You have been dreaming of that summer road trip, cruising down the highway with the windows down and the wind in your hair. But when you sit down to research car loans, reality hits – your credit score is not where it needs to be to qualify for availing the best loans. A good credit score, that three-digit number, holds immense potential, influencing everything from loan approvals to top credit card processors. However, building a good credit score is not a mystery.

While credit cards often get a bad rap, using them responsibly can be a powerful tool to establish a positive credit history and pave the way for a brighter financial future. Therefore, this article is going to be about how to harness the power of credit cards to ease the process of building a good credit score for you. So without any further delay, let’s spill the beans. Read on.

What is A Credit Score?

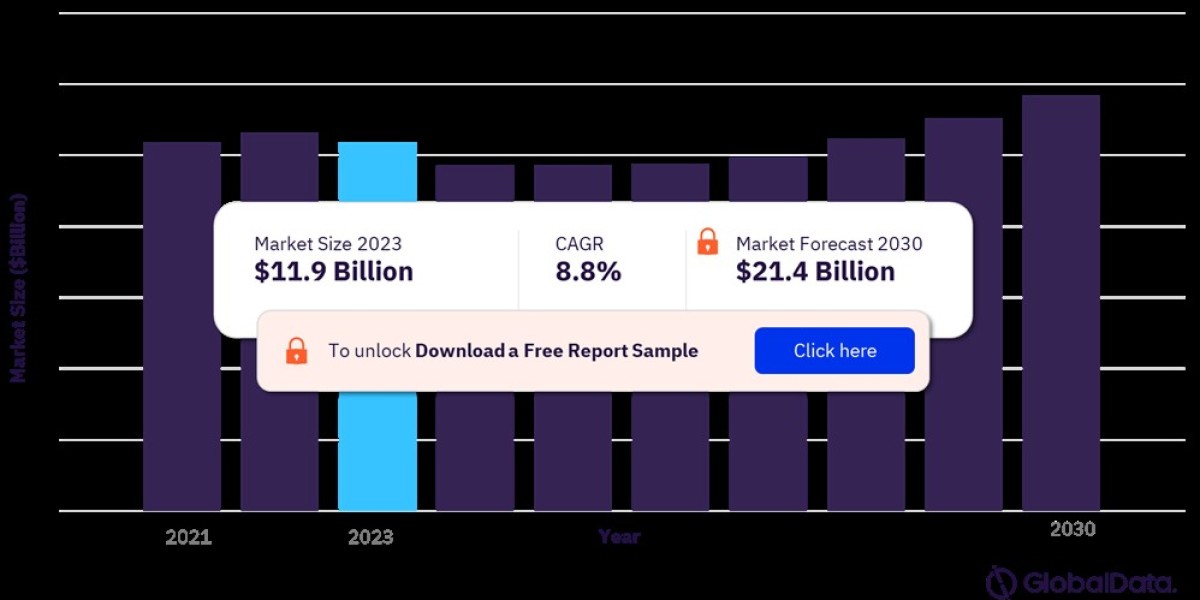

Before jumping to the 5 tips to increase your credit score, it is better to have a basic idea of what a credit score means. Think of your credit score as your financial report card. It tells lenders how reliable you have been with borrowed money in the past. A high score indicates responsible credit management and unlocks doors to better financial options like lower interest rates and favorable loan terms.

5 Smart Credit Card Habits For Building Credit:

1. Be Punctual of On-Time Payments:

This is the golden rule that every credit card holder should know! Because the late payments are the Achilles hills for a credit score. Missing even one payment can significantly damage your score and take a long time to recover from. Set up automatic payments or calendar reminders to ensure your payments are always submitted on time. Consistency is key here.

2. Always Pay off The Full Balance Payment:

While credit cards offer a convenient way to pay, avoid carrying a balance month-to-month. The ideal scenario is to pay your credit card balance in full each month. This strategy has a double benefit:

➔ Interest Charges Be Gone! You avoid the hefty interest charges which credit card companies love to impose.

➔ Credit Utilization Champion: By paying your balance in full, you keep your credit utilization ratio low (ideally below 30%). Remember, this ratio reflects the percentage of your credit limit you are using. A low ratio shows responsible credit management and gets a thumbs up from your credit score.

3. Do Not Max Out, Stay Within The Credit’s Limit:

Many credit holders surpass the maximum limit of their credit card which impacts their credit score. Maxing out your credit cards is considered a red flag to lenders. It suggests you might be overextending yourself financially. To cure this habit, Keep your credit card balances low, ideally well below your credit limit. This demonstrates responsible credit management and improves your credit utilization ratio, boosting your score.

4. Go Strategically, Do Not Haste To Apply:

While exploring different credit card options is tempting, resist the urge to apply for a bunch at once. Multiple credit card inquiries within a short period can negatively impact your credit score. Each inquiry leaves a temporary mark on your report. Apply strategically, only when necessary, and focus on the specific credit card processing that fits your credit-building goals.

5. Be Your Own Credit Report Detective:

Your credit report is a crucial document that significantly impacts your financial well-being. Make it a habit to check your credit report regularly for any errors or inaccuracies. These could be anything from missed payments that you rectified to mistakes in your personal information. The Fair Credit Reporting Act (FCRA) allows you to dispute any errors you find and get them corrected. A clean and accurate credit report is essential for a healthy credit score.

Bonus Tips To Level Up Your Credit Score:

Building a good credit score is slow process which takes time, but here are some ways to maximize speed up progress:

Team Up: Become an authorized user on a friend or family member's credit card with a good history. Their on-time payments can positively impact your score! (Just make sure you both agree beforehand).

Start Secure: If you are new to credit, consider a secured credit card. Put down a deposit as security, use the card responsibly, and eventually, you might be able to upgrade to a regular credit card.

Patience is Key: Building a good credit score does not happen overnight. Keep using your credit card responsibly and making payments on time. Over time, you will see positive results!

Conclusion:

In a gist, using credit cards responsibly can be a powerful tool for building a strong credit score. Remember the golden rule: pay your bills on time and keep your credit card balances low as well as choose a good credit card processing company to avoid headaches. By demonstrating consistent, responsible credit management, you can unlock a world of financial opportunities. Embrace financial discipline and make informed credit card choices to pave the way for a healthy financial future.