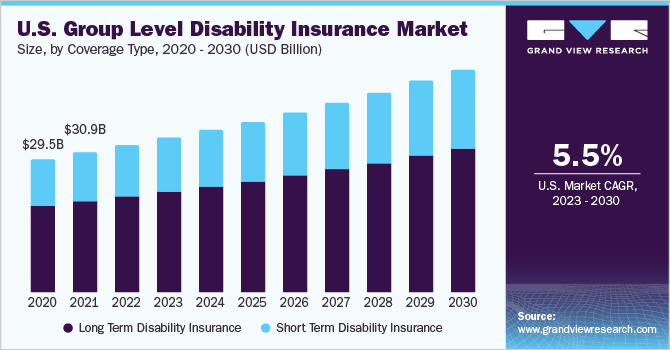

The U.S. group level disability insurance market was valued at USD 32.37 billion in 2022 and is projected to reach USD 49.31 billion by 2030, growing at a CAGR of 5.5% from 2023 to 2030. This growth is driven by the essential financial protection these plans offer. Group disability insurance helps employees who become disabled due to illness or injury by providing a partial income replacement, enabling them to manage key expenses such as housing, utilities, and daily living costs.

In the U.S., group disability insurance is also a favorable option for employers, as premiums are generally tax-deductible and considered a tax-free benefit for employees. Under Section 162(a) of the Internal Revenue Code (IRC), employers can deduct the cost of premiums as a business expense and are not required to pay payroll taxes on those amounts—making it a financially efficient addition to employee benefits packages.

Key Market Insights:

- By coverage type: The long-term disability insurance segment led the market in 2022, accounting for over 65.0% of total revenue. These policies offer extended income protection for periods ranging from a few years to life, depending on the coverage terms.

- By insurance type: The employer-supplied disability insurance segment dominated in 2022, with a revenue share exceeding 58.0%, as most employers include disability coverage in their standard benefits offerings, contributing to widespread adoption.

- By distribution channel: The tied agents and branches segment held the largest share in 2022, representing over 54.0% of revenue. Their direct relationships with clients and perceived trustworthiness enhance customer engagement and policy uptake.

- By end-use: The enterprise segment led the market in 2022, contributing to over 64.0% of total revenue. Larger enterprises often possess greater negotiating power, allowing them to secure better terms and more comprehensive coverage for their workforce.

Order a free sample PDF of the U.S. Group Level Disability Insurance Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2022 Market Size: USD 32.37 Billion

- 2030 Projected Market Size: USD 49.31 Billion

- CAGR (2025-2030): 5.5%

Key Companies & Market Share Insights

Disability insurance providers are increasingly adopting modern technologies such as digitalization, data analytics, artificial intelligence (AI), machine learning (ML), and simplified underwriting to enhance customer experience and operational efficiency. Digital platforms—including online application portals, mobile apps, and policy management tools—are making it more convenient for customers to purchase, access, and manage their policies anytime, anywhere. At the same time, advanced data analytics is enabling insurers to gain deeper insights into customer behavior, helping them tailor products and services more effectively.

In the U.S., group-level disability insurance providers are actively pursuing strategic initiatives such as mergers and acquisitions, partnerships, and new product launches to remain competitive and meet evolving market demands. For example, in August 2022, AFLAC INCORPORATED introduced an enhanced version of its Individual Short-Term Disability Insurance. Launched amid ongoing economic challenges and post-pandemic workforce shifts, the upgraded product was designed to help employers support their teams by providing monthly income protection for covered injuries, illnesses, or mental health conditions that prevent employees from working.

Key Players

- The Hartford

- Unum Group

- Prudential Financial, Inc.

- MetLife

- StanCorp Financial Group, Inc.

- The Guardian Life Insurance Company of America

- Reliance Standard

- AFLAC INCORPORATED

- Mutual of Omaha Insurance Company

- Principal Financial Services, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

In conclusion, the U.S. group level disability insurance market is evolving in response to growing awareness around financial protection and the need for comprehensive employee benefits. As both employers and employees recognize the value of income replacement during times of illness or injury, demand for group disability insurance continues to rise. At the same time, advancements in technology, product innovation, and strategic partnerships are reshaping the competitive landscape. With a focus on accessibility, convenience, and tailored offerings, insurers are well-positioned to meet the changing needs of today’s workforce and ensure long-term market growth.