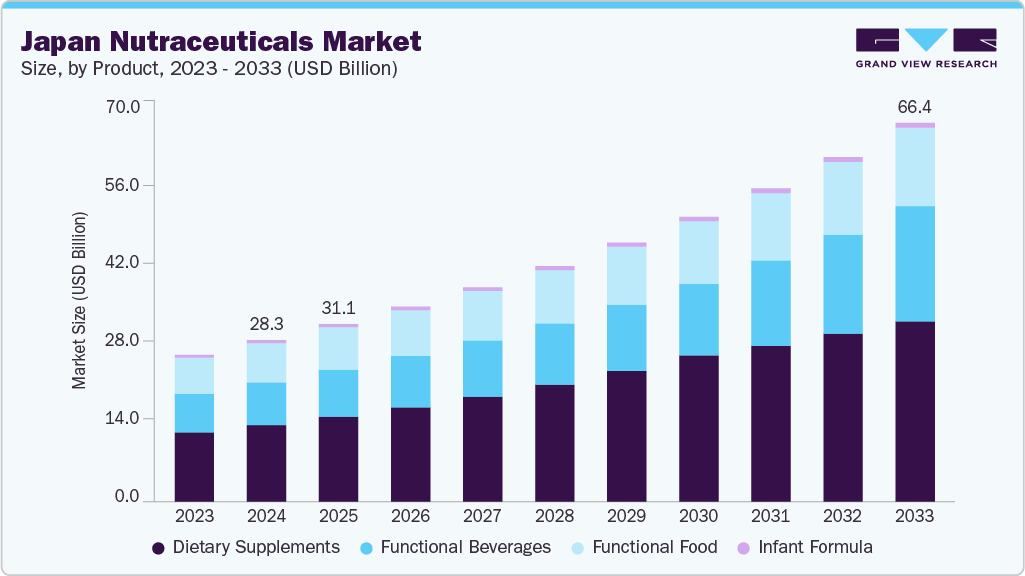

The Japan nutraceuticals market, valued at an estimated USD 28.31 billion in 2024, is on a growth trajectory, with projections to hit USD 66.4 billion by 2033. This expansion is forecasted to occur at a compound annual growth rate (CAGR) of 9.9% between 2025 and 2033. A key driver behind this growth is the increasing consumer preference for convenient, nutrient-dense liquid nutraceuticals. These products cater to a wide range of health needs, including energy, immune support, weight management, and healthy aging. Ready-to-drink supplements are particularly popular, as they seamlessly integrate into the fast-paced lives of urban consumers and align with a growing focus on personal health. The enhanced bioavailability and rapid nutrient absorption offered by liquid delivery systems also make them appealing to health-conscious individuals.

The market is also being reshaped by innovation and personalized products. For example, in November 2024, DSM-Firmenich and Rohto Pharmaceutical introduced "Vision R," a liquid multivitamin specifically designed for elderly Japanese consumers. This product utilizes DSM's "Sprinkle It Technology" to help bridge micronutrient deficiencies and support healthy aging.

Key Market Highlights:

- Product: Dietary supplements accounted for the largest market share in 2024, at 47.4%.

- Application: The weight management and satiety segment was the market leader in terms of application in 2024.

- Distribution Channel: The offline distribution channel held the highest market share in 2024.

Order a free sample PDF of the Japan Nutraceuticals Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 28.31 Billion

- 2033 Projected Market Size: USD 66.44 Billion

- CAGR (2025-2033): 9.9%

Key Companies & Market Share Insights

The Japan nutraceuticals market features several key players, including Amway Corp., Orthomol, Danone, Yakult Honsha Co., Ltd., and Otsuka Pharmaceutical Co., Ltd. These companies actively employ strategies like innovation, new product development, and distribution partnerships to meet evolving consumer demands and broaden their product portfolios to appeal to a diverse range of consumers.

Orthomol, for instance, provides a wide array of dietary supplements aimed at various health concerns. Their offerings cover categories such as brain and energy metabolism, children's health, gut health, eye health, heart and immune support, men's and women's health, sleep, fatigue, and sports and vegan nutrition.

Amway Corp., a global company with a presence in nutrition, beauty, home, and personal care, has a robust nutrition segment. Their portfolio includes targeted and foundational food supplements, personalized solutions, and sports nutrition products, among others.

Key Players

- Nestlé Health Science

- Amway Japan G.K.

- Herbalife International of America, Inc.

- Otsuka Pharmaceutical Co., Ltd.

- FANCL CORPORATION

- Kirin Holdings Company, Limited.

- SUNTORY HOLDINGS LIMITED.

- Yakult Honsha Co., Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Japan nutraceuticals market is witnessing robust growth, driven by rising consumer demand for convenient, functional, and health-focused products. Liquid nutraceuticals, especially ready-to-drink supplements, are gaining popularity due to their ease of use and enhanced nutrient absorption. Innovations like personalized formulations and advanced delivery technologies are reshaping product offerings. Major players are leveraging these trends to diversify portfolios and strengthen market presence. As urban lifestyles continue to evolve, the demand for targeted, accessible wellness solutions is expected to remain strong.