The global autonomous finance market was valued at USD 14.57 billion in 2021 and is projected to reach USD 56.93 billion by 2030, exhibiting a robust CAGR of 16.8% from 2022 to 2030. This significant growth is driven by the increasing adoption of autonomous finance solutions by financial leaders who recognize their potential to enhance business processes, functions, and workflows through self-learning software automation.

Autonomous finance operations offer numerous advantages to businesses, including improved cost-efficiency, reduced system downtime, real-time data analytics and reporting, and the ability to scale operations without the need for additional staff. The integration of advanced technologies like Artificial Intelligence (AI), cloud services, and Robotic Process Automation (RPA) is crucial in developing digital processes and elevating the customer experience within the realm of digital and autonomous financial services.

Early adopters of autonomous finance are expected to gain a first-mover advantage due to the technological capabilities offered by fintech companies in this space. According to receeve GmbH, a debt recovery and collection platform, a substantial 89.0% of finance leaders within the Banking, Financial Services, and Insurance (BFSI) industry believe that companies embracing autonomous finance operations early will secure a significant competitive edge. Autonomous finance is already being applied across various financial operations, including accounting, asset management, loan application processing, and liquidity management. The market is set for continued expansion as companies increasingly focus on enhancing their technological capabilities and improving customer experience.

Key Market Insights:

- Regional Dominance: North America led the autonomous finance market in 2021, accounting for more than 29.0% of the total revenue. This leadership is primarily due to the region's conducive ecosystem, which encourages the early adoption of innovative technologies, including autonomous finance.

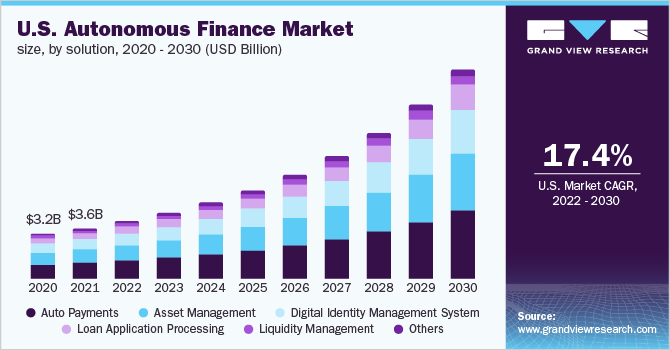

- Solution Leadership: The auto payments segment dominated the market by solution in 2021, holding a revenue share of more than 30.0%. This reflects a rising preference for mobile banking and digital payments, driven by the high penetration rate of smartphones.

- End-Use Dominance: In terms of end-use, the banks segment held the largest share in 2021, contributing more than 35.0% of the global revenue. The recent pandemic spurred banks to engage in collaborations to integrate automation capabilities into their operations.

Order a free sample PDF of the Autonomous Finance Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2021 Market Size: USD 14.57 Billion

- 2030 Projected Market Size: USD 56.93 Billion

- CAGR (2022-2030): 16.8%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

The autonomous finance market is a competitive landscape where key players are actively pursuing various strategies to gain an advantage. These include investing heavily in research and development, expanding their operations, forming strategic partnerships and joint ventures, and engaging in mergers and acquisitions. These initiatives are aimed at enhancing product offerings, fostering innovation, and capturing a larger market share by meeting the growing demand for fully automated financial solutions.

Vendors are consistently developing and launching autonomous solutions designed to improve customer experience globally. A notable example is Roots Automation, which in January 2022, introduced a new SaaS platform for injury claims. This innovative insurance technology solution automates data extraction, significantly streamlining insurance workflows and claims operations. Such continuous initiatives and new product introductions by prominent market players are pivotal in driving the overall growth of the autonomous finance market.

Key Players

- Signzy Technologies Private Limited

- Roots Automation

- ReGov Technologies Sdn Bhd

- Fennech Financial

- AI

- High Radius Corporation

- Oracle Corporation

- NICE

- Viral Gains

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The autonomous finance market is experiencing significant growth, driven by its ability to automate and enhance financial processes, offering benefits like cost-efficiency and real-time data. Early adoption of AI, cloud, and RPA is crucial for competitive advantage, with North America leading the charge. Key players are focusing on R&D, partnerships, and new solutions to meet the rising demand for fully automated financial services and improve customer experiences.