For businesses that have embraced Salesforce as their central operational platform, the continued reliance on external systems for vendor management often creates a significant operational disconnect. Accounts payable teams find themselves constantly switching between Salesforce for customer context and separate accounting software for vendor interactions, leading to inefficiencies, data discrepancies, and missed opportunities for strategic vendor relationships. This fragmentation becomes particularly problematic when trying to connect vendor spending to customer outcomes or project results. By bringing vendor bill and payment management directly into Salesforce, organizations can create a unified operational environment where vendor relationships receive the same sophisticated management as customer relationships, leading to improved efficiency, better terms, and stronger strategic partnerships.

The Disconnect Between Vendor and Customer Management

Most organizations manage vendor relationships fundamentally differently than customer relationships, despite both being crucial to business success. While customer information resides in Salesforce with detailed interaction histories, performance metrics, and relationship insights, vendor data often remains trapped in accounting systems that focus primarily on transactional details rather than relationship value. This separation means that teams cannot easily see how vendor performance impacts customer satisfaction or how vendor costs correlate with revenue generation. The accounts payable team processes invoices without visibility into which projects or customers those expenses support, while sales and service teams have no insight into vendor performance issues that might be affecting their accounts.

Centralizing Vendor Information and Relationships

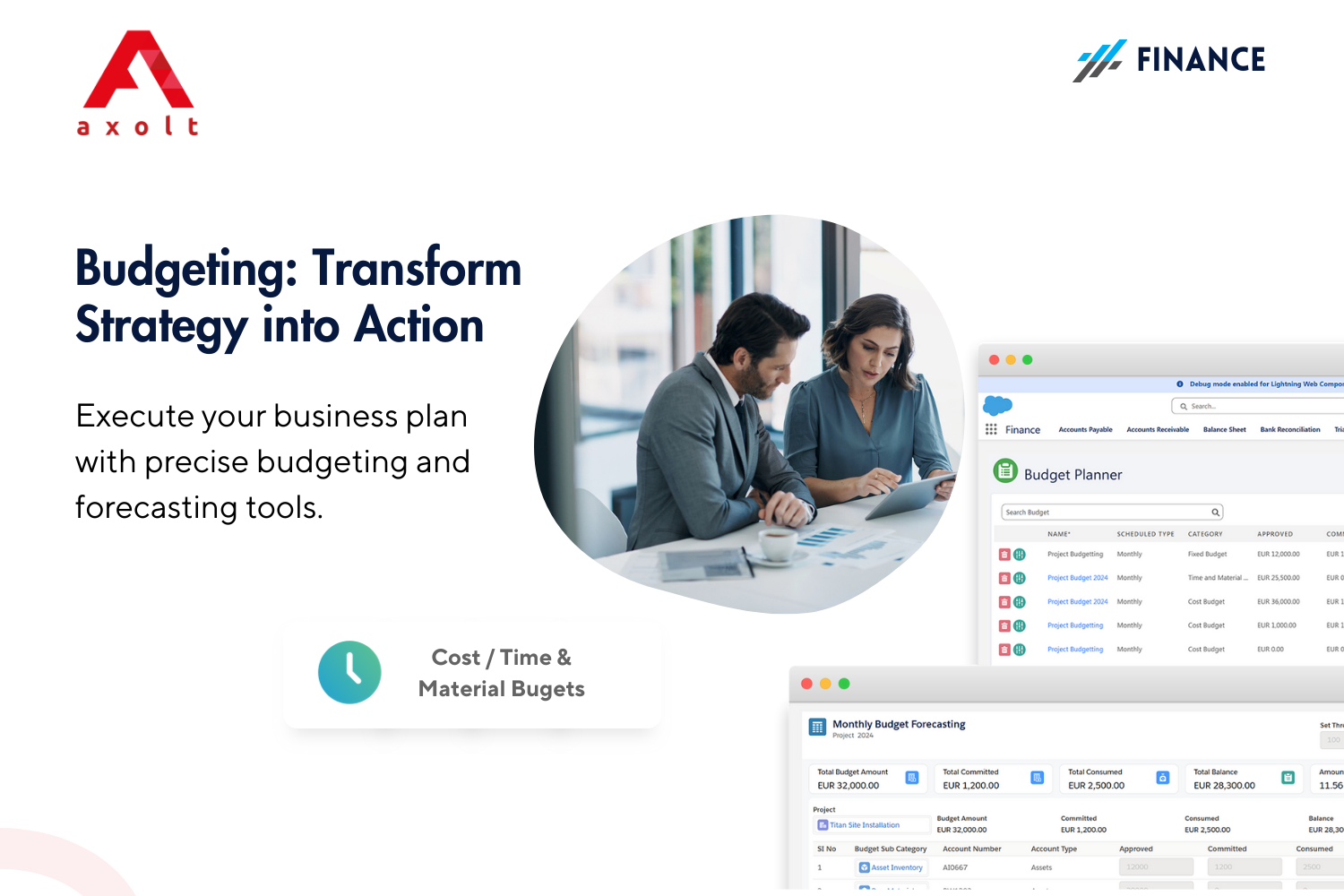

Moving vendor management into Salesforce begins Real-time Financial Workflow Salesforce comprehensive vendor profiles that go beyond basic payment information. These profiles can include contract terms, performance metrics, certification status, and relationship history—all stored alongside the vendor's transactions and communications. This centralized approach allows organizations to track not just what they pay vendors, but how vendors contribute to business outcomes. Teams can associate vendor expenses with specific clients, projects, or opportunities, creating a complete picture of how vendor relationships impact financial performance. This holistic view enables better vendor selection, more effective contract negotiations, and stronger ongoing relationship management.

