The global high-performance fibers market is on a strong growth trajectory, expanding from a valuation of USD 13.42 billion in 2023 to an anticipated USD 26.53 billion by 2032, registering a healthy CAGR of 7.90% during 2024–2032. This surge is being driven by the increasing demand for lightweight, durable, and high-strength materials across multiple sectors, particularly aerospace, defense, automotive, and renewable energy.

High-performance fibers—such as carbon fiber, aramid, and polybenzimidazole (PBI)—stand out for their superior mechanical strength, thermal stability, and chemical resistance. Industries are adopting these materials to enhance efficiency, reduce weight, and improve operational performance in demanding environments.

Get Insights into Market Movements: Request a Sample Report! https://www.snsinsider.com/sample-request/4740

Market Growth Catalysts

- Aerospace & Defense Leading the Way

Aerospace and defense sectors are among the most significant adopters of high-performance fibers, where strength-to-weight ratio is a critical performance metric. The use of composite materials in modern aircraft and defense systems directly correlates to better fuel efficiency, improved maneuverability, and reduced maintenance.

- Airbus A350 XWB: Incorporates 53% composite materials, primarily carbon fiber, achieving a 25% reduction in fuel consumption compared to previous models.

- F-35 Lightning II fighter jet: Uses 35% composites, enhancing performance and cutting maintenance costs.

- NASA’s James Webb Space Telescope: Carbon fiber composites reduced weight by 30% while ensuring strength under extreme space conditions.

These examples highlight how aerospace innovations are setting the tone for broader industrial adoption.

- Automotive Sector Driving Lightweight Trends

Automakers are increasingly integrating carbon fiber-reinforced plastics (CFRP) and other advanced fibers to improve vehicle performance, efficiency, and sustainability.

- Ford GT: Uses CFRP to reduce weight by 40%, significantly improving acceleration, handling, and fuel economy.

- Electric Vehicles (EVs): Lightweight high-performance fibers extend battery range and efficiency. EV pioneers like BYD are using carbon fiber composites to optimize weight distribution and enhance mileage.

As regulatory pressure mounts for fuel economy and emission reductions, lightweight materials are becoming a competitive necessity.

- Renewable Energy Potential

In the energy sector, wind power is emerging as a promising application area for high-performance fibers. Lighter and more durable turbine blades—manufactured using carbon fibers—allow for larger blade sizes, improved efficiency, and reduced operational costs.

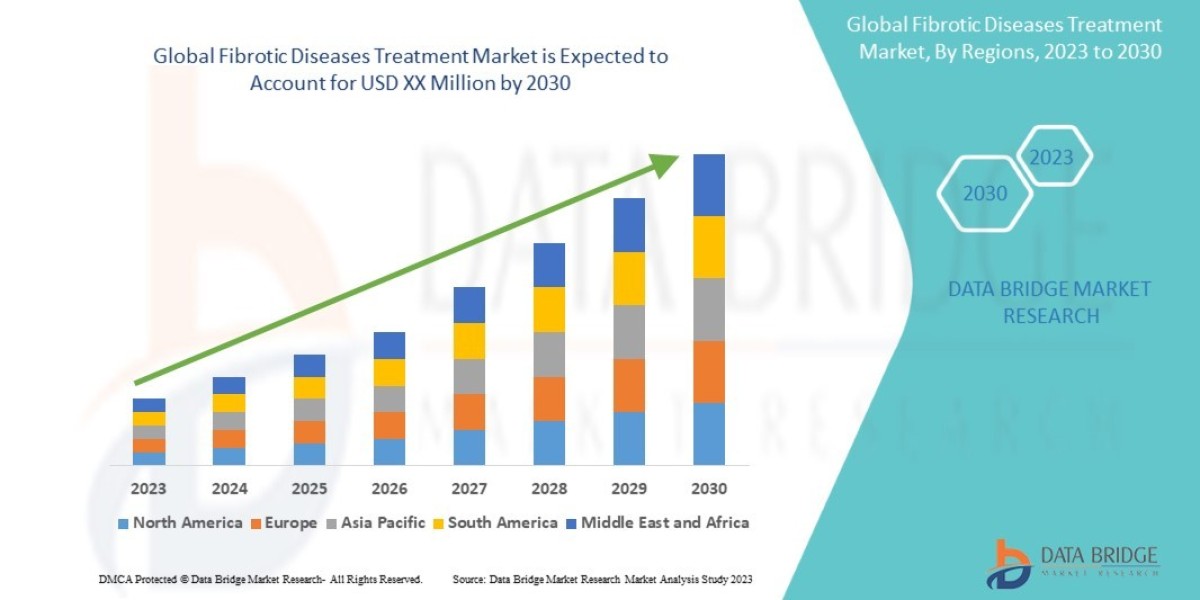

Regional Insights: Asia Pacific Dominance

In 2023, Asia Pacific accounted for over 44% of global revenue, a position it is expected to maintain and strengthen, recording the fastest CAGR during 2024–2032.

