Debt Collection Software Market Outlook

The global debt collection software market reached a value of more than USD 4197.88 million in 2024. Aided by the rising demand for automation in financial operations and the increasing need for efficient debt recovery processes across diverse sectors, the debt collection software market size is further expected to grow at a CAGR of 10.50% during the forecast period of 2025-2034 to attain a value of above USD 11393.39 million by 2034.

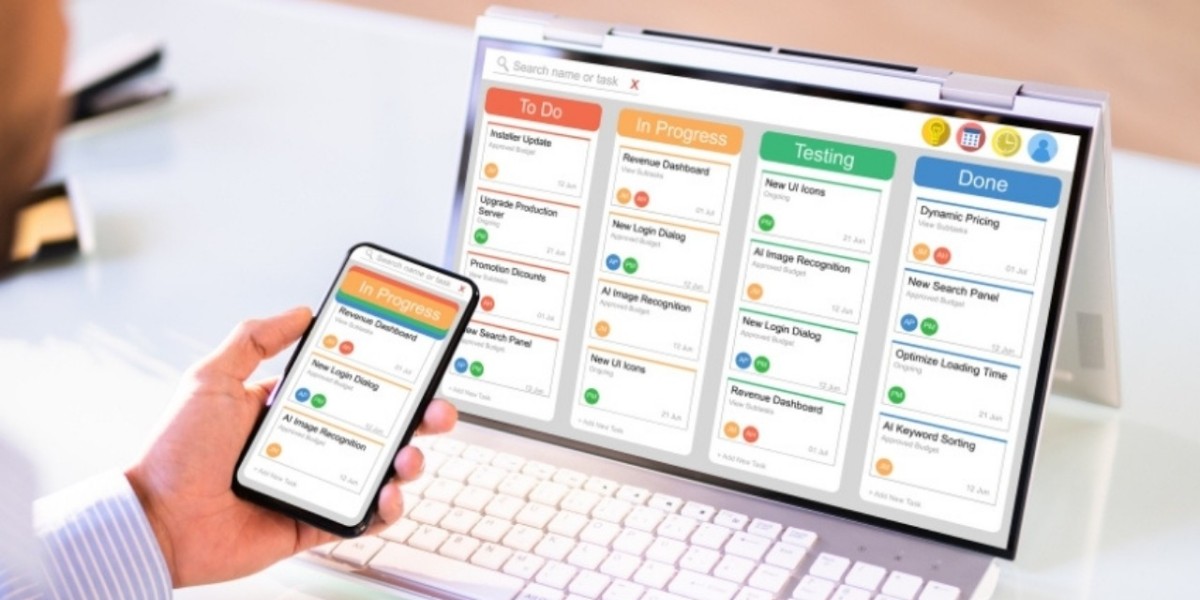

Debt collection software is designed to streamline the process of collecting overdue payments and managing delinquent accounts through automation, analytics, and workflow management. This software is widely utilised by financial institutions, collection agencies, government departments, and utility companies to enhance operational efficiency, reduce manual errors, and comply with regulatory standards. By automating tasks such as payment reminders, account tracking, and report generation, debt collection solutions help organisations improve recovery rates and customer experiences while reducing operational costs.

The global debt collection software market is experiencing robust growth driven by the increasing complexity of debt portfolios, rising digital transformation in the financial services sector, and the growing pressure on businesses to maintain cash flow and mitigate financial risk. With businesses expanding their customer bases and financial products becoming more diversified, the demand for scalable and customisable debt management solutions is rising significantly. Moreover, the growing emphasis on consumer-friendly debt collection practices and compliance requirements is prompting firms to adopt advanced software platforms that ensure transparency, security, and ethical engagement with debtors.

Debt Collection Software Market Trends

One of the key trends observed in the global debt collection software market is the rising integration of artificial intelligence (AI) and machine learning (ML) capabilities into software platforms. These technologies enable predictive analytics, customer segmentation, and automated decision-making, helping organisations prioritise high-risk accounts and personalise recovery strategies. AI-driven chatbots, for instance, are increasingly used to interact with customers, send reminders, and collect payments without human intervention, reducing labour costs and improving efficiency.

Another notable trend is the increasing shift toward cloud-based deployment models. Cloud-based debt collection software offers scalability, remote accessibility, data security, and cost-effectiveness, making it an ideal choice for organisations of all sizes. Small and medium-sized enterprises (SMEs), in particular, are adopting cloud platforms to gain access to enterprise-grade solutions without heavy upfront investment. The subscription-based pricing model of cloud software also allows for flexible budgeting and minimal infrastructure requirements.

Additionally, the market is witnessing a growing emphasis on omnichannel communication strategies. As customers increasingly interact across multiple platforms, debt collection software is evolving to include voice calls, emails, SMS, social media, and mobile apps to ensure effective debtor engagement. Multichannel communication not only improves customer responsiveness but also enhances the chances of successful collections by reaching customers on their preferred platforms.

Request your free report sample now and see the contents firsthand - https://www.expertmarketresearch.com/reports/debt-collection-software-market/requestsample

Drivers of Growth

The growing need for automation in financial operations is one of the primary drivers of the global debt collection software market. Manual collection processes are time-consuming, error-prone, and often fail to meet the demands of fast-paced business environments. By automating collection workflows, businesses can ensure faster debt recovery, reduce operational costs, and allocate resources more efficiently.

Another key driver is the rising volume of consumer and commercial debt. As credit becomes more accessible, the number of loans, credit cards, and installment-based services is increasing across both developed and developing economies. This surge in lending activity has created a pressing need for effective debt management systems to handle large volumes of accounts, monitor payment behaviour, and ensure timely follow-ups.

