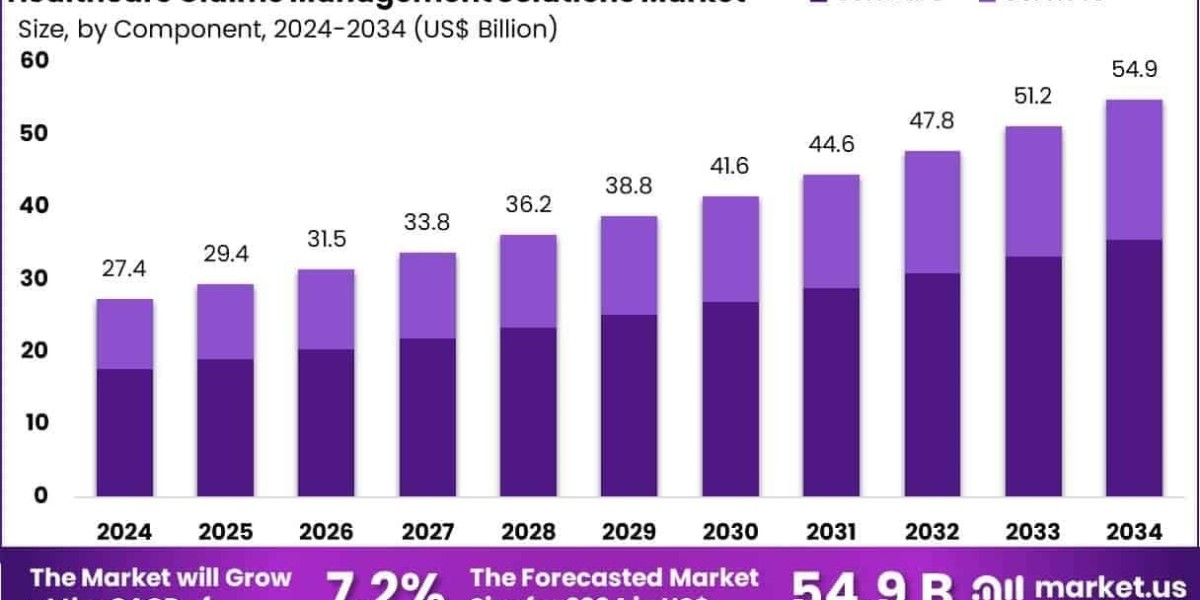

The Global Healthcare Claims Management Solutions Market Size is expected to be worth around US$ 54.9 Billion by 2034, from US$ 27.4 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.2% share and holds US$ 10.4 Billion market value for the year.

In 2025, the Healthcare Claims Management Solutions Market is enjoying rapid growth thanks to cloud interoperability and blockchain-secured claims workflows. Innovative SaaS platforms now allow real-time data exchange between payors, providers, and clearinghouses. With data residency and auditability concerns addressed through blockchain, clinical and financial records are securely tethered to claim files.

This transparency has reduced reconciliation delays and strengthened compliance with HIPAA and CMS mandates. Healthcare organizations are migrating their legacy claim engines to scalable cloud infrastructures to improve security and cost-efficiency. As telehealth usage continues to rise alongside hybrid care delivery, interoperable, blockchain-backed claims management is becoming a strategic priority.

Click here for more information: https://market.us/report/healthcare-claims-management-solutions-market/

Emerging Trends

- Cloud-native claim engines streamline claim intake, adjudication, and remittance across multiple service lines.

- Blockchain audit trails create immutable claim logs, simplifying regulatory audits and insurer-provider reconciliations.

- Cross‑organizational claims exchange via API-based workflows allows providers to access payor data in real time.

- Smart contracts automate payment triggers when contract conditions are met, expediting provider reimbursement.

Use Cases

- A regional health information exchange uses cloud claims platforms to connect rural clinics and urban hospitals.

- A commercial payor implements blockchain-led audit logs, cutting claim reconciliation time from weeks to days.

- A large insurer uses automated smart contracts to release funds upon claim approval, improving cash flow for providers.

- A telehealth provider integrates APIs for real-time claims submission and adjudication at point-of-care.