Key Factors Behind Asia Pacific’s Leadership:

- Rapid industrialization and technological advancements in China, Japan, and South Korea.

- Significant manufacturing capacity expansion for aerospace, automotive, and electronics.

- Strong policy push for electric vehicle adoption, with China targeting 20% EV sales by 2025.

- Strategic investments in advanced materials—Mitsubishi Heavy Industries and Korean Air are pioneering carbon fiber integration in airframes.

With a combination of industrial maturity and innovation leadership, the Asia Pacific region is poised to remain the growth engine of the high-performance fibers market.

Connect with Our Analyst to Address All Your Inquiries! https://www.snsinsider.com/request-analyst/4740

Key Market Drivers

- Increased demand for fuel efficiency in aerospace and automotive industries.

- Growing focus on renewable energy, particularly wind power.

- Superior performance properties (heat, chemical, and mechanical resistance).

- Expanding applications in defense, electronics, and sports equipment.

Market Restraints

- High production costs of high-performance fibers such as carbon and aramid.

- Complex manufacturing processes that require advanced infrastructure.

- Limited recycling capabilities, raising sustainability concerns.

Opportunities

- Sustainable composites: Development of recyclable and bio-based high-performance fibers.

- Next-gen aerospace projects: Increased demand for lightweight, durable airframes.

- EV boom: Lightweight fiber demand to enhance battery efficiency and range.

- Smart textiles: Integration of high-performance fibers into wearable technology for healthcare and defense applications.

Challenges

- Price competitiveness against conventional materials like steel and aluminum.

- Raw material supply chain constraints, especially for specialty polymers.

- Regulatory compliance for safety and environmental standards in multiple sectors.

Market Segmentation

By Product

- Carbon Fiber – Leading segment due to exceptional strength-to-weight ratio and versatility.

- Polybenzimidazole (PBI) – Known for extreme thermal resistance.

- Aramid Fiber – Widely used in defense and protective clothing.

- M5/PIPD & Polybenzoxazole (PBO) – Niche applications in aerospace and defense.

- Glass Fiber – Cost-effective option for construction and automotive.

- High Strength Polyethylene (HSPE) – High impact resistance, used in defense and sporting goods.

- Others – Emerging specialty fibers.

By Application

- Electronics & Telecommunication – High strength and thermal stability for advanced devices.

- Textile – High durability for specialized protective wear.

- Aerospace & Defense – Largest application segment.

- Construction & Building – Structural reinforcement and insulation.

- Automotive – Lightweight solutions for performance and fuel efficiency.

- Sporting Goods – High-performance sports equipment.

- Others – Industrial filtration, marine applications.

Regional Coverage

- North America – Driven by aerospace innovation and defense spending.

- Europe – Strong automotive and renewable energy adoption.

- Asia Pacific – Industrialization, EV adoption, aerospace innovation.

- Middle East & Africa – Emerging aerospace and construction markets.

- Latin America – Automotive manufacturing growth.

Competitive Landscape

The market is highly competitive, with global players focusing on innovation, sustainability, and production capacity expansion.

Key Companies:

Toray Industries, Inc. | DuPont | Teijin Ltd. | Mitsubishi Chemical Corporation | Honeywell International Inc. | DSM | Kolon Industries, Inc. | Kermel S.A. | Corning Incorporated | PBI Performance Products | AGY | Zoltek Corporation | Yantai Tayho Advanced Materials Co. | SGL Carbon | Solvay | Owens Corning | Toho Tenax Co., Ltd. | Toyobo Co. Ltd. | Mitsubishi Rayon Co. | China Jushi Group

These companies are actively investing in R&D, strategic partnerships, and sustainability initiatives to capture growing demand.

Future Outlook

The high-performance fibers market is at the forefront of materials innovation, and its growth will be closely tied to global trends in sustainability, electrification, and aerospace advancement. With increasing applications in both traditional and emerging industries, the market offers vast opportunities for companies that can balance performance, cost, and environmental responsibility.

By 2032, high-performance fibers will be indispensable to next-gen engineering solutions, from carbon-neutral aircraft to longer-range electric vehicles and sustainable energy infrastructure.