Introduction:

When Bitcoin was introduced in 2009, mainly people who were good at computer programming could use it because it required typing in special commands.

But as more people started liking cryptocurrencies, websites known as crypto exchanges were created. These made it easier for everyone to buy, sell, or keep cryptocurrencies like Bitcoin.

These platforms have made it possible for a broader audience to engage with cryptocurrencies, including those interested in how to buy Bitcoin in India, by providing a more user-friendly interface.

Before selecting a crypto exchange, that acts similarly to a stockbroker but for cryptocurrencies, it’s essential to evaluate not only the platform’s fees and features but also its security measures.

The failure of major crypto exchanges due to hacking incidents highlights the importance of security.

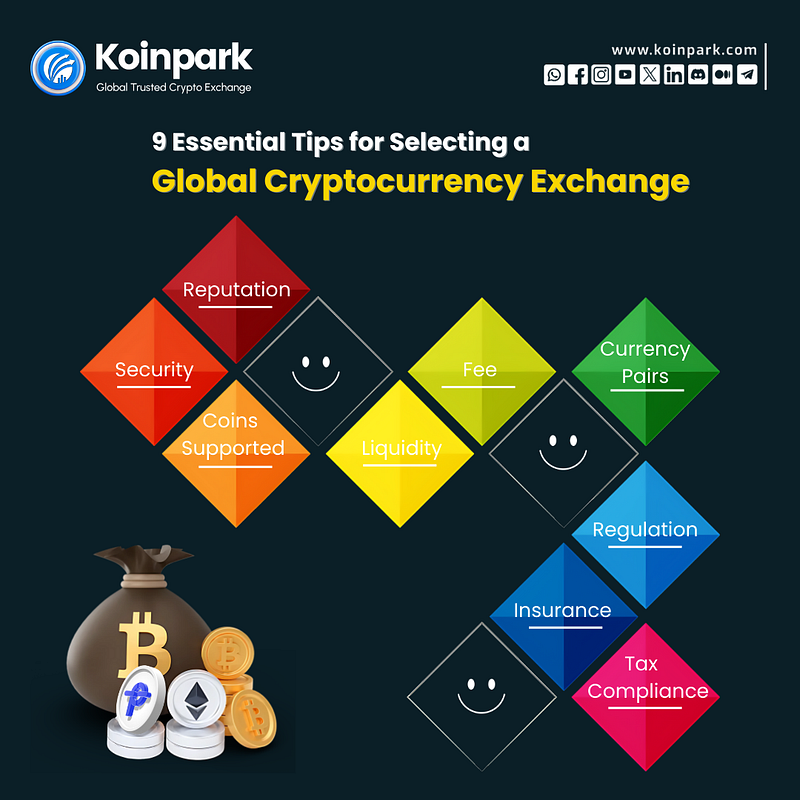

Choosing the Right Crypto Exchange: A Simple Guide

Reputation: Visit the exchange’s website, peruse user reviews, and explore its history. Opt for exchanges that have been operational for at least three years. Ensure they have verifiable proof of the cryptocurrencies they claim to possess.

Positive feedback from prominent investors and a clean history free from involvement in scams are good indicators. This step is crucial, especially when considering the best exchange platform to buy Bitcoin in India.

Security: Top-notch exchanges require several verification steps before account creation, indicating strong security protocols. Platforms that store digital assets offline in cold wallets offer enhanced safety. Additionally, rigorous transaction security measures are preferable.

Coins Supported: Leading exchanges provide support for a wide array of cryptocurrencies, from well-known ones to meme currencies.

If you’re interested in niche cryptocurrencies, you might need to look at exchanges based outside your home country, which might have different regulatory standards.

This consideration is particularly relevant for users converting BTC to INR, as they might seek platforms that support specific currency pairs.

Liquidity: Choose an exchange with high trading activity to ensure you can execute trades promptly at competitive prices. High trading volume generally equates to better liquidity.

Fee: Crypto exchanges typically impose transaction fees, which vary based on the traded volume and frequency. For those primarily interested in widely recognized cryptocurrencies or planning to hold them long-term, platforms like Robinhood, which do not charge commission fees, might be appealing.

This factor can influence the cost-effectiveness of converting Bitcoin to Indian rupees.

Currency Pairs: If frequent trading between different cryptocurrencies is your strategy, ensure the exchange offers a wide range of currency pairs. This feature is essential for efficiently managing transactions from Bitcoin to Indian rupees.

Regulation: Although crypto exchanges are not as heavily regulated as traditional financial institutions, choosing a platform with robust security practices and independent financial audits is wise.

Insurance: Some platforms offer insurance against theft, including protection from cyberattacks. Verify whether the exchange provides insurance for digital assets and FDIC protection for cash balances, which covers up to $250,000.

Tax Compliance: Profits from cryptocurrency trading are taxable. Not all exchanges, particularly those based abroad, may promptly issue the necessary tax documentation.

Opt for an exchange with reliable customer support that can assist with tax-related inquiries, which is an important aspect when considering how to buy Bitcoin in India and ensuring compliance with local tax laws.

Remember, when choosing a global cryptocurrency exchange, the platform’s safety and reliability are as crucial as its fees and functionalities.

Conclusion:

Selecting the right global cryptocurrency exchange is pivotal for a successful foray into digital trading. Prioritize a platform’s reputation, security measures, supported cryptocurrencies, liquidity, fee structure, available currency pairs, regulatory compliance, insurance policies, and tax support.

A reliable exchange not only secures your digital assets but also enriches your trading experience, making it vital for those exploring how to buy Bitcoin in India or seeking the best exchange platform to buy Bitcoin in India.

Always prioritize safety and conduct thorough research to embark on a secure and rewarding cryptocurrency trading journey.