Market Overview 2025-2033

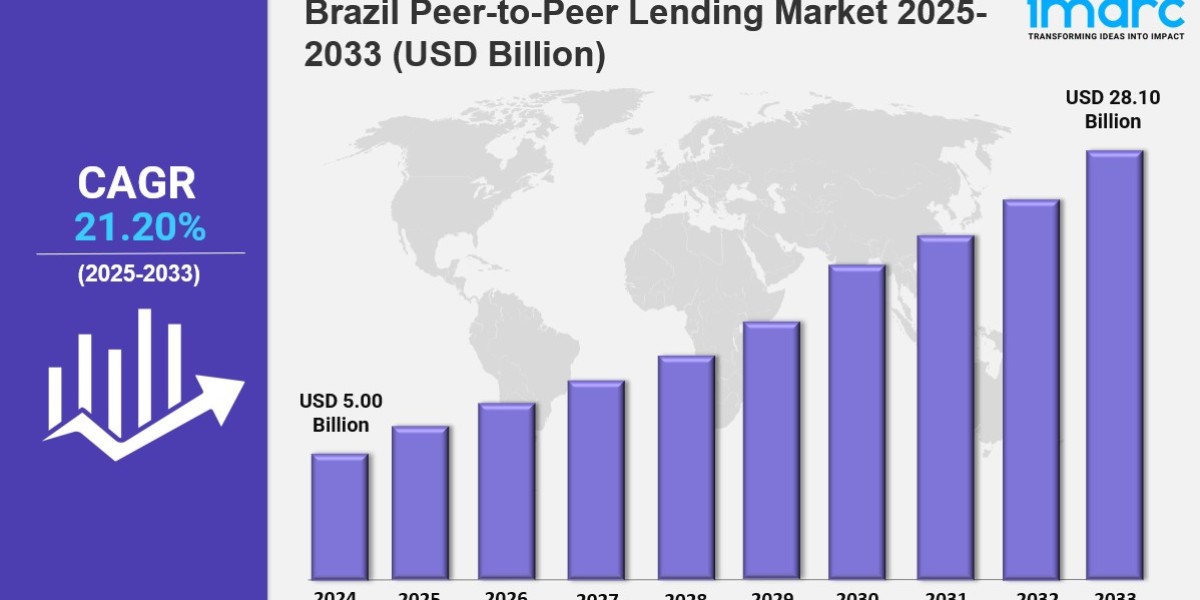

The Brazil peer-to-peer lending market size reached USD 5.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 28.10 Billion by 2033, exhibiting a growth rate (CAGR) of 21.20% during 2025-2033. The market is expanding due to increasing digital financial services, rising demand for alternative lending solutions, and growing fintech adoption. Regulatory developments, investor participation, and technological advancements are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by increasing demand for alternative financing solutions

✔️ Rising adoption of digital lending platforms and AI-driven credit assessment

✔️ Expanding regulatory support for fintech innovations and financial inclusion

Request for a sample copy of the report: https://www.imarcgroup.com/brazil-peer-to-peer-lending-market/requestsample

Brazil Peer-to-Peer Lending Market Trends and Drivers:

The market for peer-to-peer (P2P) lending in Brazil is expanding at a revolutionary rate, and it has established itself as a major participant in terms of both market size and market share. Improvements in regulations intended to promote financial inclusion are the main driver of this growth. The PIX rapid payment system and Open Banking are two frameworks that the Central Bank of Brazil has implemented to improve transparency and expedite transactions. P2P platforms can now extend their operations while adhering to anti-fraud and data protection regulations thanks to these measures and the 2024 update to the Legal Framework for Fintechs, which has lowered administrative barriers.

Startups can test new credit models without having to worry about full compliance thanks to regulatory sandboxes, especially those tested in 2024, which draw in both domestic and foreign investors. Because P2P assets offer yields higher than those of traditional fixed-income instruments, both retail and institutional investors are using them to diversify their portfolios as confidence in digital financial ecosystems increases. Since early 2024, platform registrations have increased by 35% annually due to the availability of customized loans with competitive rates for borrowers, particularly SMEs that are not eligible for traditional banking.

This momentum underscores the Brazil peer-to-peer lending market growth, which continues to gain traction. Technological innovation is reshaping Brazil’s P2P lending landscape, further driving Brazil peer-to-peer lending market size and Brazil peer-to-peer lending market share. Platforms are leveraging AI, blockchain, and big data to mitigate risks and expand reach. Machine learning algorithms analyze alternative data—social media activity, utility payments, and e-commerce behavior—to assess creditworthiness for underserved populations. In 2024, blockchain-based smart contracts gained traction, automating loan agreements and reducing defaults through immutable transaction records.

Mobile app adoption has skyrocketed, with 78% of loans originated via smartphones, reflecting Brazil’s 85% smartphone penetration rate. Platforms are also partnering with neobanks and e-commerce giants to embed lending options at checkout stages, targeting micro-entrepreneurs and gig workers. This tech-centric approach has slashed approval times from weeks to minutes, democratizing access to credit in regions where traditional banks maintain limited physical presence.

With increasing investor confidence, continuous regulatory support, and advanced fintech solutions, the Brazil peer-to-peer lending market growth is set to accelerate further, making it a vital segment of the country’s evolving financial landscape. High interest rates in Brazil's formal banking sector average 45.6% for personal loans in 2024. This situation is pushing borrowers to seek P2P alternatives. Inflation and stagnant wages have increased the need for affordable credit, especially for low-to-middle-income households.

P2P platforms meet this need by offering rates 20–30% lower than banks and providing flexible repayment terms. At the same time, institutional investors are putting money into P2P portfolios to protect against volatility in stocks and bonds. A key trend in 2024 is the growth of niche platforms focused on green energy projects and agribusinesses. These align with Brazil's sustainability goals and its strong agricultural exports. However, economic inequality and regional gaps remain.

Platforms in São Paulo and Rio de Janeiro account for 70% of market activity, revealing untapped potential in the Northeast and Amazon regions. The Brazilian P2P lending sector is becoming a key part of the country’s financial system. This growth is supported by flexible regulations and advanced technology. Platforms are now connecting with other fintech services, like digital wallets and accounting software, to improve borrowing experiences.

In 2024, the Central Bank launched a pilot program. This program links P2P credit scores to the national registry, which helps in assessing risks more accurately. Sustainability is also gaining attention. Many platforms now offer lower rates for eco-friendly projects and renewable energy initiatives.

However, challenges remain. There are credit risks in unstable economic areas, and better financial literacy programs are needed. Still, the market is set for consolidation. Larger companies are acquiring niche platforms to expand their offerings. Looking ahead, cross-border P2P lending and partnerships with international fintechs could strengthen Brazil’s position as the top alternative credit hub in Latin America.

Brazil Peer-to-Peer Lending Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Loan Type:

Consumer Lending

Business Lending

Breakup by Business Model:

Marketplace Lending

Traditional Lending

Breakup by End User:

Consumer (Individual/Households)

Small Businesses

Large Businesses

Real Estate

Others

Breakup by Region:

Southeast

South

Northeast

North

Central-West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145