Market Overview 2025-2033

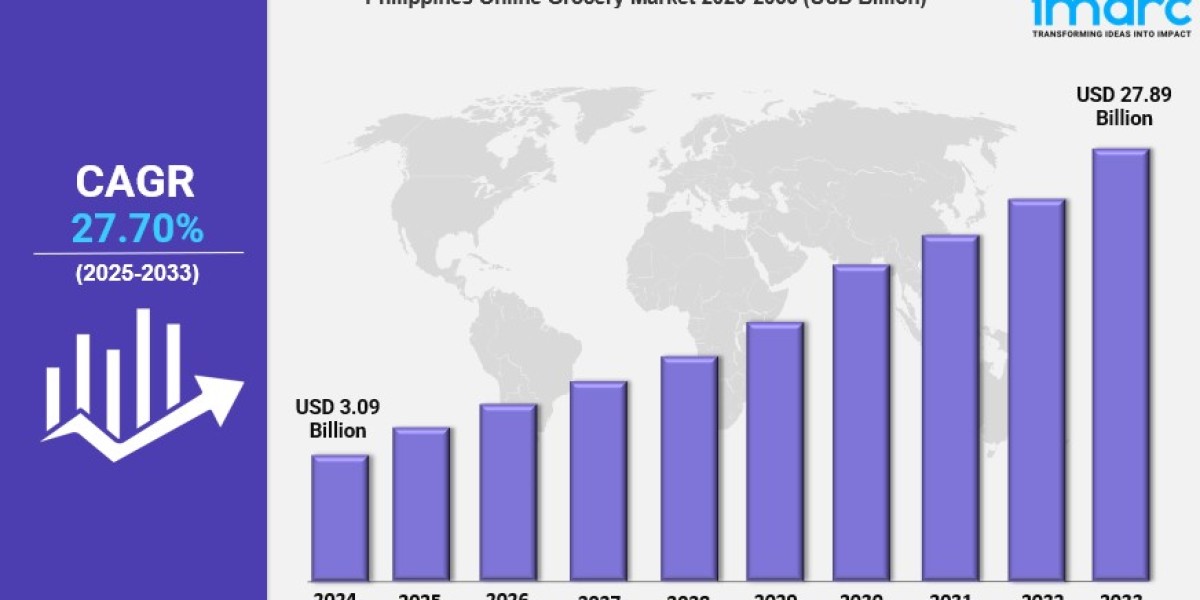

The Philippines online grocery market size reached USD 3.09 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.89 Billion by 2033, exhibiting a growth rate (CAGR) of 27.70% during 2025-2033. The Philippines online grocery market share is growing due to rising internet penetration, smartphone usage, and digital payments. Mobile-friendly platforms, fintech adoption, and cashless transactions enhance convenience. Government support, retailer investments, and secure payment systems drive e-commerce expansion.

Key Market Highlights:

✔️ Strong market expansion driven by digital adoption & urban lifestyle shifts

✔️ Increasing demand for fresh and premium grocery products online

✔️ Rising preference for sustainable and eco-friendly packaging solutions

Request for a sample copy of this report: https://www.imarcgroup.com/philippines-online-grocery-market/requestsample

Philippines Online Grocery Market Trends and Drivers:

The rapid growth of technologies across the Philippines has greatly accelerated the demand for online grocery stores since more and more consumers are embracing the convenience of purchasing online. The growing popularity of the internet and the wide-spread use of smartphones, and the rising acceptance of cashless transactions makes it easy for Filipinos to switch of traditional grocery shopping to online alternatives. In 2025, the demand for a seamless, technologically-driven grocery shopping experience will likely to grow even more because of urban lifestyle demands and the desire of convenience.

Supermarket chains e-commerce giants, and independent retailers are continuously making improvements to their online presence through investing in user-friendly apps that provide AI-driven suggestions and personalized buying experiences. Furthermore, the most advanced technology for payments such as buy-now-pay-later, e-wallets and buy-now (BNPL) services, make the online shopping experience more accessible to a wider audience. With competition growing, businesses are seeking to improve the efficiency of last-mile delivery. They offer quick and same-day delivery to meet the evolving requirements of customers.

Filipino customers are increasingly discerning in their shopping for groceries. There is a growing demand for organic, fresh and premium foods. The need for high-quality products like fruits, meats, seafood and vegetables is increasing as health-conscious consumers seek healthier alternatives to their diets. In 2025, the online food market will experience an exponential increase in high-end and specialty items that are organic, such as organic vegetables and fruits plants, and imported gourmet foods. Online stores are responding by collaborating with local producers, farmers and international brands to offer an extensive array of unique and fresh goods.

A subscription-based food delivery and the delivery of personalised meals kits are also becoming popular with individuals with a busy schedule and families with convenience, but without sacrifices to high-end quality. In addition new cold chain logistics and enhanced packaging methods are ensuring the freshness of perishable products and make shopping online much more convenient and secure option for shoppers.

As the awareness of the environment is growing, Filipino consumers are becoming more conscious of eco-friendly packaging choices when purchasing food items online. The increasing concern over the impact of plastic waste on the environment has prompted the need for biodegradable, recyclable and compostable containers. In 2025, the online retailers of groceries will be focusing on sustainable packaging alternatives such as paper-based bags, compostable wraps, as well as recyclable containers that conform with the needs of consumers as well as legal requirements. Supermarkets and grocery stores online are also offering sustainability initiatives, for example encouraging returns on packaging that is reusable and the distribution of items which are recyclable.

Additionally, the need for sustainability isn't limited to packaging. A lot of retailers are now purchasing ethically produced products and are encouraging local sustainable and organic products. Since customers are to support brands with sustainable policies that align with their values and beliefs that are sustainable, retailers that adopt sustainable practices will gain an advantage in the market and improve customer loyalty and grow within the business.

Philippines Online Grocery Industry Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Product Type Insights:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Business Model Insights:

- Pure Marketplace

- Hybrid Marketplace

- Others

Platform Insights:

- Web-Based

- App-Based

Purchase Type Insights:

- One-Time

- Subscription

Regional Insights:

- Luzon

- Visayas

- Mindanao

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145