The global dried blood spot collection cards market, valued at USD 381.57 million in 2023, is projected to reach USD 578.95 million by 2032, growing at a CAGR of 4.76% from 2024 to 2032. This upward trajectory is fueled by increasing adoption of minimally invasive diagnostic methods, rapid technological innovation, and a strong focus on expanding equitable healthcare access—particularly in underserved and rural regions.

Get Ahead of Market Shifts: Request Your Sample Report! https://www.snsinsider.com/sample-request/6239

Market Drivers and Restraints

The DBS collection cards market is gaining strong momentum, propelled by both demand-side growth and innovation-led advancements.

- Key Growth Driver – Newborn Screening Expansion

Growing newborn screening programs in both developed and emerging economies are a major catalyst. DBS cards allow for early detection of health conditions in infants, offering a cost-effective and efficient alternative to traditional sample collection—especially valuable where advanced infrastructure is lacking.

- Home-Based and Decentralized Diagnostics

Rising healthcare costs and the global shift toward home-based testing are driving adoption. DBS cards require minimal sample volumes, are cost-effective, and can be transported via postal services, making them ideal for remote analysis in low-resource settings.

- Challenges to Adoption

Barriers include a lack of global standardization, inconsistent regulatory requirements, and potential issues with sample contamination or degradation. Nonetheless, ongoing efforts in quality control, storage stability, and procedural harmonization are steadily overcoming these obstacles.

Regional Market Insights

- North America

Dominated the global market in 2023, supported by well-funded healthcare systems, robust neonatal screening mandates, and innovation in forensic and pharmaceutical applications. In the U.S., legislative measures like the Newborn Screening Saves Lives Act continue to drive adoption.

- Europe

Close behind, with countries such as Germany, France, and the UK integrating DBS into both medical diagnostics and forensic protocols. Strict regulations around early disease detection have spurred uptake across hospitals, labs, and research centers.

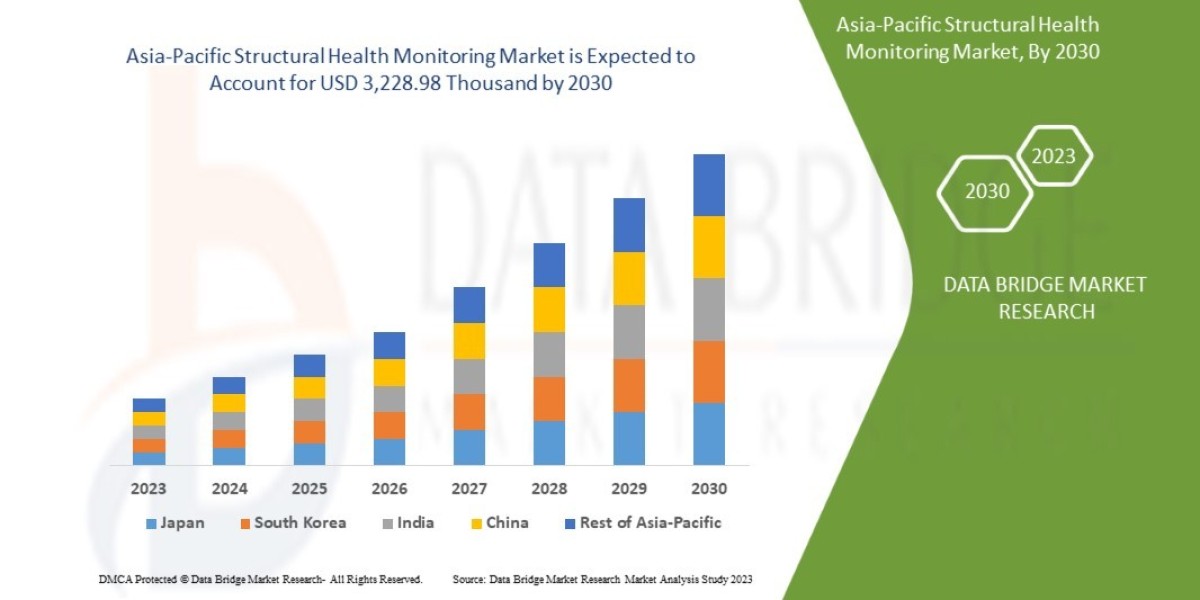

- Asia-Pacific – Fastest Growth Rate

Expected to lead market growth over the forecast period, driven by increasing healthcare awareness, higher birth rates, and government investments in diagnostic infrastructure. China, India, and Japan are witnessing rising applications in molecular diagnostics, therapeutic drug monitoring, and infectious disease screening, all benefiting from DBS’s cost-efficiency.

Opportunities and Challenges Ahead

- Opportunities

Advancements such as automated DBS processing, improved sample stability, and AI-powered data analysis are streamlining workflows. The technology’s expansion into forensic toxicology, biobanking, and clinical trials opens new growth avenues. R&D investment is accelerating, enabling multi-disease screening from a single blood sample—in line with the global move toward personalized medicine and remote health monitoring. - Challenges

Persistent issues include inter-laboratory variability, privacy risks in sample transport, and logistical hurdles in hard-to-reach areas. Additionally, a shortage of trained personnel could slow adoption in developing markets.

Connect with Our Analyst For Answers to Your Inquiries! https://www.snsinsider.com/request-analyst/6239

Market Segmentation

By Application

- Newborn Screening (largest segment)

- Infectious Disease Testing

- Therapeutic Drug Monitoring

- Forensics

- CRO/Research

- Other Applications

By Card Type

- Whatman 903

- Ahlstrom 226

- FTA Cards

- Others

By End Use

- Hospitals & Clinics

- Diagnostic Centers

- Others

Competitive Landscape

The market is home to both established diagnostic leaders and innovative niche players. Key participants include:

QIAGEN | PerkinElmer | Roche | Shimadzu Corporation | Ahlstrom-Munksjö | Pall Corporation | Eastern Business Forms, Inc. | Archimed Life Science GmbH | Centogene N.V. | GE Healthcare

Companies are prioritizing automation, strategic partnerships, and geographic expansion to secure market share. Consolidation through mergers and acquisitions is expected as emerging players bring specialized solutions that enhance established product portfolios.

Outlook: A Transformative Role in Global Healthcare

The DBS collection cards market is set to play a pivotal role in early disease detection, global health surveillance, and personalized medicine. Backed by supportive government policies, technological innovations, and heightened R&D activity, the technology is expected to integrate deeply into both public health systems and private diagnostic networks.

For the market to reach its full potential, stakeholders—manufacturers, healthcare providers, policymakers, and researchers—must work collaboratively to standardize practices, improve sample integrity, and optimize logistics. With these efforts, DBS technology will continue reshaping diagnostic accessibility worldwide in the decade ahead.