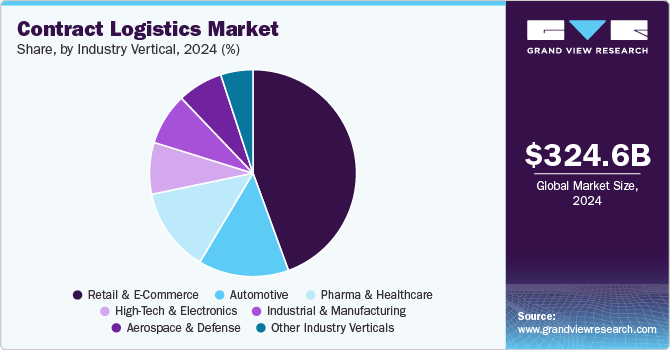

The global contract logistics market, valued at USD 324.6 billion in 2024, is forecast to reach USD 503.3 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 7.8% from 2025 to 2030. This expansion is fueled by the rapid growth of e-commerce, increasing globalization of supply chains, and the imperative for businesses to optimize operations and reduce overheads.

Companies are increasingly opting to outsource logistics to third-party logistics (3PL) providers, enabling them to concentrate on their core business activities and achieve cost efficiencies. However, maintaining comprehensive visibility across intricate, multi-modal logistics networks continues to be a significant challenge. The adoption of automation, artificial intelligence (AI), and advanced digital logistics platforms presents substantial opportunities for market expansion.

Key Market Insights:

- Asia Pacific Dominance: In 2024, the Asia Pacific region held a substantial 34.2% share of the global contract logistics market. This strong performance is attributed to the region's burgeoning e-commerce sector, widespread mobile commerce adoption, and escalating cross-border trade activities.

- Transportation Leads by Service: The transportation segment secured the largest share, accounting for 34.4% of the market in 2024. This is driven by the escalating demand for swift, last-mile delivery solutions, the proliferation of same-day delivery models, and the expanding e-commerce infrastructure across both urban and rural areas.

- Outsourcing Prevails by Type: The outsourcing segment commanded the largest share in 2024. This trend is fueled by the growing necessity for cost-efficiency, access to specialized logistics infrastructure, and increased reliance on third-party logistics providers for global operations.

- Roadways as Primary Transportation Mode: The roadways segment held the largest share in 2024. Key drivers for this include the rising demand for flexible, last-mile delivery services, a growing preference for cost-effective short- to mid-haul transport, and continuous expansion of road infrastructure.

- Retail & E-commerce Leads Industrial Verticals: The retail & e-commerce segment accounted for the largest share within industrial verticals in 2024. This growth is propelled by the increasing penetration of online shopping, the rise of omnichannel retailing, and consumer demand for rapid delivery and real-time order tracking.

Order a free sample PDF of the Contract Logistics Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 324.6 Billion

- 2030 Projected Market Size: USD 503.3 Billion

- CAGR (2025-2030): 7.8%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Some of the leading companies in the market include DHL Supply Chain (a division of Deutsche Post AG), GXO Logistics, Inc., United Parcel Service, Inc. (UPS), and DB Schenker.

DHL Supply Chain, founded in 1969 and headquartered in Bonn, Germany, is a specialized division of Deutsche Post AG focused on contract logistics and supply chain management. It provides comprehensive logistics solutions encompassing warehousing, transportation, packaging, and various value-added services for sectors such as automotive, healthcare, retail, and technology. The company operates an extensive global network of logistics facilities and employs cutting-edge automation, robotics, and data analytics to enhance supply chain efficiency.

GXO Logistics, Inc., established in 2021 and headquartered in Greenwich, Connecticut, U.S., is the world's largest pure-play contract logistics provider. The company offers a wide range of logistics services including warehousing, distribution, e-commerce fulfillment, and reverse logistics to blue-chip customers across various industries in over thirty countries. GXO is recognized for its significant investments in automation and technology to optimize supply chain operations.

United Parcel Service, Inc. (UPS), founded in 1907 and based in Atlanta, Georgia, U.S., is a global leader in logistics and package delivery. Its services extend to freight forwarding, supply chain management, and last-mile delivery. Through its UPS Supply Chain Solutions division, the company delivers contract logistics, customs brokerage, and e-fulfillment services. UPS leverages a robust global logistics infrastructure, supported by advanced digital tools such as real-time tracking, automated sortation, and AI-driven supply chain visibility platforms.

DB Schenker, founded in 1872, is headquartered in Essen, Germany. A subsidiary of DSV, it is a prominent global logistics provider with divisions specializing in air, land, and sea freight, as well as contract logistics. DB Schenker offers a comprehensive suite of logistics services to diverse industries worldwide.

Key Players

- Kuehne + Nagel International AG

- DSV A/S

- Nippon Express Co., Ltd.

- CEVA Logistics

- GEODIS SA

- Ryder System, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

In conclusion, the global contract logistics market is undergoing a significant transformation, driven by the surge in e-commerce, increasing globalization, and the growing need for operational efficiency across industries. As businesses strive to streamline supply chains and focus on core competencies, outsourcing to specialized logistics providers has become a strategic imperative. While challenges such as visibility across complex networks persist, the integration of digital technologies—ranging from AI to automation—is paving the way for smarter, more agile logistics operations. With strong regional growth, particularly in Asia Pacific, and continuous innovation by key market players, the contract logistics sector is poised for sustained advancement in the years ahead.