"Latest Insights on Executive Summary Voice Banking Market Share and Size

CAGR Value

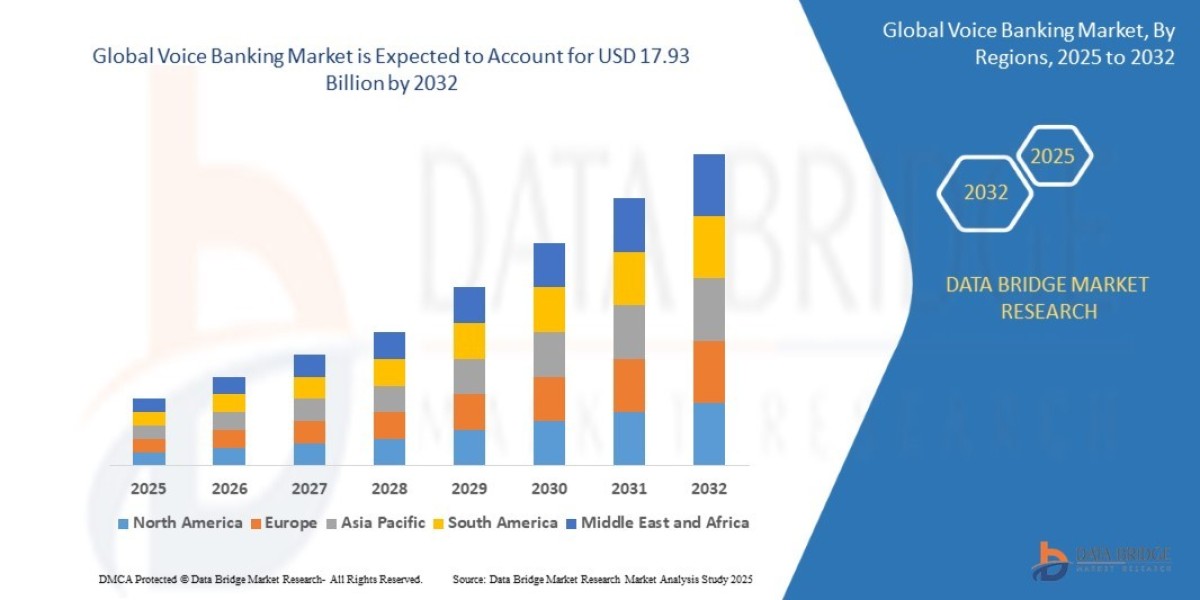

The global voice banking market size was valued at USD 6.20 billion in 2024 and is projected to reach USD 17.93 billion by 2032, with a CAGR of 14.20% during the forecast period of 2025 to 2032.

This Voice Banking Market research report proves to be true in serving the purpose of businesses of making enhanced decisions, deal with marketing of goods or services, and achieve better profitability by prioritizing market goals. This market research report deeply analyses the potential of the market with respect to current scenario and the future prospects by taking into view numerous industry aspects. The Voice Banking Market report explains market definition, currency and pricing, market segmentation, market overview, premium insights, key insights and company profile of the major market players. Moreover, the Voice Banking Market report endows with the data and information for actionable, most recent and real-time market insights which make it uncomplicated to take critical business decisions.

The Voice Banking Market report displays the systematic investigation of existing scenario of the market, which takes into account several market dynamics. The market report also helps to get idea about the types of consumers, their reaction and views about particular products, and their thoughts for the improvement of a product. Geographical scope of the products is also taken into consideration comprehensively for the major global areas which helps characterize strategies for the product distribution in those areas. This Voice Banking Market research report can be used to acquire valuable market insights in a cost-effective way.

Dive into the future of the Voice Banking Market with our comprehensive analysis. Download now:

https://www.databridgemarketresearch.com/reports/global-voice-banking-market

Voice Banking Business Outlook

**Segments**

- On the basis of component, the global voice banking market can be segmented into solutions and services. With the increasing demand for voice-enabled banking services, the solutions segment is expected to witness significant growth.

- By application, the market can be categorized into account management, customer engagement, and others. Account management is likely to dominate the market as more financial institutions adopt voice banking for seamless account access.

- Considering deployment, the market is divided into cloud and on-premises. Cloud-based voice banking solutions are anticipated to gain traction due to their scalability and cost-effectiveness.

**Market Players**

- Nuance Communications, Inc.

- Amazon Web Services, Inc.

- Google LLC

- Microsoft

- Apple Inc.

- Smartcard Marketing Systems Inc.

- Sensory Inc.

- Avaya Inc.

- 24/7 Customer Inc.

- Verbio Technologies

The global voice banking market is witnessing robust growth, driven by the rising adoption of digital banking solutions and the increasing preference for convenient banking services among consumers. The emergence of advanced technologies such as artificial intelligence and natural language processing has paved the way for the integration of voice banking solutions in the financial sector. Voice banking offers customers a hands-free, convenient way to access banking services, inquire about account information, and perform transactions through simple voice commands. The market is also benefiting from the growing focus of financial institutions on enhancing customer experience and streamlining operations through automation.

North America is expected to lead the global voice banking market, attributed to the early adoption of advanced technologies and the presence of key market players in the region. Additionally, the Asia Pacific region is anticipated to witness significant growth in the voice banking market due to the increasing smartphone penetration and digitalization of banking services in countries like China, India, and Japan. The European market is also projected to experience steady growth as banks and financial institutions in the region are investing in advanced technologies to improve customer service and operational efficiency.

