The world of finance is evolving at a breakneck pace, with cryptocurrencies standing at the forefront of this revolution. As more investors look to diversify their portfolios, the demand for innovative financial instruments has never been higher. Structured Crypto Products and Crypto Wealth Management are two key elements driving this transformation, offering investors a sophisticated way to capitalize on the volatile yet rewarding crypto market.

What Are Structured Crypto Products?

Structured Crypto Products are customized financial instruments designed to meet specific investment objectives. These products often combine multiple cryptocurrencies or a mix of cryptocurrencies with traditional assets like stocks or bonds. The goal is to create a product that balances risk and reward according to the investor’s preferences.

For example, a structured product might offer exposure to Bitcoin and Ethereum while providing downside protection through a traditional asset. This allows investors to participate in the potential upside of cryptocurrencies without fully exposing themselves to their inherent volatility. As a result, Structured Crypto Products can be an excellent option for those looking to enter the crypto market cautiously.

The Rise of Crypto Wealth Management

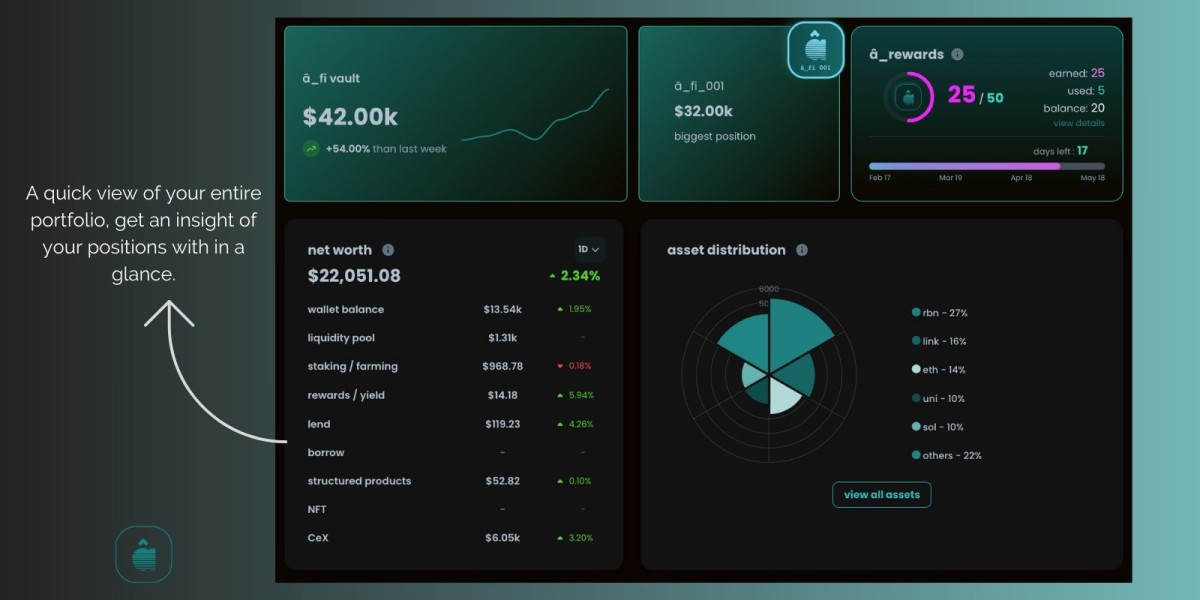

As the cryptocurrency market matures, so does the need for professional management of these digital assets. Crypto Wealth Management is a service that helps investors navigate the complexities of the crypto market, ensuring that their portfolios are aligned with their financial goals. Whether it's managing a diversified portfolio of cryptocurrencies or optimizing returns through yield farming and staking, Crypto Wealth Management provides the expertise needed to make informed decisions.

One of the main advantages of Crypto Wealth Management is the ability to access a range of investment strategies that may not be available to individual investors. For instance, wealth managers can employ advanced techniques like algorithmic trading, arbitrage, and DeFi (Decentralized Finance) lending to enhance returns while mitigating risk.

Why These Tools Matter

Both Structured Crypto Products and Crypto Wealth Management are crucial for investors looking to maximize their returns while managing risk in the volatile crypto market. These tools provide a structured approach to investing in digital assets, making them more accessible to traditional investors who may be wary of the market's unpredictability.

Moreover, as regulatory frameworks around cryptocurrencies become more defined, the demand for these sophisticated investment tools is likely to grow. Investors will seek products and services that offer both security and growth potential, making Structured Crypto Products and Crypto Wealth Management indispensable in the modern financial landscape.

Conclusion

In summary, the integration of Structured Crypto Products and Crypto Wealth Management into your investment strategy can unlock new opportunities in the digital asset space. These tools provide the necessary framework to navigate the complexities of the crypto market while aligning your investments with your long-term financial goals. As the world of finance continues to evolve, embracing these innovative products can help you stay ahead of the curve and achieve sustained success in your investment journey.