Health insurance is no longer a luxury—it’s a necessity in today’s world of rising medical costs and unpredictable health risks. Whether you are single, married, or have a growing family, choosing the right medical insurance plans is a crucial part of health insurance planning. The decision often boils down to two main options: individual health insurance plans and family health insurance plans. Each comes with its own set of advantages and disadvantages, and understanding these can help you make an informed choice that aligns with your needs and budget.

Let’s explore the pros and cons of both types of plans, what features to look for, and how to identify the best health insurance in India for your unique situation.

Understanding Individual and Family Health Insurance Plans

Before diving into the pros and cons, it’s important to understand what sets these two types of medical insurance plans apart:

Individual Health Insurance Plans: These policies cover a single person. Each insured member has their own sum insured and policy benefits.

Family Health Insurance Plans: Also known as family floater plans, these policies cover the entire family under a single sum insured. The sum insured is shared among all covered members, typically including the policyholder, spouse, children, and sometimes dependent parents.

Both types of plans are offered by the best health insurance company in India, and both can be tailored with add-ons like Health Insurance With Opd Cover, critical illness benefits, and more.

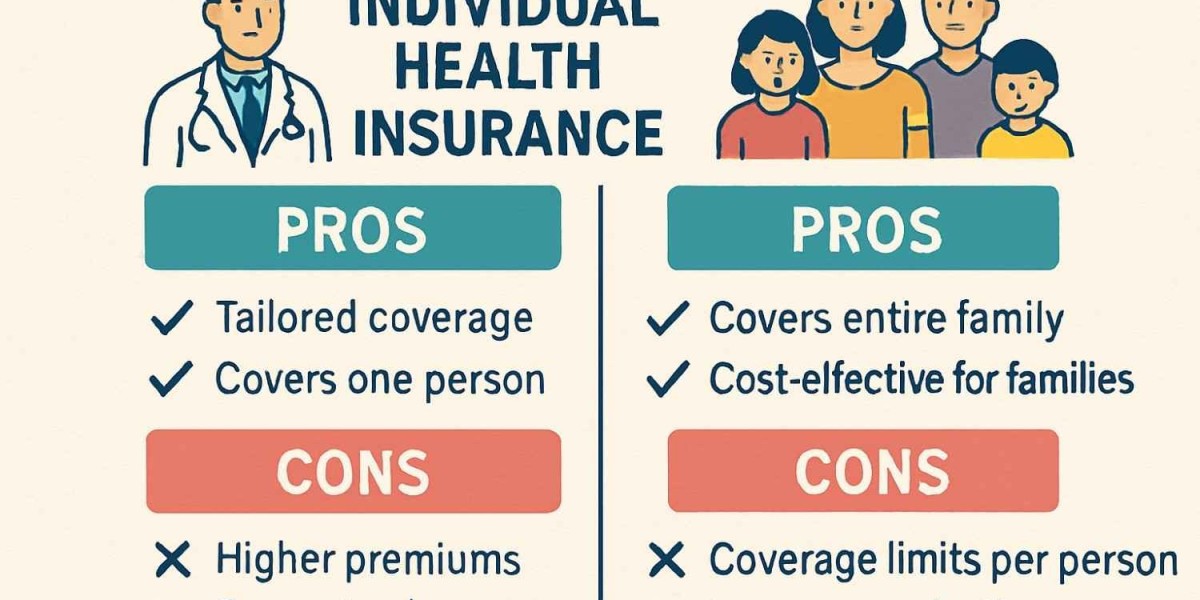

Pros of Individual Health Insurance Plans

1. Dedicated Sum Insured

Each person covered under an individual plan has their own sum insured. This means if you have a policy with a sum insured of ₹5 lakh, that entire amount is available to you alone, regardless of claims made by other family members.

2. Customisation

Individual plans allow you to tailor coverage based on specific needs, age, and health conditions. For example, you can opt for higher coverage or additional features like Health Insurance With Opd Cover for elderly parents or those with pre-existing conditions.

3. No Age-Related Premium Hikes Due to Family Members

Premiums are calculated based on the insured person’s age and health profile. If you’re young and healthy, your premium remains unaffected by the age or health status of other family members.

4. Ideal for Older Family Members

If you have elderly parents or family members with chronic illnesses, individual plans are often more cost-effective and provide broader coverage without affecting the sum insured for others.

Cons of Individual Health Insurance Plans

1. Higher Overall Premiums

Covering each family member with a separate policy can be more expensive than a family floater plan, especially for younger, healthier families.

2. More Paperwork and Management

Managing multiple policies means keeping track of different renewal dates, policy documents, and claim processes, which can be cumbersome.

