The global electrostatic precipitator (ESP) market is projected to witness robust growth from 2025 to 2035, driven by intensifying global initiatives to curb industrial air pollution. Valued at USD 8,164.8 million in 2025, the market is expected to nearly double, reaching USD 16,827.9 million by 2035. This growth trajectory reflects a steady CAGR of 7.5% over the forecast period, underscoring the critical role of ESPs in modern emission control strategies.

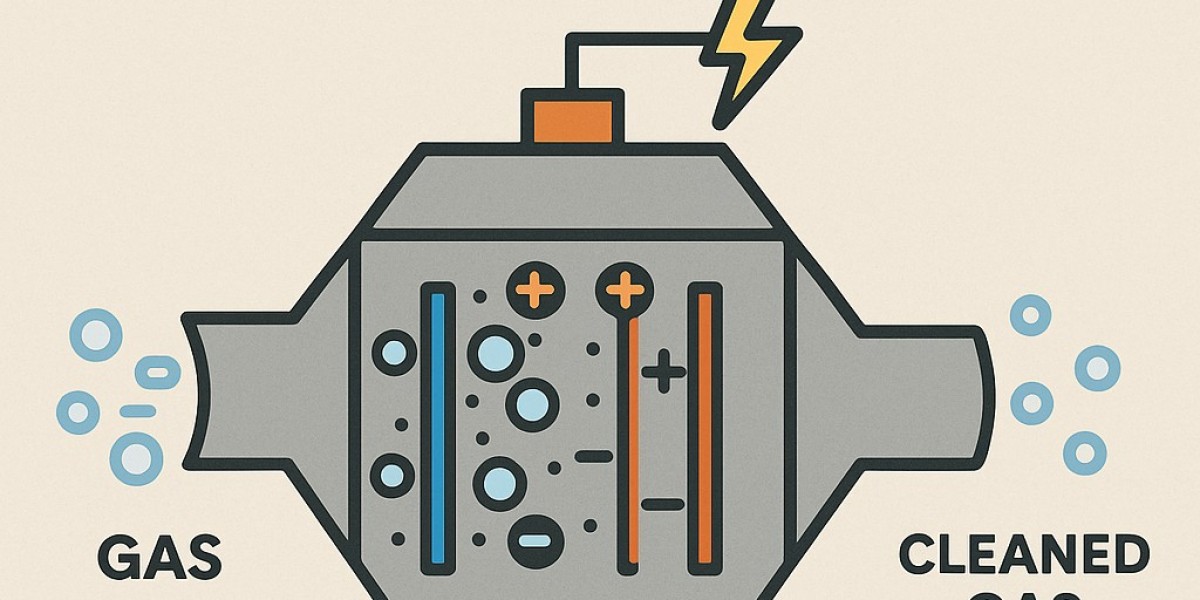

Electrostatic precipitators are indispensable for ensuring clean air in industries with high particulate emissions such as power generation, cement manufacturing, steel production, and chemical processing. Capable of removing over 99% of airborne particulates—including fine particles and heavy metals—ESPs are increasingly preferred for compliance with tightening air quality standards across industrial sectors.

Gain Valuable Insights from Industry Experts to Shape Your Growth Strategies. Access our Sample Report Now: https://www.futuremarketinsights.com/reports/sample/rep-gb-17173

Key Growth Drivers:

Accelerated industrialization and rapid urbanization, particularly in emerging economies, have heightened the urgency for efficient air purification solutions. Expanding megacities, new industrial corridors, and the growing public awareness of air quality issues are spurring investments in advanced pollution control technologies.

Stricter environmental policies, including the USA’s Clean Air Act, Euro VI norms, and China’s ultra-low emission directives, are compelling industries to adopt or upgrade ESP systems. Compliance with these mandates is pushing both new installations and retrofits in aging facilities to reduce emissions and align with sustainability commitments.

Emerging Trends and Innovations:

A notable shift is underway with the advent of smart ESPs integrated with artificial intelligence (AI) and IoT technologies. These advanced systems enable real-time diagnostics, predictive maintenance, and adaptive controls, significantly improving operational efficiency and reducing downtime.

Retrofitting older power plants and industrial units with modern ESPs is gaining momentum, aligning aging infrastructure with current emission norms and extending asset life while supporting global decarbonization efforts.

Additionally, the development of compact modular ESP designs is addressing space constraints in dense industrial settings. Hybrid systems and pre-conditioning solutions are also being employed to tackle limitations in handling high-resistivity dust, thus broadening the applicability of ESPs across diverse industries.

Operational Considerations:

While ESPs offer exceptional particulate removal efficiency with low pressure drop—translating to lower energy consumption—they come with certain operational and financial challenges. High initial capital costs and complex installation requirements can pose barriers for some industries. Maintenance remains critical, as consistent flue gas conditions are necessary to maintain peak performance and avoid issues like corrosion or arcing.

Industries are increasingly investing in advanced monitoring and control technologies to stabilize temperature, moisture, and gas flow conditions, ensuring optimal ESP efficiency and prolonging system lifespan.

Regional Outlook:

- North America: Growth is propelled by stringent EPA standards and retrofitting drives across the U.S.

- Latin America: Moderate expansion supported by mining and thermal power investments in countries like Brazil and Chile.

- Western Europe: High adoption driven by the region’s commitment to clean energy transitions and tight compliance frameworks.

- Eastern Europe: EU integration and industrial modernization fuel spending on emission control solutions.

- Asia Pacific: The fastest-growing region, led by China and India’s aggressive pollution control measures and large-scale industrialization.

- Middle East & Africa: Market expansion is linked to refinery developments, cement manufacturing growth, and increasing regulatory awareness.

Key Industry Players:

Prominent companies shaping the competitive landscape include General Electric (GE Grid Solutions), Siemens AG, Mitsubishi Heavy Industries Ltd., Babcock & Wilcox Enterprises, Inc., and Thermax Limited. These players are focusing on technological advancements, smart upgrades, and customized solutions to meet diverse industry demands while maintaining global compliance.

Conclusion:

As industries worldwide face mounting pressure to reduce emissions, the electrostatic precipitator market is set to play a pivotal role in delivering clean air solutions. While challenges such as high upfront costs and operational complexity persist, continuous innovation and regulatory support are ensuring that ESPs remain an essential component of sustainable industrial practices.