in education and workforce training, growing adoption of digital logistics platforms, and increased manufacturing activity. Government initiatives promoting regulatory reforms and digital transformation are enhancing operational efficiency. Major plans for seaport expansion, including modernization projects and better multimodal links, reflect Vietnam’s commitment to maritime infrastructure. Additionally, the growth of tourism and the development of free trade zones are further strengthening logistics demand and positioning Vietnam as a key regional logistics hub.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-logistics-market/requestsample

Vietnam Logistics Market Trends and Drivers:

The remarkable and ongoing growth of Vietnam's e-commerce sector is truly transforming the logistics landscape, bringing with it both incredible opportunities and significant operational hurdles. With over 70 million internet users who are digitally savvy and a rapidly expanding middle class with disposable income, online retail sales are seeing impressive double-digit growth each year. This shift in consumer behavior is pushing for a complete revamp of traditional logistics models, putting a lot of pressure on last-mile delivery, which often makes up more than half of total shipping costs. In response, the market is buzzing with innovation and investment aimed at enhancing speed, flexibility, and cost-effectiveness. Logistics providers are actively rolling out cutting-edge tech solutions, like AI-driven route optimization and dynamic fleet management systems, to tackle the notorious traffic jams in major cities such as Ho Chi Minh City and Hanoi. Additionally, the rise of dark stores and micro-fulfillment centers strategically placed in urban areas is slashing delivery times from days to just hours. This shift is also marked by the emergence of a diverse network of local couriers and grab-and-go services teaming up with major platforms to manage peak season demands. The future of this market will depend on cracking the complex last-mile delivery puzzle, pushing companies to embrace more automation, leverage data analytics for demand forecasting, and explore sustainable delivery options, including testing electric vehicles to cut down on environmental impact and operational costs in busy urban areas.

One of the key forces driving the Vietnam logistics market is the government's massive and strategic investment in national infrastructure. This effort is actively breaking down long-standing bottlenecks that have held back growth and driven up costs for years. You can see this commitment in the rapid development of an integrated transport network, highlighted by the ongoing expansion of major deep-sea port complexes like Lach Huyen in Haiphong and Thi Vai-Cai Mep in Ba Ria-Vung Tau. These upgrades are boosting the country's ability to accommodate mega-vessels and are reducing the need to rely on foreign transshipment hubs. At the same time, the construction of the enormous Long Thanh International Airport is set to create a top-notch aerospace logistics gateway for the region. Importantly, these projects are not happening in a vacuum; there’s a strong emphasis on building solid connections through new and improved highways, like the North-South Expressway, and modernizing railway lines to ensure smooth intermodal freight movement. This strategic connectivity is crucial for linking industrial zones in the north with the manufacturing hubs in the south and key export points, significantly cutting down inland transit times and enhancing supply chain reliability. This infrastructure surge is drawing in substantial foreign direct investment into logistics real estate, leading to the development of high-quality warehouses and custom-built distribution centers with modern features near these new transport hubs, ultimately creating a more resilient and cost-effective national logistics framework.

Beyond just automation, Vietnam's logistics sector is undergoing a significant transformation as it embraces advanced technology and weaves sustainability into its core operations. Leading companies are moving beyond simple digitization and fully adopting Industry 4.0 solutions to achieve remarkable visibility, efficiency, and resilience. This shift involves the implementation of comprehensive Warehouse Management Systems (WMS) and Transportation Management Systems (TMS) that connect with the Internet of Things (IoT), using sensors to monitor the location, temperature, and handling of valuable goods in real-time throughout the supply chain. The use of blockchain technology is also gaining momentum, as it helps create secure, tamper-proof documentation for customs and trade finance, effectively tackling fraud and streamlining cross-border processes. At the same time, sustainability has shifted from being just a corporate social responsibility initiative to a vital business necessity, influenced by strict international regulations from major export partners in Europe and North America, as well as the rising environmental awareness among local consumers. Major logistics companies are now performing thorough carbon footprint audits, investing in fleets of electric and CNG-powered trucks for first and last-mile deliveries, and building green warehouses equipped with solar panel roofs, energy-efficient lighting, and water recycling systems. This combined focus on advanced technology and sustainable logistics has become a fundamental requirement for competitiveness, attracting partnerships with global giants that expect these standards from their supply chain providers.

Vietnam Logistics Market Industry Segmentation:

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure : https://www.imarcgroup.com/request?type=report&id=16495&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302