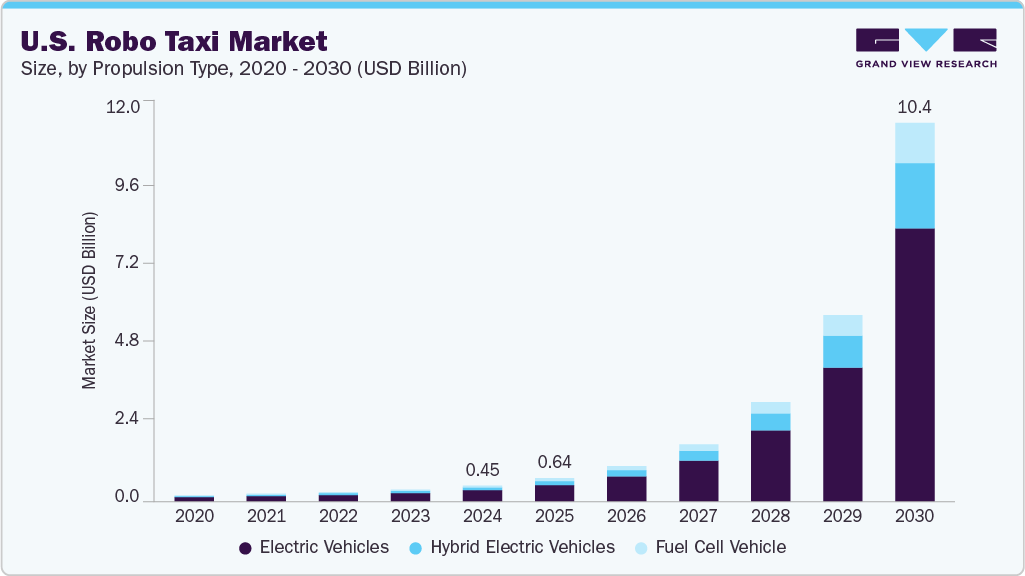

The U.S. robo-taxi market was valued at $0.45 billion in 2024 and is projected to reach $10.39 billion by 2030, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 74.6% from 2025 to 2030. The market is propelled by forward-thinking urban policies in major metropolitan hubs like San Francisco, Los Angeles, Austin, and Phoenix. These cities are actively testing autonomous mobility zones, developing AV-specific zoning codes, and collaborating with tech companies to create operational frameworks that support their sustainability and traffic management goals. This city-centric strategy is a key driver for the rapid commercialization of robo-taxis in high-density urban areas.

A fiercely competitive innovation landscape, fueled by well-funded tech giants and a thriving startup ecosystem, is unique to the U.S. robo-taxi market. Companies like Waymo, Cruise, Zoox (Amazon), and Aurora are leveraging significant capital and advanced technology to rapidly develop and refine autonomous ride-hailing platforms. Simultaneously, smaller startups are innovating in specialized areas such as mapping, safety software, and autonomous fleet management. The concentration of intellectual property, venture funding, and talent in U.S. tech hubs, particularly in California and Texas, ensures a continuous flow of innovation.

Furthermore, the U.S. insurance industry is playing a crucial role by creating new underwriting models and liability frameworks specifically for autonomous vehicles. Insurers are using telematics data and behavioral AI to evaluate risk and design customized policies for robo-taxi fleets. State-level regulatory flexibility permits the testing of new insurance models, such as usage-based pricing. This adaptability by insurers is helping to overcome a major commercial barrier to scaling robo-taxi services and is creating a more stable environment for investment and fleet expansion.

Key Market Insights:

- By Vehicle Type: The cars segment held the largest market share in 2024. Cars are the dominant vehicle type due to their compatibility with existing urban infrastructure and favorable regulatory preferences.

- By Service Type: The car rental segment was the market leader in 2024 and is expected to maintain significant growth. This model's dominance is attributed to its seamless integration with the country's well-established ride-hailing ecosystem.

- By Application: The passenger segment held the largest market share in 2024. The demand for flexible, tech-enabled transportation solutions has surged as cities such as San Francisco, Austin, and Miami embrace autonomous vehicle trials.

Order a free sample PDF of the U.S. Robo Taxi Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 0.45 Billion

- 2030 Projected Market Size: USD 10.39 Billion

- CAGR (2025-2030): 74.6%

Key Companies & Market Share Insights

Some of the major players in the U.S. robo-taxi market include Waymo LLC, Cruise LLC, Tesla Inc., Aptiv, and Uber Technologies Inc. These companies are making substantial investments in key areas like artificial intelligence (AI), vehicle autonomy, sensor technology, and fleet operations to revolutionize urban mobility. Their extensive real-world testing, strategic partnerships with vehicle manufacturers and regulators, and development of scalable platforms have positioned the U.S. as a global leader in autonomous mobility innovation.

- Waymo LLC, a subsidiary of Alphabet Inc., is a pioneer in the autonomous vehicle industry. Its flagship service, Waymo One, provides fully driverless robo-taxis in a number of U.S. cities, including Phoenix, San Francisco, Los Angeles, and Austin. By leveraging advanced sensor technology, AI-driven systems, and billions of miles logged in simulation and on public roads, Waymo has become one of the most commercially advanced and mature players in the market. The company's focus on safety, scalability, and user experience has set a high bar for the industry.

- Cruise, which is majority-owned by GM, is scaling its all-electric autonomous ride-hailing fleet in U.S. cities like San Francisco and Phoenix. The company has a focus on dense urban deployment and benefits from GM’s manufacturing and engineering support. Cruise's robo-taxis are equipped with redundant systems, advanced perception capabilities, and vehicle-to-cloud connectivity. While facing some regulatory challenges, Cruise continues to invest in technology and safety protocols, positioning itself as a strong long-term contender in the urban mobility sector.

- Uber Technologies Inc. is shifting its strategy from developing its own autonomous technology to becoming a platform for self-driving services. Uber is forging partnerships with a range of AV companies to integrate their robo-taxis into its ride-hailing network. For instance, Uber has a multi-year partnership with Cruise for customers to book rides through the Uber app. This approach allows Uber to scale its autonomous offerings more quickly and cost-effectively, leveraging its extensive network and data platform to manage supply and demand. This hybrid model of combining human and autonomous drivers is central to Uber's long-term vision.

Key Players

- Waymo LLC

- Cruise LLC

- Tesla Inc.

- Aptiv

- Uber Technologies Inc.

- Lyft, Inc.

- Zoox, Inc.

- Aurora Operations, Inc.

- Nuro

- Gatik

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. robo-taxi market is rapidly evolving, driven by progressive urban policies, strong technological capabilities, and a supportive regulatory environment. Major tech firms and startups are accelerating innovation across autonomous driving, fleet management, and AI integration. Strategic partnerships, particularly among mobility platforms and AV developers, are enabling faster commercialization in urban areas. Meanwhile, the insurance sector is adapting to address the unique challenges of autonomous fleets, paving the way for greater scalability. As cities continue to embrace AV trials and infrastructure improvements, the U.S. is poised to lead the global robo-taxi revolution.