The UAE jewelry market, valued at an estimated USD 4.66 billion in 2024, is projected to expand significantly, reaching USD 7.65 billion by 2033. This growth is expected to proceed at a CAGR of 5.8% from 2025 to 2033. The market's upward trajectory is primarily fueled by increasing disposable income, a thriving luxury tourism sector, and the strong investment demand for both gold and diamonds.

The industry is further buoyed by the strong appetite for luxury items among the country's affluent population and tourists, particularly those from neighboring regions. The combination of rapid urbanization and exposure to global fashion trends is driving the demand for more contemporary jewelry designs. Additionally, the UAE’s welcoming government policies and tax incentives are attracting both retailers and consumers. The growing availability and popularity of online jewelry sales channels are also playing a crucial role in extending the market's reach.

The UAE's strategic position as a global trading hub is a major advantage, drawing in international brands and buyers. A heightened consumer focus on branded and certified jewelry is building trust and stimulating demand. Furthermore, the cultural significance of jewelry, deeply embedded in gifting traditions, consistently drives purchases throughout the year. The market also benefits from innovations in craftsmanship and personalized design options, which appeal to a broad customer base.

Key Market Insights:

- Product: Rings were the leading product segment in 2024, representing the largest revenue share at 37.4%. The demand for rings is deeply rooted in their cultural and emotional importance, especially during engagement and wedding ceremonies.

- Material: In 2024, gold jewelry dominated the market with a 58.5% share of the revenue. Gold's enduring popularity is tied to its profound cultural and religious significance in the region, where it is often associated with prosperity and celebration.

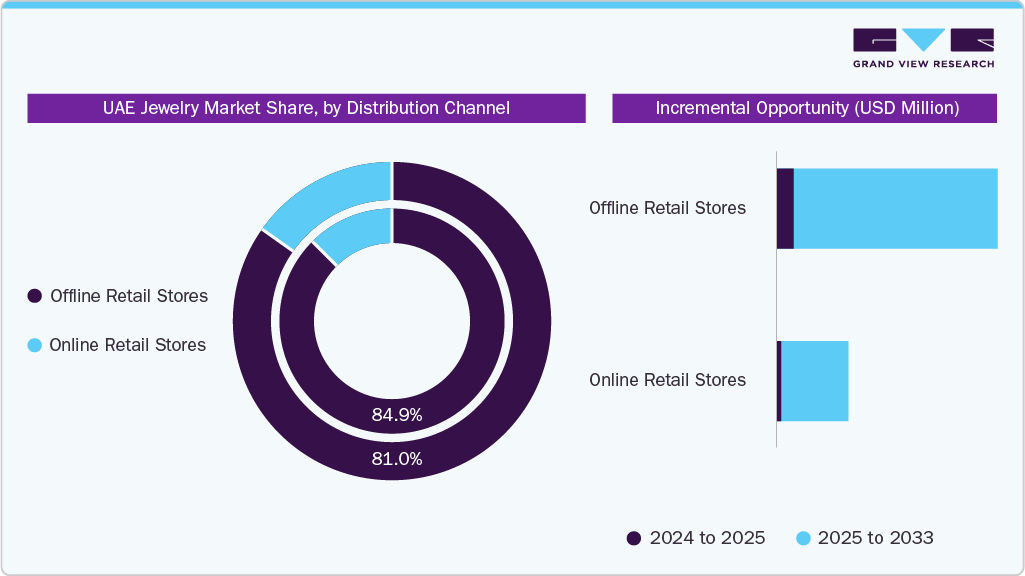

- Distribution Channel: In-store retail was the primary distribution channel, accounting for approximately 84.9% of total revenue in 2024. The strong preference for offline shopping is driven by consumers' desire to physically examine high-value items such as diamonds and gold before making a purchase.

- End-use: The women's jewelry segment held the largest share of the market in 2024, with approximately 74.3% of the revenue. Women remain the key consumer group, a trend fueled by strong traditions of gifting and personal adornment.

Order a free sample PDF of the UAE Jewelry Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 4.66 Billion

- 2033 Projected Market Size: USD 7.65 Billion

- CAGR (2025-2033): 5.8%

Key Companies & Market Share Insights

The UAE jewelry sector is a dynamic market where both well-established international brands and new local businesses compete for consumer attention. The most prominent companies have secured their position by entering the market early, maintaining a high standard of product quality, and successfully catering to the region's evolving focus on health and wellness.

Key Players

- Titan Company Limited

- Gafla

- Malabar Gold & Diamonds Limited

- Damas Jewellery

- Liali Jewellery

- Pure Gold Jewellers

- Taiba Jewellery

- Amwaj Jewellery

- Al Romaizan Gold & Jewellery

- Cara Jewellers

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The UAE jewelry market is poised for steady growth, driven by rising consumer affluence, a robust tourism industry, and a deep cultural connection to ornamental luxury. The sector thrives on a mix of tradition and innovation, with gold and diamond jewelry maintaining strong demand. Offline retail remains dominant, though online platforms are rapidly gaining traction. International and local brands alike are capitalizing on evolving preferences and the market's openness to global trends. With favorable policies and increasing personalization, the UAE continues to solidify its position as a premier jewelry destination.