Overall, the global voice banking market is poised for substantial growth, driven by technological advancements, shifting consumer preferences, and the increasing demand for personalized banking experiences. Market players are focusing on developing innovative voice banking solutions to cater to the evolving needs of customers and gain a competitive edge in the market.

The global voice banking market is undergoing a significant transformation due to the rapid digitization of the financial sector and the increasing adoption of advanced technologies by banks and financial institutions. One emerging trend in the market is the integration of voice-enabled solutions for enhancing customer engagement and operational efficiency. Voice banking offers a hands-free and seamless banking experience to customers, allowing them to perform various transactions and inquiries through simple voice commands. This trend is reshaping the way traditional banking services are delivered and is expected to drive significant growth in the market.

Another key development in the voice banking market is the focus on personalized customer experiences. As financial institutions strive to differentiate themselves in a competitive market landscape, they are leveraging voice banking solutions to provide tailored services to their customers. By leveraging artificial intelligence and natural language processing capabilities, banks can offer customized recommendations, proactive assistance, and personalized interactions, leading to higher customer satisfaction and loyalty.

Moreover, the increasing emphasis on data security and privacy is shaping the dynamics of the voice banking market. With the rising concerns around data breaches and cyber threats, banks are investing in robust security measures to protect customer information in voice-enabled transactions. This heightened focus on security compliance and data protection is driving the adoption of secure voice banking solutions that ensure confidentiality and integrity in customer interactions.

Furthermore, the market is witnessing collaborations and partnerships between technology providers, financial institutions, and fintech companies to drive innovation and expand the reach of voice banking services. By combining their expertise and resources, companies are developing integrated solutions that offer a seamless and comprehensive banking experience to customers. These partnerships are instrumental in accelerating the adoption of voice banking and expanding its applications across different banking functions.

Overall, the global voice banking market is poised for continued growth and innovation as market players continue to leverage advanced technologies, customer insights, and strategic partnerships to redefine the future of banking services. With the evolution of voice-enabled solutions and the increasing demand for personalized and secure banking experiences, the market is expected to witness further expansion and diversification, creating new opportunities for stakeholders across the financial ecosystem.The global voice banking market is currently experiencing a significant transformation driven by the rapid digitization of the financial sector and the increasing adoption of innovative technologies by banks and financial institutions worldwide. One of the emerging trends in the market is the integration of voice-enabled solutions aimed at enhancing customer engagement and operational efficiency. This trend is reshaping traditional banking services by providing customers with a hands-free and seamless banking experience, allowing them to conduct various transactions and inquiries through simple voice commands.

Another noteworthy development in the voice banking market is the growing emphasis on delivering personalized customer experiences. As financial institutions seek to differentiate themselves in a highly competitive landscape, they are leveraging voice banking solutions to provide tailored services to their customers. By harnessing the power of artificial intelligence and natural language processing, banks can offer customized recommendations, proactive assistance, and personalized interactions, ultimately leading to increased customer satisfaction and loyalty.

Additionally, the increasing focus on data security and privacy is playing a crucial role in shaping the dynamics of the voice banking market. With the escalating concerns surrounding data breaches and cyber threats, banks are making substantial investments in robust security measures to safeguard customer information in voice-enabled transactions. This heightened emphasis on security compliance and data protection is propelling the adoption of secure voice banking solutions that ensure the confidentiality and integrity of customer interactions.

Furthermore, the market is witnessing a surge in collaborations and partnerships between technology providers, financial institutions, and fintech companies to drive innovation and expand the reach of voice banking services. Through these strategic alliances, companies are leveraging their combined expertise and resources to develop integrated solutions that offer a seamless and comprehensive banking experience to customers. Such partnerships play a pivotal role in accelerating the adoption of voice banking and expanding its applications across various banking functions.

In conclusion, the global voice banking market is poised for continued growth and innovation as industry players capitalize on advanced technologies, customer insights, and strategic collaborations to redefine the future of banking services. With the evolution of voice-enabled solutions and the increasing demand for personalized and secure banking experiences, the market is expected to witness further expansion and diversification, creating new opportunities for stakeholders across the financial ecosystem.

Analyze detailed figures on the company’s market share

https://www.databridgemarketresearch.com/reports/global-voice-banking-market/companies

Voice Banking Market – Analyst-Ready Question Batches

- What is the current demand volume of the Voice Banking Market?

- How is the market for Voice Banking expected to evolve in the next decade?

- What segmentation criteria are applied in the Voice Banking Market study?

- Which players have the highest market share in the Voice Banking Market?

- What regions are assessed in the country-level analysisfor Voice Banking Market?

- Who are the top-performing companies in the Voice Banking Market?

Browse More Reports:

Global Walking Aids Market

Global Perfluoropolyether Market

Global Pemphigus Vulgaris Market

Global Tackifier Market

Global Antithrombin Market

Middle East and Africa Alkylation Market

Global Home Care Products Market

Asia-Pacific AWS Managed Services Market

Global Sapphire Glass Market

Global Smart Doorbell Market

North America Corrugated Box Market

Global Platelet-Rich Plasma Therapy Market

Global Fruit and Vegetable Ingredients Market

Europe Chromatography Solvents Market

Asia-Pacific Chromatography Solvents Market

Global Cork Flooring Market

Global Turner Syndrome Drug Market

Global Rig and Oil Field Market

Global Memory and Processors for Military and Aerospace Market

North America Digital Scent Technology Market

Global Teak Wood Packaging Market

Global Physiotherapy Tapes and Bandages Market

Global Antacids Market

Global Rheumatoid Arthritis Treatment Market

Global A2 Milk Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"