Furthermore, the tightening of regulatory frameworks across regions is compelling organisations to adopt compliant debt collection practices. Laws such as the Fair Debt Collection Practices Act (FDCPA) in the United States and the General Data Protection Regulation (GDPR) in Europe require businesses to protect consumer rights and maintain data privacy. Debt collection software helps ensure compliance by offering audit trails, consent management, and predefined communication protocols, reducing the risk of legal penalties and reputational damage.

The rise in digital banking and fintech innovations is also contributing to the market's growth. As financial institutions and fintech firms launch new credit products and expand into underserved markets, they increasingly rely on technology-driven solutions to manage collections and mitigate non-performing loans. The integration of debt collection software with core banking systems and customer relationship management (CRM) platforms provides a unified approach to account management, helping organisations enhance decision-making and customer service.

Industry Analysis

The global debt collection software market comprises a diverse mix of established software vendors, fintech innovators, and emerging start-ups offering tailored solutions to different industry verticals. Key players are focusing on continuous innovation, strategic partnerships, and product differentiation to strengthen their market presence. Features such as AI-based analytics, automated workflows, integrated payment gateways, and multilingual support are being prioritised to cater to a global clientele.

Based on end-users, the market includes financial institutions, collection agencies, healthcare providers, government agencies, telecommunications companies, and utilities. The financial services segment accounts for the largest share due to the sector's high dependence on credit and its need for robust risk management tools. However, sectors such as healthcare and utilities are emerging as high-growth segments due to increasing customer bases and rising payment defaults.

Deployment models in the market are segmented into cloud-based and on-premise solutions. While on-premise software offers greater control and customisation, the cloud-based segment is witnessing higher growth due to its flexibility, ease of updates, and lower upfront costs. With remote work becoming more prevalent, cloud adoption is expected to increase further in the coming years.

Regionally, North America dominates the global debt collection software market, driven by the presence of major industry players, advanced IT infrastructure, and a highly regulated financial environment. Europe follows closely, supported by stringent consumer protection laws and widespread adoption of digital financial services. The Asia Pacific region is projected to witness the fastest growth due to rising debt levels, increasing internet penetration, and digital transformation initiatives across emerging economies like India, China, and Indonesia.

Debt Collection Software Market Segmentation

The market can be divided based on component, deployment, organisation size, end user, and region.

Breakup by Component

- Software

- Services

Breakup by Deployment

- On-Premise

- Cloud

Breakup by Organisation Size

- Small and Medium Enterprises

- Large Enterprises

Breakup by End User

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom and Utilities

Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Competitive Landscape

Some of the major players explored in the report by Expert Market Research

- Chetu Inc.

- Experian Information Solutions, Inc.

- Fair Isaac Corporation

- Nucleus Software Exports Ltd.

- Transunion LLC

- Others

Challenges and Opportunities

Despite the positive growth trajectory, the global debt collection software market faces certain challenges. One of the primary concerns is data privacy and cybersecurity. Debt collection involves handling sensitive customer information, and any breach or misuse of data can lead to severe legal consequences and damage to brand reputation. Ensuring compliance with data protection regulations and maintaining robust security infrastructure is critical for vendors and users alike.

Another challenge is the resistance to automation within certain organisations. Traditional businesses may hesitate to transition from manual to automated systems due to fears of job displacement, implementation complexity, or high initial costs. Effective change management strategies and user training are essential to overcome these barriers and unlock the full benefits of digital solutions.

However, the market also presents substantial opportunities for growth. The increasing availability of open APIs and integration frameworks allows debt collection software to seamlessly interface with other enterprise systems, enabling a more comprehensive and connected approach to customer management. As digital transformation accelerates across industries, the demand for integrated, data-driven, and scalable software solutions is set to rise.

Emerging markets also offer untapped potential for software vendors. As credit systems expand and digital infrastructure improves in regions such as Latin America, Southeast Asia, and Africa, there is a growing need for efficient debt management tools to support financial inclusion and responsible lending. Tailoring solutions to local languages, payment preferences, and regulatory contexts can help companies expand their footprint in these high-growth markets.

Debt Collection Software Market Forecast

The global debt collection software market is projected to witness significant expansion during the forecast period from 2025 to 2034. Growing from a market size of USD 4197.88 million in 2024, it is expected to reach over USD 11393.39 million by 2034, reflecting a strong CAGR of 10.50%. This growth will be driven by the increasing automation of financial processes, the rising need for efficient and compliant debt management, and the growing role of AI and analytics in customer engagement strategies.

Continued innovation in features such as predictive modelling, speech analytics, robotic process automation (RPA), and real-time performance monitoring will enhance the capabilities of debt collection software. Vendors are likely to focus on modular and customisable offerings that cater to the specific needs of different industries and regions. As businesses prioritise cost optimisation and risk management, the role of advanced debt collection platforms will become increasingly central to financial operations.

Read Our Trending Reports:

Hydraulic Hose Market: https://www.expertmarketresearch.com/reports/hydraulic-hose-market

Paints and Coatings Market: https://www.expertmarketresearch.com/reports/paints-and-coatings-market

Wastewater Treatment Market: https://www.expertmarketresearch.com/reports/wastewater-treatment-market

Europe Toys Market: https://www.expertmarketresearch.com/reports/europe-toys-market

Media Contact:

Company Name: Claight Corporation

Email: sales@expertmarketresearch.com

Toll Free Number: +1-415-325-5166 | +44-702-402-5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: https://www.expertmarketresearch.com