The global native advertising market, valued at $105.88 billion in 2024, is on a path of substantial growth, with projections to reach $346.88 billion by 2033. This expansion is forecasted to occur at a compound annual growth rate (CAGR) of 13.9% between 2025 and 2033. The market's upward trajectory is propelled by a shift in consumer and advertiser preferences towards less intrusive, more relevant, and privacy-conscious digital marketing solutions.

A significant force driving this market is the demand for personalized user experiences. As consumers increasingly favor content that aligns with their specific interests, advertisers are moving away from broad, generic ads. This trend towards tailored messaging is enabled by technologies like artificial intelligence (AI) and machine learning, which facilitate the seamless integration of native content into a user's digital environment. The result is an industry that is becoming more focused on performance, prioritizing relevance, user engagement, and a strong return on investment (ROI).

Furthermore, the native advertising industry is being reshaped by the growing emphasis on data privacy and regulations such as GDPR and CCPA. Advertisers are adapting by adopting native formats that rely on contextual rather than behavioral targeting. This approach offers a non-intrusive way to connect with audiences while adhering to evolving legal frameworks. Consequently, there's been an increase in investment in ad technologies and platforms that are specifically designed to be privacy-focused.

Key Market Highlights:

- North America was the dominant region in 2024, holding the largest revenue share of 31.0% in the global native advertising market.

- Within North America, the U.S. market led with the biggest revenue share in 2024.

- In terms of content, in-feed native ads were the market leader, representing a 42.7% revenue share in 2024.

- By platform, the closed platform segment held the dominant position in the market in 2024, accounting for a leading revenue share of 55.6%.

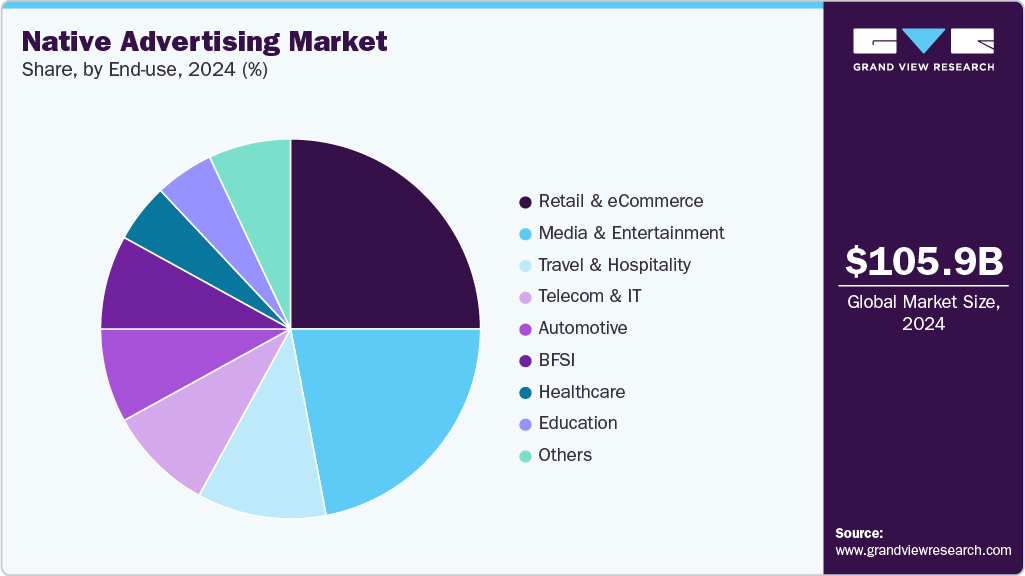

- Among end-use sectors, the education segment is anticipated to exhibit the most rapid growth, with a projected CAGR of 17.1% from 2025 to 2033.

Order a free sample PDF of the Native Advertising Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 105.88 Billion

- 2033 Projected Market Size: USD 346.88 Billion

- CAGR (2025-2033): 13.9%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Some of the key players operating in the market include Taboola and Outbrain, and among others.

Taboola is a leading platform for native advertising and content discovery. It is distinguished by its ability to deliver highly personalized content recommendations, which drives strong user engagement. Taboola collaborates with numerous major publishers and advertisers to place native ads across a wide array of digital platforms, including websites and mobile apps. The platform's use of algorithms for targeting and its extensive network make it a go-to choice for advertisers running performance-based native campaigns. Taboola specializes in sponsored content and product recommendations, which are often delivered through in-feed and content carousel formats.

Outbrain is a key innovator in the native advertising space. It provides sophisticated content recommendation technology to a global client base of brands and publishers. The platform allows marketers to create engaging, non-disruptive native ad experiences on premium digital properties. Outbrain's core strength lies in its AI-driven targeting and optimization tools, which are designed to enhance ad relevance and user engagement. The company is focused on driving traffic and conversions through native placements seamlessly integrated within editorial content.

The market also includes emerging players who are gaining significant traction.

Nativo Inc. is one such participant, known for its emphasis on automation, brand storytelling, and a seamless user experience. The platform provides a solution for publishers and advertisers to scale native campaigns efficiently without compromising the quality of the content. Nativo's technology is specifically designed to streamline the distribution of branded content across various digital environments. It specializes in native ad formats that prioritize contextual relevance and high-quality content integration.

MGID is another rising global native advertising platform, recognized for its competitive pricing and expansive publisher network. It offers a diverse range of native formats, including in-content, recommendation widgets, and video ads, all optimized for high user engagement. MGID is rapidly expanding its footprint, particularly in emerging markets, making it a viable and cost-effective option for performance marketers. The company's expertise lies in audience targeting, real-time analytics, and monetization solutions for mid-tier publishers.

Key Players

- Taboola

- Outbrain

- RevContent

- MGID

- TripleLift

- Nativo Inc

- net

- Sharethrough

- Verizon Media (Yahoo Native)

- Teads

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

Reflecting the comprehensive analysis, the native advertising market is on a steady upward trajectory, fueled by growing brand demand for more integrated, less disruptive ad experiences. Evolving consumer expectations and rising mobile and social media usage are reshaping campaign strategies, prompting a shift toward personalized and contextually relevant content. Ongoing concerns around brand safety, transparency, and ad fraud are driving more robust measurement and compliance mechanisms. Geographic trends highlight strong growth in North America and the Asia‑Pacific region, with innovation in formats such as sponsored content, in-feed ads, and recommendation widgets. Moving forward, success in native advertising will hinge on deeper storytelling, dynamic data-driven optimization, and maintaining consumer trust.