Venmo is a popular peer-to-peer payment service that add venmo to apple pay simplifies the way we handle financial transactions. Whether you're adding funds, integrating with other payment systems, or understanding customer service options, this guide covers it all. Let’s dive into the details using some key topics and questions.

Send PayPal to Venmo

Currently, there isn't a direct way to send money from PayPal to Venmo. However, you can transfer funds between the two platforms through a linked bank account. Here’s how:

Transfer from PayPal to Bank: Move the desired amount from your PayPal balance to your linked bank account.

Transfer from Bank to Venmo: Once the funds are in your bank account, transfer them to your Venmo balance.

This method might take a few business days, but it's effective for moving money between PayPal and Venmo.

Venmo Add Funds

To add funds to your Venmo account:

Open the Venmo App: Log in to your account.

Navigate to Settings: Tap on the menu icon (☰) and select "Manage Balance."

Add Money: Tap "Add Money" and enter the amount you want to transfer.

Choose Bank Account: Select the linked bank account to transfer funds from.

Confirm: Review the details and confirm the transfer.

The funds will typically appear in your Venmo balance within 3-5 business days.

Venmo API

Venmo provides an API for developers to integrate Venmo payments into their applications. The API allows businesses to request and receive payments, handle refunds, and more. You can access the Venmo API documentation on the Venmo Developer site to get started with your integration.

Venmo Apple Pay

While Venmo and Apple Pay are separate services, you can use your Venmo card with Apple Pay. Here’s how:

Open Apple Wallet: On your iPhone, open the Wallet app.

Add Card: Tap the "+" sign to add a new card.

Enter Venmo Card Details: Either scan your Venmo card or manually enter the card information.

Verify: Follow the on-screen instructions to venmo weekly limit verify your card with Venmo.

Once added, you can use your Venmo card through Apple Pay for purchases wherever Apple Pay is accepted.

Venmo ATMs Near Me

To find ATMs that accept Venmo, follow these steps:

Use the Venmo App: Open the Venmo app and navigate to the "Venmo Card" section.

Find ATMs: Look for the "Find ATMs" option, which will help you locate ATMs nearby that accept Venmo.

Check Fees: Venmo offers free ATM withdrawals at certain ATMs (typically within the MoneyPass network). Out-of-network ATMs may charge a fee.

Venmo Call

If you need to contact Venmo customer service by phone, you can reach them at their official customer service telephone number. Visit the Venmo website or app for the most up-to-date contact information.

Venmo Chat

Venmo offers a chat feature for customer support. To use Venmo chat:

Open the Venmo App: Log in and go to the menu (☰).

Select "Get Help": Tap on "Get Help" or "Contact Us."

Choose Chat Option: Select the chat option to start a conversation with a Venmo support representative.

Venmo Customer Service Telephone Number

For direct assistance, you can contact Venmo’s customer service via their official telephone number. Always refer to the Venmo website or app for the current number to ensure you reach the correct support line.

Venmo Email

To get in touch with Venmo via email, you can use their customer support email address. This can be found in the “Contact Us” section of the Venmo website or app. Email support is useful for detailed queries or issues that require documentation.

Venmo Free ATM

Venmo offers free ATM withdrawals at ATMs within the MoneyPass network. To find a free ATM:

Use the Venmo App: Navigate to venmo.login the "Venmo Card" section and use the "Find ATMs" feature.

MoneyPass Network: Look for ATMs that are part of the MoneyPass network to avoid withdrawal fees.

Venmo IRS

Venmo transactions may be subject to IRS reporting. If you receive $600 or more for goods and services, Venmo will issue a Form 1099-K for tax purposes. It’s important to report this income on your tax return. Consult a tax professional if you have questions about how Venmo transactions affect your taxes.

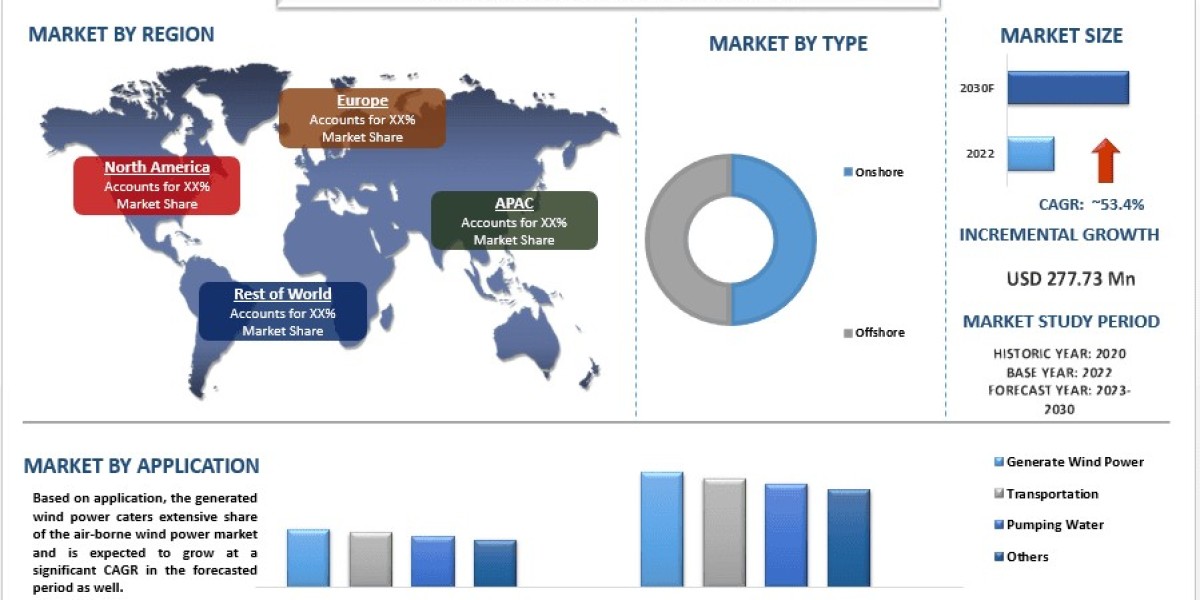

Venmo Limits Per Day

Venmo imposes certain limits on transactions:

Unverified Accounts: $299.99 per week.

Verified Accounts: Up to $4,999.99 per week for person-to-person payments and up to $6,999.99 per week for authorized merchant payments.

To increase your limits, you must verify your identity by providing personal information such as your Social Security number and date of birth.

Venmo Login for Android

To log in to Venmo on an Android device:

Download the Venmo App: Available on the Google Play Store.

Open the App: Tap the Venmo icon to open the app.

Enter Credentials: Enter your email or phone number and password.

Two-Factor Authentication: Complete any additional security steps, such as entering a verification code sent to your phone.

Once logged in, you can manage your Venmo account, send and receive payments, and more.

Conclusion

Venmo is a versatile payment platform that offers a range of features to manage your finances easily. Whether you’re adding funds, understanding limits, or contacting customer service, this guide provides all the information you need to use Venmo effectively. Stay informed and make the most out of venmo sign up bonus your Venmo experience!