The global Buy Now Pay Later Market was valued at an estimated USD 9.50 billion in 2024. It is forecast to grow at a CAGR of 27.0% from 2025 to 2033, reaching a projected USD 80.15 billion by the end of that period. A key factor propelling this growth is the increasing consumer desire for flexible and convenient payment methods.

BNPL services allow consumers to purchase goods and services without having to pay the full cost upfront, which offers greater financial flexibility and reduces the initial financial burden. The expansion of the BNPL market is also heavily influenced by the rise of e-commerce. As online shopping becomes more prevalent, consumers are looking for smooth and efficient payment options. BNPL solutions seamlessly integrate into the online checkout process, providing a quick and hassle-free payment experience. With the proliferation of e-commerce platforms and digital wallets, BNPL has become an appealing choice for both customers and merchants.

A significant challenge for the BNPL market is the potential for increased consumer debt. The growing availability of these services raises concerns that customers might overspend, leading to unmanageable debt. To mitigate this risk and encourage responsible lending, BNPL providers should implement rigorous credit checks and properly assess a customer's creditworthiness. Furthermore, providing clear information on the terms and conditions of BNPL options through educational campaigns can help consumers make informed financial choices and avoid excessive debt.

Key Market Insights:

- Regional Share: The North America market for Buy Now Pay Later held a 29.3% share of the total market in 2024.

- Regional Growth: The BNPL industry in Mexico is expected to experience substantial growth over the forecast period.

- Channel: The online segment was the dominant channel in 2024, accounting for a 66.5% share of the market.

- Enterprise Size: Large enterprises held the largest market share in 2024.

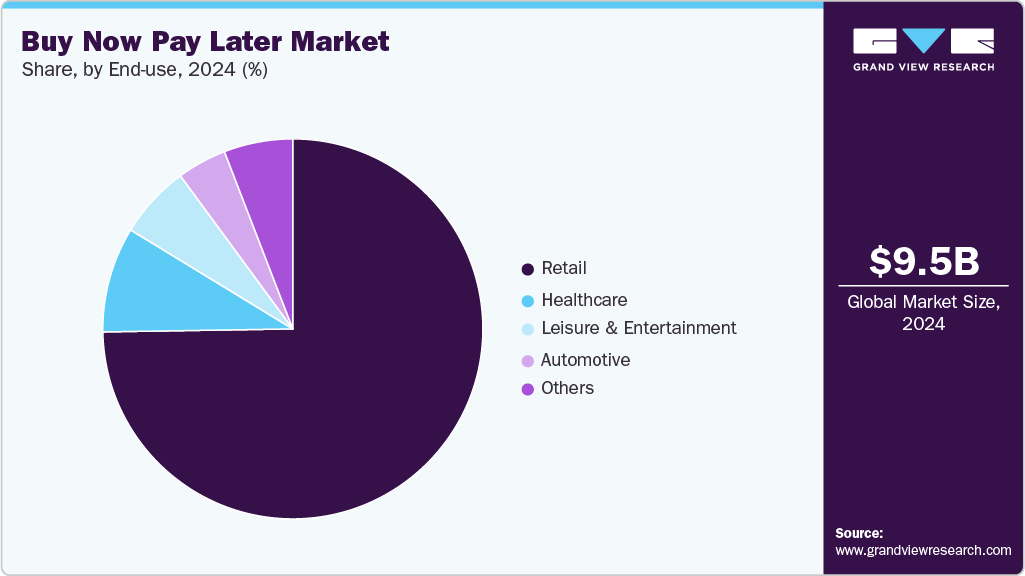

- End-use: In 2024, the retail sector was the primary end-use segment, dominating the market.

Order a free sample PDF of the Buy Now Pay Later Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 9.50 Billion

- 2033 Projected Market Size: USD 80.15 Billion

- CAGR (2025-2033): 27.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

The BNPL market includes several key players such as Affirm Inc., Klarna AB, Afterpay Limited (Block Inc.), PayPal Holdings Inc., and Zip Co Ltd. These companies are striving for a competitive advantage by engaging in strategic activities like forming partnerships with major retailers and fintech platforms, acquiring small payment startups, and integrating with digital wallets and e-commerce platforms. Through these collaborations, BNPL providers can improve their technological capabilities, offering advanced features like AI-powered credit risk assessments, real-time fraud detection, and customized financing plans.

Affirm Inc. is well-known for its transparent, interest-free installment options and sophisticated underwriting technology. The company emphasizes responsible lending by using machine learning and real-time data analytics to determine personalized credit limits without charging any hidden fees. Affirm has significantly expanded its customer base through partnerships with prominent retailers such as Amazon, Walmart, and Peloton, reaching consumers both online and in physical stores. Its focus on financial inclusivity and a user-friendly digital experience has made it a favorite BNPL option among Gen Z and millennial shoppers in North America.

Klarna AB differentiates itself in the BNPL sector with its extensive global presence, customer-focused platform, and innovative payment solutions. With operations in more than 45 countries, Klarna provides a seamless app and checkout experience that includes flexible payment options, direct payments, and interest-free installments. The company continues to stand out from competitors by offering unique features such as purchase tracking, loyalty rewards, and in-app shopping recommendations.

Key Players

- Affirm, Inc.

- Klarna Inc.

- Splitit Payments, Ltd.

- Sezzle

- Perpay Inc.

- Zip Co, Ltd

- PayPal Holdings, Inc.

- AfterPay Limited

- Openpay

- LatitudePay Financial Services

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Buy Now Pay Later (BNPL) market is rapidly evolving, driven by consumer demand for flexible payment options and the surge in e-commerce activity. Seamless integration into online platforms has made BNPL a preferred choice for both consumers and retailers. While the model offers notable convenience, rising concerns over consumer debt highlight the need for responsible lending practices. Leading providers are innovating with AI-driven risk assessments and enhanced digital experiences to remain competitive. With continued expansion across regions and sectors, the BNPL market is set to play a pivotal role in the future of digital commerce.