Market Overview 2025-2033

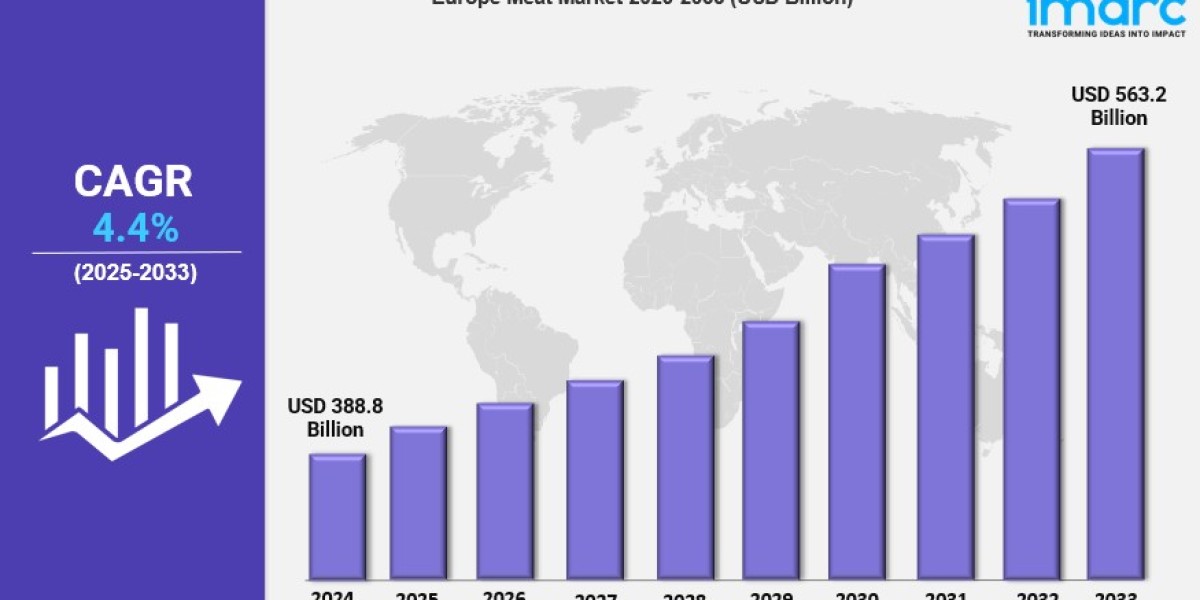

The Europe meat market size was valued at USD 388.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 563.2 Billion by 2033, exhibiting a CAGR of 4.4% from 2025-2033. The market is driven by rising consumer demand for high-protein diets, expanding fast-food chains, advancements in meat processing technologies, and increasing availability of organic and plant-based meat alternatives. Additionally, growing awareness of sustainable farming practices and regional preferences for premium and processed meat products further fuel market growth.

Key Market Highlights:

✔️ Steady Market Growth Driven by Changing Dietary Habits & Urbanization

✔️ Increasing Popularity of Premium, Organic, and Plant-Based Meat Alternatives

✔️ Rising Focus on Sustainable and Eco-Friendly Meat Production & Packaging

Request for a sample copy of this report: https://www.imarcgroup.com/europe-meat-market/requestsample

Europe Meat Market Trends and Drivers:

The European meat market is undergoing significant transformation in 2025 as consumer preferences shift toward high-quality, ethically sourced, and convenient meat options. Urbanization and busy lifestyles are fueling the demand for ready-to-cook and processed meat products that offer both convenience and premium taste. Consumers are increasingly seeking transparency in sourcing, with a growing preference for locally produced, grass-fed, and antibiotic-free meat. Reports indicate that retail chains and food service providers are responding to this demand by offering a wider range of gourmet meat cuts, dry-aged beef, and traceable supply chain products.

Additionally, the rise of digital grocery shopping and direct-to-consumer (DTC) meat delivery services is reshaping purchasing patterns, making it easier for consumers to access fresh, high-quality meats from local farms. Meat subscription boxes, customized portion sizes, and vacuum-sealed packaging innovations are further enhancing the convenience factor. With an increasing focus on quality over quantity, European meat producers are adapting their strategies to cater to discerning consumers looking for ethically produced, flavorful, and easy-to-prepare meat options.

Health consciousness and sustainability concerns are driving a surge in demand for organic, grass-fed, and plant-based meat alternatives across Europe. Consumers are becoming more mindful of the nutritional value of their food, leading to a rise in sales of leaner and naturally raised meat options that contain fewer additives and hormones. Organic meat, free from antibiotics and pesticides, is particularly gaining traction, with supermarkets and butchers expanding their organic product lines to meet demand. Simultaneously, the flexitarian movement is growing, encouraging the consumption of both traditional and plant-based proteins.

As a result, hybrid meat products—blending plant-based ingredients with conventional meat—are emerging as a popular choice for consumers seeking healthier and more sustainable alternatives. Major food manufacturers and startups are investing in cultivated and lab-grown meat technologies to reduce the environmental impact of meat production while maintaining taste and texture. According to industry reports, plant-based meat sales are expected to rise significantly by 2025, influencing traditional meat companies to diversify their product offerings and embrace alternative protein solutions.

Sustainability is becoming a central focus in the European meat industry, with producers adopting eco-friendly practices to reduce carbon emissions, minimize waste, and enhance ethical farming methods. Climate-conscious consumers are pressuring meat companies to implement more sustainable sourcing, such as regenerative agriculture, responsible livestock farming, and carbon-neutral meat production. Leading meat producers are investing in improved waste management, water conservation systems, and energy-efficient processing facilities to meet stringent environmental regulations.

Furthermore, sustainable packaging solutions are gaining importance, with meat brands transitioning to biodegradable trays, compostable wrapping, and recyclable vacuum-sealed packs to reduce plastic waste. The European Union’s push for stricter food sustainability policies is also driving companies to rethink their supply chain strategies and prioritize eco-friendly innovations. Reports suggest that brands incorporating transparency, ethical sourcing, and green packaging will have a competitive advantage, as environmentally conscious consumers increasingly favor products that align with their values. By 2025, the European meat industry is expected to be more focused on sustainability, balancing consumer demand for high-quality meat with environmentally responsible practices.

Europe Meat Industry Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Type:

- Raw

- Processed

Analysis by Product:

- Chicken

- Beef

- Pork

- Mutton

- Others

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Countries Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145