The global bunker fuel market was valued at USD 125.05 billion in 2024 and is expected to reach USD 160.94 billion by 2030, expanding at a CAGR of 4.35% from 2025 to 2030. This steady growth is fueled by the expansion of global maritime trade and the rising need for dependable marine fuel solutions.

Key growth drivers include the increase in international shipping activity, continued fleet expansion, and the recovery of seaborne trade. Additionally, evolving IMO sulfur emission regulations are accelerating the transition toward cleaner fuel options, significantly influencing bunker fuel consumption patterns at major global ports.

Technological advancements, such as enhanced fuel blending methods and digital monitoring tools, are boosting fuel efficiency and ensuring better environmental compliance. These innovations support improved fuel quality control, real-time tracking of consumption, and optimized logistics, resulting in both cost efficiency and lower emissions. The increasing focus on low-sulfur and alternative fuels aligns closely with global environmental mandates, positioning bunker fuel solutions toward a more sustainable maritime future.

Key Market Insights:

- Asia Pacific leads the global bunker fuel market, supported by intense shipping activity, rapid port infrastructure growth, and proactive compliance with IMO 2020 sulfur emission standards.

- By type, Very Low Sulfur Fuel Oil (VLSFO) holds a pivotal position, balancing compliance with IMO emission regulations and cost-effectiveness for shipping operators.

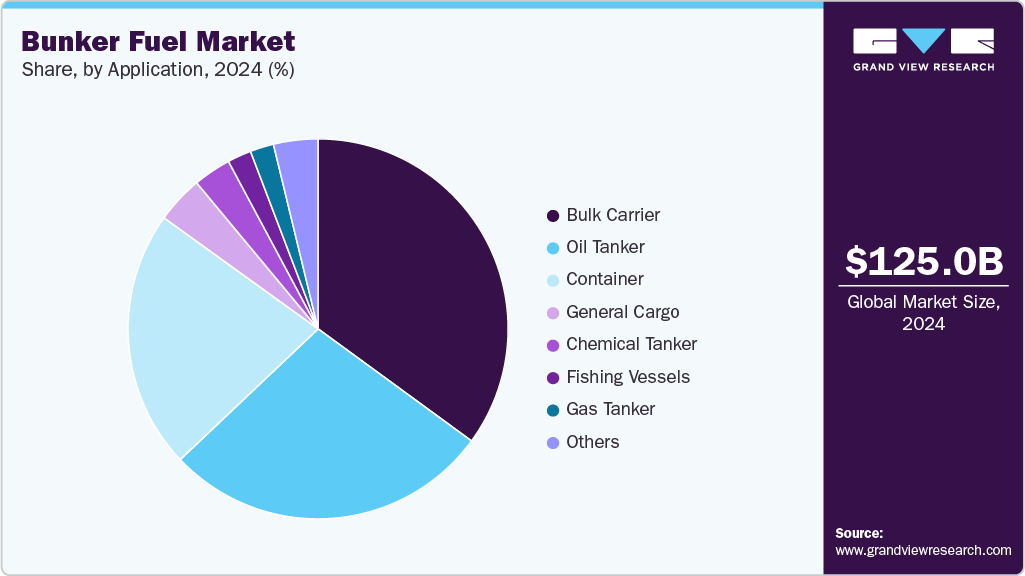

- By application, bulk carriers constitute a major segment due to their essential role in transporting large volumes of raw materials such as coal, iron ore, and grains across global trade routes.

Order a free sample PDF of the Bunker Fuel Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 125.05 Billion

- 2030 Projected Market Size: USD 160.94 Billion

- CAGR (2025-2030): 4.35%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Key players in the bunker fuel market include BP p.l.c., Exxon Mobil Corporation, Royal Dutch Shell PLC, Lukoil, Sinopec Group, Gazprom Neft PJSC, Chevron Corporation, Neste, and others.

In February 2024, TotalEnergies launched a new bunker barge at the Port of Rotterdam, capable of supplying both VLSFO and LNG. This move reinforces the company’s presence in Europe’s busiest marine fuel hub and supports its efforts to offer diversified, low-emission fuel options.

In March 2024, Neste expanded its bio-based marine fuel supply network across Northern Europe through strategic partnerships with major shipping companies. This initiative aims to lower maritime carbon emissions and meets the growing demand for sustainable bunker fuel alternatives.

Key Players

- BP p.l.c.

- Exxon Mobil Corporation

- Royal Dutch Shell PLC

- Lukoil

- Sinopec Group

- Gazprom Neft PJSC

- Chevron Corporation

- PETRONAS

- Total SE

- Neste

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The bunker fuel market is experiencing consistent growth, fueled by the expansion of global maritime trade and the rising need for dependable marine fuel options. The market's trajectory is heavily shaped by the International Maritime Organization's (IMO) changing regulations on sulfur emissions, leading to a transition towards environmentally friendlier fuel choices. Advances in technology are further enhancing fuel efficiency and adherence to environmental standards. Despite obstacles such as unpredictable crude oil prices and regulatory ambiguities, the market is poised to be crucial in fostering more sustainable and efficient global shipping activities.