Real estate investing offers lucrative wealth-building opportunities, but navigating the Karachi real estate market can be daunting for beginners. Understanding the fundamentals and avoiding common pitfalls are essential for success. In this guide, we'll provide actionable insights and practical tips to help beginners start their real estate investment journey while avoiding costly mistakes.

Understanding Real Estate Investment:

- Define your investment goals: Determine whether you're looking for long-term appreciation, rental income, or short-term profits through flipping properties.

- Learn the basics: Familiarize yourself with key concepts such as property types, market cycles, financing options, and investment strategies.

Setting Financial Goals and Budgeting:

- Assess your financial situation: Evaluate your current financial position, including income, expenses, savings, and credit score.

- Set realistic goals: Define your investment objectives, timeframe, and expected returns to create a clear roadmap for your real estate ventures.

- Establish a budget: Determine how much you can afford to invest, considering down payments, closing costs, renovation expenses, and ongoing maintenance.

Conducting Market Research:

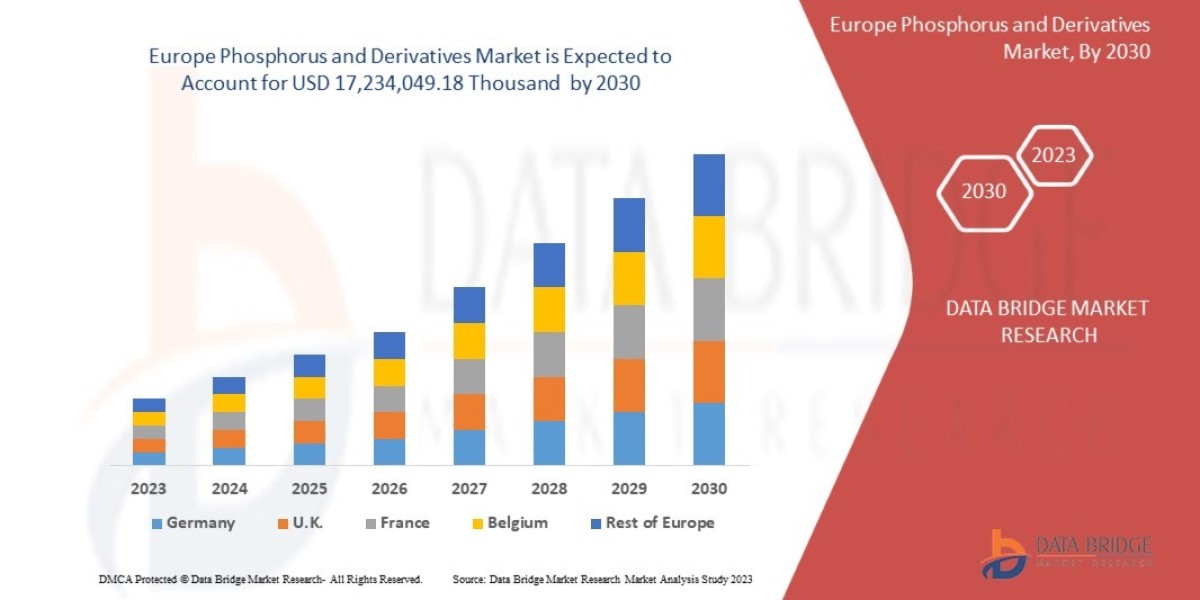

- Analyze local market trends: Research supply and demand dynamics, property values, rental rates, vacancy rates, and economic indicators in your target market.

- Identify investment opportunities: Look for emerging neighborhoods like HMR waterfront, areas with growth potential, and properties priced below market value.

- Consider risk factors: Assess factors such as job growth, population trends, crime rates, school districts, and infrastructure developments that may affect property values and rental demand.

Building a Professional Network:

- Find a mentor or advisor: Seek guidance from experienced investors, real estate professionals, or mentors who can provide valuable insights and advice.

- Hire a real estate agent: Work with a licensed agent who has local market knowledge and can help you find suitable investment properties.

- Partner with professionals: Collaborate with experts such as attorneys, accountants, contractors, and property managers to streamline your investment process and mitigate risks.

Financing Your Investments:

- Explore financing options: Consider traditional mortgages, FHA loans, VA loans, hard money loans, private financing, or seller financing based on your financial situation and investment strategy.

- Improve your credit score: Maintain good credit hygiene by paying bills on time, reducing debt, and monitoring your credit report for errors.

- Negotiate favorable terms: Shop around for the best interest rates, loan terms, and closing costs to minimize borrowing costs and maximize returns.

Avoiding Common Pitfalls:

- Overleveraging: Avoid taking on too much debt or investing beyond your means, as it can increase financial risk and lead to foreclosure or bankruptcy.

- Neglecting due diligence: Conduct thorough inspections, research, and analysis before purchasing a property to uncover potential issues and avoid costly surprises.

- Ignoring market trends: Stay informed about local market conditions, economic indicators, and regulatory changes that may impact your investment decisions.