United States Optical Transceiver Market Overview

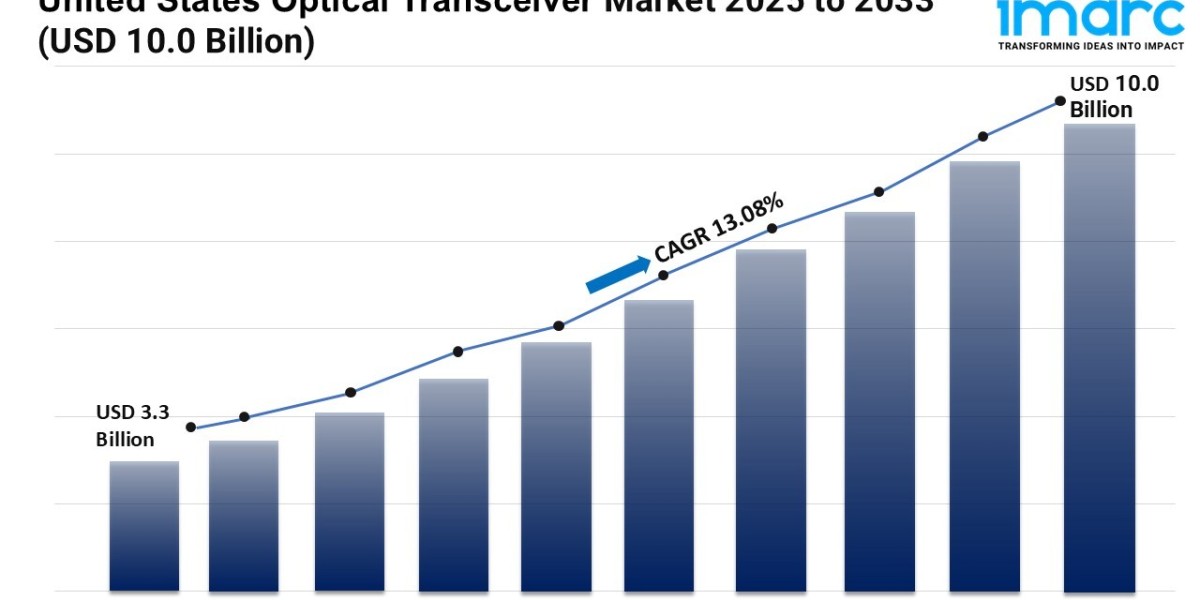

Market Size in 2024: USD 3.3 Billion

Market Forecast in 2033: USD 10.0 Billion

Market Growth Rate: 13.08% (2025-2033)

According to the latest report by IMARC Group, the U.S. optical transceiver market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.0 Billion by 2033, exhibiting a growth rate (CAGR) of 13.08% during 2025-2033. The market is experiencing significant growth, driven by the surging demand for high-speed internet and the expansion of data centers.

Download sample copy of the Report: https://www.imarcgroup.com/united-states-optical-transceiver-market/requestsample

United States Optical Transceiver Industry Trends and Drivers:

The optical transceiver market in the United States is experiencing robust growth, driven by the increasing demand for high-speed data transmission and the expansion of technologies such as 5G, data centers, and edge computing. Optical transceivers, which are crucial components in networking systems, facilitate the conversion of electrical signals into optical signals and vice versa, allowing for faster, more efficient data transfer over fiber optic cables. As the world moves towards more data-intensive applications, the need for advanced transceiver technologies has never been greater. The rise in internet traffic, the growing demand for higher-capacity networks, and the continuous evolution of fiber optic technologies are key factors contributing to the growth of the market.

Several trends are shaping the development of the optical transceiver market. The expansion of data centers, for instance, has created an insatiable demand for high-speed data transmission solutions. Data centers rely on optical transceivers to manage and route massive volumes of data, and as data consumption continues to soar, these systems must be equipped to handle increasingly complex and high-speed networking needs. Similarly, the ongoing rollout of 5G networks has also provided a significant boost to the optical transceiver market. With 5G networks requiring enhanced capacity and speed to support everything from smart cities to autonomous vehicles, optical transceivers play a pivotal role in ensuring that the infrastructure supporting these technologies can handle the immense amount of data traffic generated.

