The global embedded finance market was valued at USD 83.32 billion in 2023 and is projected to reach USD 588.49 billion by 2030, expanding at a CAGR of 32.8% from 2024 to 2030. This significant growth is largely attributed to the widespread adoption of smartphones and increasing internet penetration across the globe.

A critical component supporting this growth is the rise of Account-to-Account (A2A) transactions, which enable direct fund transfers between bank accounts without intermediaries. A2A payments are gaining traction for their secure, frictionless processing capabilities, making them ideal for integration within non-financial platforms. This trend is proving transformative for both B2C and B2B ecosystems. According to The Global Payments Report 2023, A2A transactions are expected to grow at a CAGR of 13% through 2026, with the global market value nearing USD 850 billion.

Around the world, embedded finance providers are increasingly focused on launching solutions tailored for businesses to seamlessly integrate financial services into their existing platforms. For example, in November 2023, U.K. and EU-regulated FinTech company Andaria introduced its embedded finance solution to help non-financial businesses embed payment capabilities within their digital ecosystems. This initiative allows partners to enhance their service offerings by incorporating a range of financial products directly into their platforms—boosting revenue potential and adding value for customers. The solution aims to deliver a streamlined, unified financial experience that strengthens customer engagement while enabling partners to stay focused on their core operations.

Key Market Insights:

- Regional Outlook: North America led the embedded finance market in 2023, accounting for a 29.0% share. The presence of major industry players and advanced digital infrastructure continues to drive growth in this region.

- By Type: The embedded payment segment held the largest revenue share of 28.14% in 2023. These solutions allow businesses to accept payments more efficiently than through traditional invoicing methods.

- By Business Model: The B2B segment dominated the market in 2023. This includes embedded financial services like digital payments, cross-border transactions, and inventory financing offered by non-financial companies.

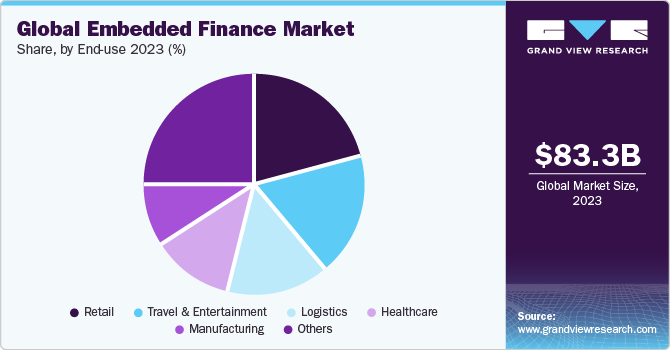

- By End-Use: The retail sector accounted for the largest revenue share in 2023. Retailers globally are adopting embedded finance technologies to enhance customer experience and streamline payment processes.

Order a free sample PDF of the Embedded Finance Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 83.32 Billion

- 2030 Projected Market Size: USD 588.49 Billion

- CAGR (2024-2030): 32.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Key players in the embedded finance market include Stripe, Inc., PAYRIX, Cybrid Technology Inc., and Walnut Insurance Inc.

Stripe, Inc. is a leading fintech firm known for its advanced online payment solutions. Leveraging AI and modern infrastructure, it helps businesses manage digital transactions seamlessly.

PAYRIX offers customizable embedded finance solutions, enabling businesses to integrate services like payment processing, digital banking, and compliance into their platforms.

Emerging participants such as Fortis Payment Systems, LLC, Transcard Payments, and Fluenccy Pty Limited are also gaining traction.

Fluenccy focuses on intelligent cross-border payment solutions, helping businesses manage foreign invoice costs more efficiently.

Fortis integrates modern technologies, such as EMV and contactless payments, to enhance transaction speed and security.

Key Players

- Stripe, Inc.

- PAYRIX

- Cybrid Technology Inc.

- Walnut Insurance Inc.

- Lendflow

- Finastra

- Zopa Bank Limited

- Fortis Payment Systems, LLC

- Transcard Payments

- Fluenccy Pty Limited

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The embedded finance market is experiencing significant growth driven by the seamless integration of financial services into non-financial platforms. This trend is fueled by rapid digital transformation, the widespread use of APIs, and a strong consumer demand for convenient, personalized experiences. The report highlights that the embedded payments segment and the B2B business model are key drivers of market expansion. The future of this ecosystem is expected to be shaped by increased collaboration among fintech companies and traditional financial institutions to further innovation.