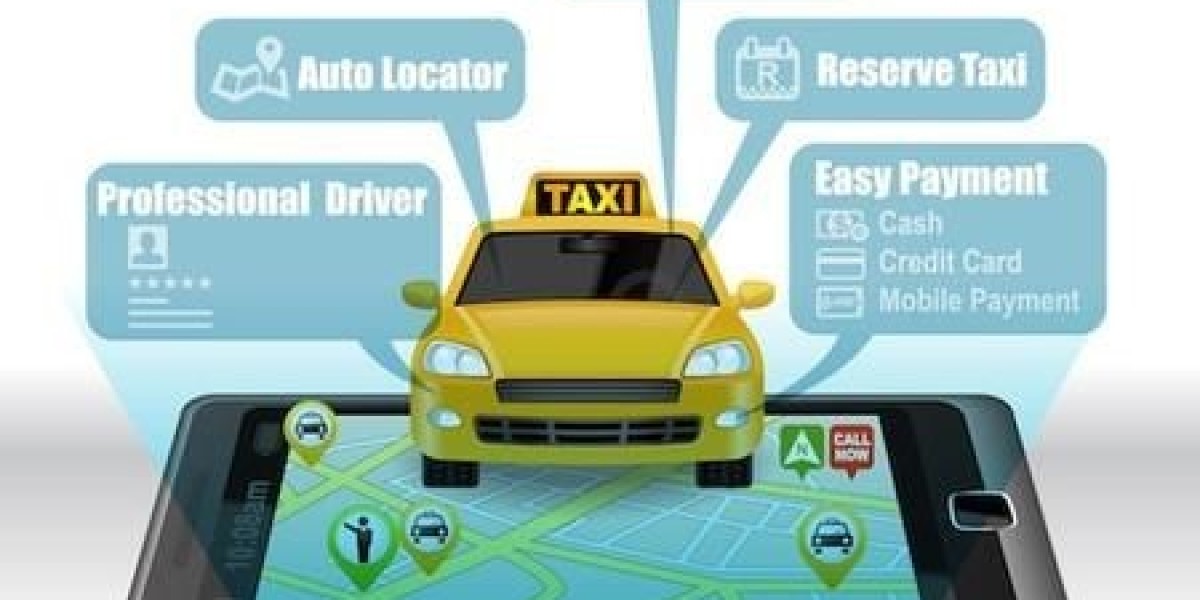

Alpha by Dualite is your personalised AI frontend agent that is capable of all frontend tasks – both for mobile and phone. It helps you build at the speed of thought that integrates with your organisation’s workflows seamlessly.

Sök

populära inlägg