Another important driver of the market is the development of higher-capacity fiber networks and advanced modulation techniques. As the demand for faster internet speeds grows, the need for more advanced transceiver technology becomes increasingly vital. Transceivers with higher data rates, such as those supporting 100 Gbps and beyond, are becoming more prevalent, as they allow for seamless communication over long distances and between various devices and systems. Additionally, innovations in fiber optic technology are allowing for better bandwidth utilization and more efficient data transfer. The rise of edge computing also contributes to market growth, as it creates the need for more localized, high-speed data processing, further fueling demand for optical transceivers in network infrastructure.

Key Factors Driving the Market Growth:

- Data Center Expansion: As data centers continue to expand to support growing data needs, the demand for high-performance optical transceivers to ensure faster, reliable data transfer is increasing.

- 5G Network Deployment: The ongoing rollout of 5G networks has created a significant need for optical transceivers that support faster data rates and enhanced network efficiency.

- Advancements in Fiber Optic Technology: Continuous innovations in fiber optic networks and modulation techniques are driving the development of higher-capacity transceivers, which are crucial for supporting the ever-increasing data demands.

- Edge Computing Growth: The rise of edge computing, which requires local data processing at the network's edge, is fueling the demand for high-speed optical transceivers that ensure efficient and low-latency connections.

As the market for optical transceivers continues to grow, the variety of product types available is also expanding. Key form factors, such as SFF, SFP, QSFP, CFP, and XFP, cater to different needs depending on the specific use case and data rate requirements. Additionally, the fiber type—whether single mode or multimode fiber—determines the range and performance of the transceiver, with single mode fiber typically used for long-distance communication and multimode fiber used for shorter distances. The data rate of optical transceivers is also evolving, with products now supporting data rates ranging from less than 10 Gbps to more than 100 Gbps, allowing for high-speed data transmission to keep pace with the ever-growing demand for bandwidth.

The optical transceiver market is also experiencing growth across various application segments, including data centers, telecommunications, and enterprise networks. Data centers, as mentioned earlier, are one of the largest consumers of optical transceivers, as they rely on these components to maintain their vast networks. The telecommunications sector also plays a vital role, with optical transceivers ensuring that high-speed communication services can be delivered to consumers and businesses alike. Enterprises are increasingly adopting optical transceivers to meet their internal networking needs, as businesses seek to upgrade their infrastructure to keep up with the digital transformation sweeping across industries.

Applications Driving Market Expansion:

- Data Centers: As data storage and processing needs grow, data centers are increasingly reliant on optical transceivers to maintain high-speed, efficient communication across their networks.

- Telecommunications: Optical transceivers are essential for telecommunications providers, enabling them to offer high-speed internet and communication services to both individuals and businesses.

- Enterprise Networks: With businesses focusing on digital transformation, enterprise networks are incorporating optical transceivers to ensure faster and more reliable data transfer.

The future of the optical transceiver market in the United States is bright, with continued advancements in technology ensuring that the market remains dynamic and capable of meeting the demands of a rapidly evolving digital landscape. As more industries adopt 5G, data centers continue to grow, and edge computing becomes more prevalent, the role of optical transceivers in providing high-speed, efficient data transfer solutions will remain critical. The market’s rapid growth highlights the importance of optical transceivers in supporting the digital infrastructure of the future, ensuring that data can be transmitted seamlessly and efficiently across networks. With innovation driving this sector forward, the United States optical transceiver market is set to play an even more integral role in the digital ecosystem in the years to come.

United States Optical Transceiver Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest optical transceiver market share in the U.S. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

The report has segmented the market into the following categories:

Form Factor Insights:

- SFF and SFP

- SFP+ and SFP28

- QSFP, QSFP+, QSFP14 and QSFP28

- CFP, CFP2, and CFP4

- XFP

- CXP

- Others

Fiber Type Insights:

- Single Mode Fiber

- Multimode Fiber

Data Rate Insights:

- Less Than 10 Gbps

- 10 Gbps To 40 Gbps

- 40 Gbps To 100 Gbps

- More Than 100 Gbps

Connector Type Insights:

- LC Connector

- SC Connector

- MPO Connector

- RJ-45

Application Insights:

- Data Center

- Telecommunication

- Enterprises

Regional Insights:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

- Arista Networks Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Coherent Corp.

- Juniper Networks Inc.

- Smiths Interconnect Inc. (Smiths Group plc)

- Source Photonics Inc.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=20184&flag=F

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145