Streamlining Bill Capture and Processing

The accounts payable process typically begins with the challenging task of capturing invoice data from various sources—paper documents, emails, PDF attachments, and electronic feeds. Within Salesforce, intelligent automation tools can transform this process. Optical character recognition technology can extract data from scanned invoices or PDFs, automatically populating fields for vendor details, amounts, and due dates. The system can automatically match incoming bills against purchase orders and receiving documents, flagging discrepancies for review while processing clean matches without manual intervention. This automated capture and matching significantly reduces processing time while improving accuracy and preventing duplicate payments.

Automated Workflow and Approval Routing

Vendor bill processing requires careful oversight and appropriate approvals based on organizational policies. Salesforce's workflow automation capabilities provide sophisticated routing based on multiple factors including invoice amount, vendor category, department, and budget availability. The system can automatically escalate invoices approaching due dates, route exceptions to specialized teams, and ensure proper segregation of duties through configurable approval hierarchies. Approvers receive notifications within their Salesforce environment with all relevant context—purchase order details, contract terms, and budget status—enabling informed decisions without searching for supporting documentation. This streamlined approval process maintains control while accelerating processing times.

Integrated Payment Processing and Execution

The payment phase represents where many organizations lose the connection between vendor management and financial strategy. Within Salesforce, payment processing can integrate directly with banking systems while maintaining full visibility into the entire process. The system can schedule payments to optimize cash flow, capturing early payment discounts when advantageous and holding payments until due dates when better for working capital. Electronic payment processing reduces manual effort while providing immediate confirmation and reconciliation. Most importantly, payment data connects back to vendor records, providing valuable intelligence on payment terms effectiveness, vendor payment preferences, and opportunities for payment term optimization.

Gaining Strategic Vendor Insights

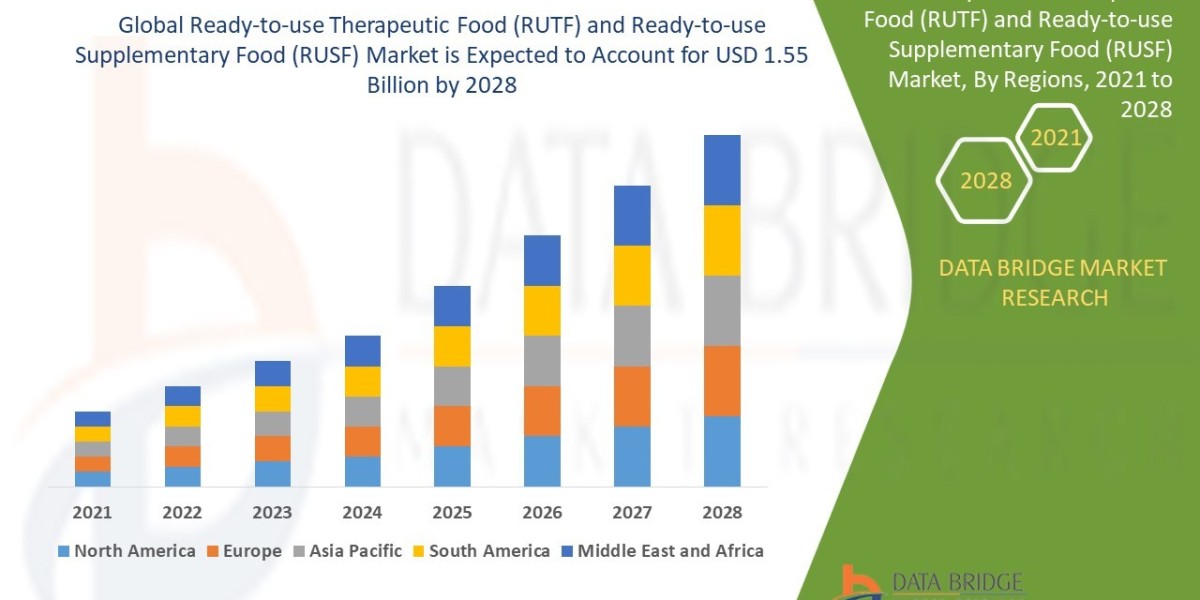

When vendor bill and payment management operates within Salesforce, organizations gain unprecedented insights into their vendor relationships and spending patterns. Custom reports and dashboards can analyze vendor performance by cost, quality, and reliability. Spending analysis can identify opportunities for vendor consolidation, volume discounts, or contract renegotiation. The connection between vendor costs and customer outcomes enables calculation of true cost-to-serve metrics and customer profitability analysis. These strategic insights transform accounts payable from a transactional function into a strategic capability that contributes directly to organizational performance and competitive advantage.