3. No Shared Benefits

Unused coverage in one policy cannot be utilised by another family member. For example, if one person never makes a claim, their sum insured remains unused, while another family member may exhaust their own policy.

Pros of Family Health Insurance Plans

1. Cost-Effective

Family floater plans are generally more affordable than buying individual policies for each member. The premium is based on the age of the eldest member, but the overall cost is usually lower for young families.

2. Shared Sum Insured

The entire sum insured is available to any family member who needs it. If one person faces a major medical emergency, they can utilise the full coverage amount.

3. Simplified Management

One policy means one renewal date, one set of documents, and a single claim process, making it easier to manage.

4. Flexibility for Growing Families

Many family plans allow you to add new members, such as a newborn or a spouse, during the policy term, often with minimal hassle.

Cons of Family Health Insurance Plans

1. Coverage Can Be Exhausted Quickly

Since the sum insured is shared, multiple claims in a year can deplete the coverage, leaving the family exposed for the rest of the policy period.

2. Premiums Rise with Age

The premium is calculated based on the eldest member’s age. If you include elderly parents, the premium can rise significantly, sometimes making individual plans more cost-effective for them.

3. Potential for Insufficient Coverage

If more than one family member falls ill in the same year, the shared sum insured may not be enough to cover all expenses, especially with rising healthcare costs.

4. Limited Customisation

Family floater plans may not offer the same level of customisation as individual policies, particularly for members with specific health needs or pre-existing conditions.

Health Insurance Planning: Which Option Is Right for You?

Choosing between individual and family health insurance plans is a key part of health insurance planning. Here’s how to approach the decision:

Young, Healthy Families: A family floater plan is usually more cost-effective and easier to manage.

Families with Elderly Members: Consider individual plans for older parents or those with chronic illnesses, as this can provide better coverage without inflating the premium for the entire family.

Large Families: If you have a large family or anticipate frequent medical claims, individual plans may offer more comprehensive protection.

Regardless of your choice, always look for policies that offer Health Insurance With Opd Cover. Outpatient expenses, such as doctor consultations, diagnostic tests, and pharmacy bills, are becoming a significant part of healthcare costs. The best health insurance in India now includes OPD cover as a standard or optional feature, making your policy more valuable and reducing out-of-pocket expenses.

Features to Look for in Medical Insurance Plans

Whether you opt for individual or family coverage, certain features are essential for robust protection:

High Sum Insured: With medical inflation on the rise, opt for a higher sum insured to ensure adequate coverage for hospitalisation and major treatments.

Comprehensive Hospital Network: The best health insurance company in India will offer a wide network of hospitals for cashless treatment.

Health Insurance With Opd Cover: Ensure your plan covers outpatient expenses for maximum value.

No Claim Bonus: Many insurers increase your sum insured for every claim-free year, enhancing your coverage without extra cost.

Restoration Benefit: Some plans automatically restore your sum insured if it’s exhausted during the policy year.

Minimal Sub-Limits and Co-Payments: Look for plans with minimal restrictions on room rent, surgery costs, and other expenses.

The Role of the Best Health Insurance Company in India

The best health insurance company in India is defined by more than just premiums. Here’s what sets them apart:

Transparent Claim Settlement: A high claim settlement ratio and clear processes are essential for peace of mind during emergencies.

Customisable Plans: The ability to tailor coverage, add OPD benefits, and adjust the sum insured is invaluable.

Efficient Customer Service: Responsive support can make a world of difference when you need help with claims or policy queries.

Comprehensive Benefits: The best health insurance in India goes beyond hospitalisation, offering features like wellness programmes, telemedicine, and preventive care.

Avoiding Common Mistakes in Health Insurance Planning

Underinsuring: Don’t compromise on coverage to save on premiums. Medical emergencies can be financially devastating.

Ignoring Exclusions: Always read the fine print to understand what is and isn’t covered.

Delaying Purchase: Waiting until you or a family member falls ill can lead to higher premiums or denial of coverage.

Not Updating Policies: As your family grows or your health needs change, review and update your policy regularly.

Conclusion: Why Niva Bupa Deserves Your Attention

When it comes to choosing between individual and family health insurance plans, the right decision depends on your family structure, health needs, and financial goals. Niva Bupa stands out as a trusted name in the industry, offering a range of medical insurance plans tailored for both individuals and families. With features like Health Insurance With Opd Cover, a wide hospital network, and a customer-centric approach, Niva Bupa is often recognised as one of the best health insurance companies in India.

In summary, health insurance planning is about more than just buying a policy—it’s about securing your family’s health and financial future. Weigh the pros and cons, prioritise comprehensive coverage, and choose a plan that grows with your needs. With the right policy in place, you can face life’s uncertainties with confidence and peace of mind.