Market Overview 2025-2033

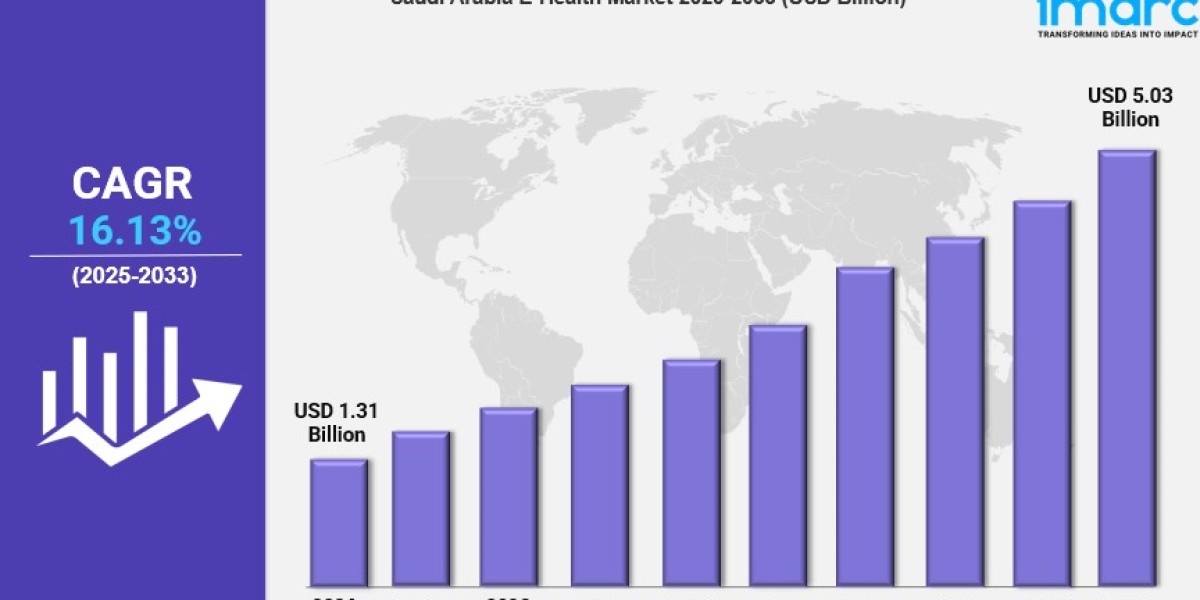

The Saudi Arabia e-health market size reached USD 1.31 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.03 Billion by 2033, exhibiting a growth rate (CAGR) of 16.13% during 2025-2033. Positive government policies for digital health revolution, higher investments in healthcare, mounting demand for distant healthcare services, expanding internet coverage, and uptake of sophisticated technologies such as AI, telemedicine, and electronic health records (EHRs) are among the major determinants bolstering the market growth.

Key Market Highlights:

✔️ Rapid market expansion driven by digital transformation in healthcare

✔️ Growing demand for telemedicine and remote patient monitoring solutions

✔️ Increasing adoption of AI and data-driven healthcare innovations

Request for a sample copy of this report: https://www.imarcgroup.com/saudi-arabia-e-health-market/requestsample

Saudi Arabia E-Health Market Trends and Drivers:

Saudi Arabia’s e-health market is undergoing rapid digital transformation, driven by government initiatives and investments in smart healthcare infrastructure. The Vision 2030 plan emphasizes digital health integration, aiming to enhance healthcare accessibility, efficiency, and patient outcomes. Hospitals and clinics across the country are adopting electronic health records (EHRs), cloud-based healthcare solutions, and AI-powered diagnostics to streamline medical processes.

Additionally, the growing use of Internet of Medical Things (IoMT) devices enables real-time health monitoring, reducing hospital visits and optimizing patient care. The expansion of 5G technology is further enhancing digital health capabilities, enabling faster data transmission and seamless integration of telehealth services. As the country continues to prioritize digital innovation in healthcare, the demand for advanced e-health solutions is expected to grow significantly in 2025.

The demand for telemedicine and remote patient monitoring in Saudi Arabia is rising due to increasing healthcare digitalization and patient preference for convenient medical consultations. The COVID-19 pandemic accelerated the adoption of virtual healthcare services, and this trend is expected to continue into 2025. Government support, including regulatory frameworks and telehealth reimbursement policies, is facilitating the expansion of online medical consultations, AI-driven diagnostics, and wearable health monitoring devices.

These solutions are particularly beneficial for managing chronic diseases such as diabetes and cardiovascular conditions, which are prevalent in the country. Moreover, rural and underserved areas are gaining improved access to healthcare services through telemedicine platforms, reducing geographical barriers to quality care. As digital health adoption continues to rise, telemedicine and remote monitoring will remain key growth drivers in Saudi Arabia’s e-health market.

Artificial intelligence (AI) and big data analytics are revolutionizing Saudi Arabia’s e-health sector, driving efficiency, accuracy, and personalization in healthcare services. AI-powered tools are being integrated into diagnostics, predictive analytics, and robotic-assisted surgeries, enhancing clinical decision-making and patient outcomes. Big data analytics is improving population health management by enabling early disease detection, real-time patient monitoring, and personalized treatment plans.

Additionally, AI-driven chatbots and virtual assistants are being deployed for automated patient support and administrative tasks, reducing operational costs and improving service delivery. The Saudi government and private healthcare providers are investing in AI research and development, further accelerating innovation in the sector. With the increasing adoption of AI and data-driven healthcare solutions, the e-health market in Saudi Arabia is expected to experience significant growth in 2025.

Saudi Arabia E-Health Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Saudi Arabia E-Health market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Type Insights:

- Electronic Health Records

- e-Prescribing

- Telehealth & Telemedicine

- Mobile Health

- Others

Services Insights:

- Monitoring

- Diagnostic

- Healthcare Strengthening

- Others

End-User Insights:

- Healthcare Professionals

- Healthcare Consumers

- Public & Private Insurers

- Pharmacies

- Others

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800