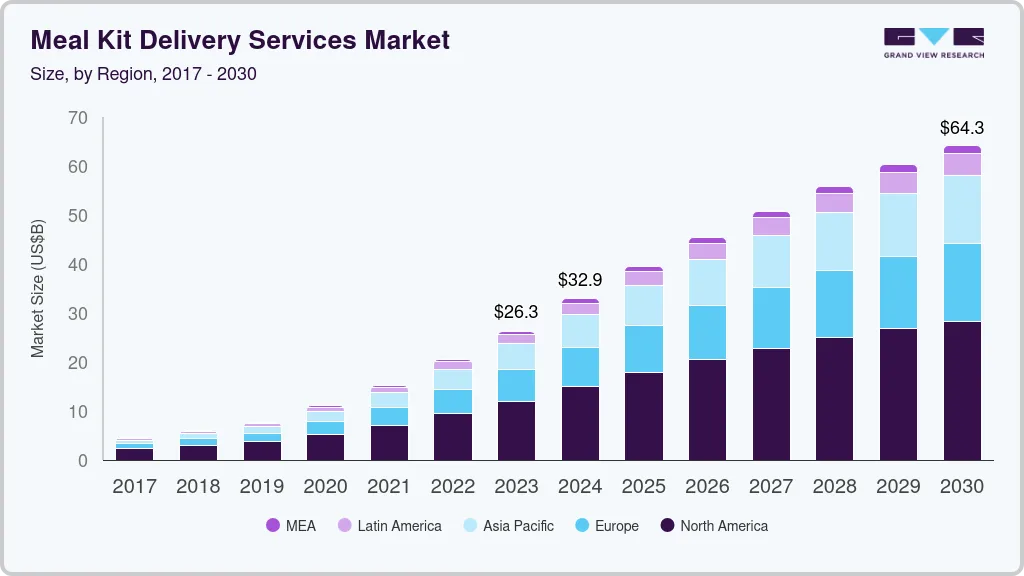

The global meal kit delivery services market was valued at an estimated USD 20.54 billion in 2022. It is anticipated to experience substantial growth, reaching USD 64.27 billion by 2030, exhibiting a robust CAGR of 15.3% from 2023 to 2030. A primary driver of this market expansion is the increasing preference among millennials for convenient home-cooked and chef-prepared food options.

These delivery services have gained significant traction and adoption among Generation Y and Z. The growing popularity stems from the economic advantages of homemade meals, which are often more budget-friendly compared to restaurant take-outs or traditional home delivery services. The COVID-19 pandemic presented a major opportunity for the meal kit delivery market, as widespread closures of restaurants and eateries led consumers to seek healthy and easy meal solutions at home, emphasizing diet for immunity and overall well-being.

Meal kit delivery services offer an ideal solution for reducing food waste, as ingredients are precisely pre-measured for each portion. This eliminates the need for excess grocery purchases and ensures efficiency. While some companies offer larger portions, they consistently provide clear calorie counts and nutritional information per serving.

Key Market Trends & Insights:

- North America was the dominant region in 2022, contributing 46.01% of the total market revenue.

- By offering, cook & eat meal kit delivery services held the largest market share in 2022, accounting for 60.6%.

- In terms of service, single delivery service was the leading contributor, generating 57.7% of the global revenue in 2022.

- The online platform segment commanded a significant share of 63.2% of the global revenue in 2022.

- Regarding meal type, the non-vegetarian segment captured the largest market share of 63.5% in 2022.

Order a free sample PDF of the Meal Kit Delivery Services Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2022 Market Size: USD 20.54 billion

- 2030 Projected Market Size: USD 64.27 billion

- CAGR (2023-2030): 15.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

The meal kit delivery services market is characterized by a mix of established players and numerous small to medium-sized enterprises. Strategic initiatives like mergers, acquisitions, and new product launches are common within the industry.

For example, in August 2021, Freshly Inc. introduced its "Purely Plant" line, their first-ever offering of plant-based prepared meals. This line featured six new meals with plant-based proteins crafted from whole-food ingredients, directly addressing the growing consumer demand for variety, taste, nutrition, and convenience in plant-based options. These meals required no preparation and could be heated and served in just three minutes.

Earlier, in November 2020, HelloFresh strengthened its position in the U.S. market and expanded its consumer base by acquiring Factor75, LLC for USD 277 million. This acquisition enhanced HelloFresh's portfolio with Factor75's focus on fresh, ready-to-eat meals catering to various dietary preferences.

Similarly, in October 2020, Nestlé acquired Freshly Inc. for USD 950 million. This strategic move aimed to accelerate Freshly Inc.'s growth opportunities and marked Nestlé's entry into the rapidly expanding U.S. meal kit delivery sector.

Key Players

- Blue Apron, LLC

- Freshly Inc.

- HelloFresh

- Sun Basket

- Relish Labs LLC (Home Chef)

- Gobble

- Marley Spoon Inc.

- Purple Carrot

- Fresh n' Lean

- Hungryroot

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The meal kit delivery services market is experiencing significant growth, driven by a rising consumer preference for convenient home-cooked meals, particularly among younger generations. The recent global health crisis further accelerated this trend as people sought healthy and easy meal solutions at home. These services also help reduce food waste by providing pre-portioned ingredients. While some regions currently dominate, there's a shift towards online platforms and diverse meal offerings, including plant-based options, shaping the future of this evolving market.