Vietnam Renewable Energy Market Overview

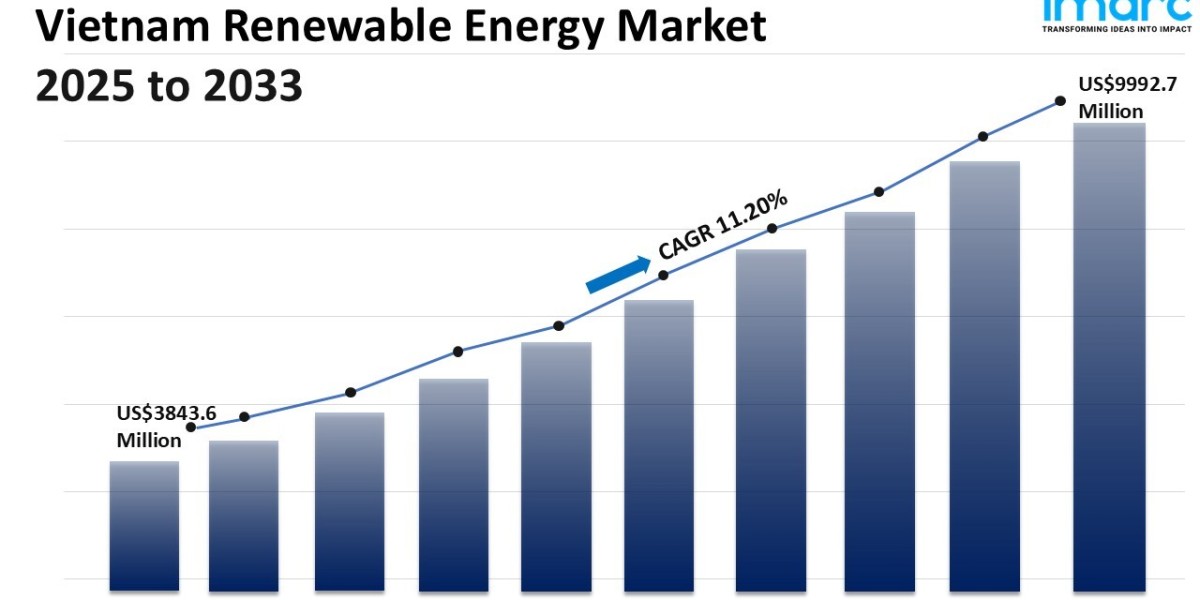

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 3,843.6 Million

Market Forecast in 2033: USD 9,992.7 Million

Market Growth Rate (2025-33): 11.20%

Vietnam renewable energy market size reached USD 3,843.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,992.7 Million by 2033, exhibiting a growth rate (CAGR) of 11.20% during 2025-2033. The rising focus on environmental conservation and sustainability, and availability of abundant renewable energy resources, including ample sunlight and strong wind, and technological advancements in renewable energy technologies represent some of the key factors driving the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-renewable-energy-market/requestsample

Vietnam Renewable Energy Market Trends and Drivers:

Vietnam's renewable energy landscape is rapidly evolving beyond its initial solar surge, with offshore wind emerging as the cornerstone of future capacity expansion and grid stability. Following the saturation of prime onshore locations and grid constraints experienced during the solar FiT rush, the government's ambitious targets outlined in Power Development Plan VIII (PDP8) explicitly prioritize large-scale offshore wind development, targeting at least 6 GW by the end of the decade. This strategic pivot leverages Vietnam's extensive coastline and superior offshore wind resources, attracting major international developers with multi-billion-dollar projects. Concurrently, diversification is evident through the maturation of onshore wind in new regions, nascent exploration of utility-scale battery storage (BESS) pilots to address intermittency, and growing interest in distributed generation models like rooftop solar paired with storage for commercial & industrial (C&I) consumers. This diversification is not merely additive; it represents a fundamental shift towards a more balanced, resilient, and technologically advanced renewable portfolio capable of meeting baseload and peak demand more effectively, underpinning long-term energy security and decarbonization goals. Future demand will be heavily driven by large industrial consumers seeking reliable, cost-competitive clean power, facilitated by evolving market mechanisms.

The transition from rigid Feed-in-Tariffs (FiTs) towards market-driven frameworks is fundamentally reshaping investment and project development. The long-awaited direct corporate power purchase agreement (DPPA) pilot program, finally approved in early 2024, marks a pivotal shift, enabling large commercial and industrial consumers to contract directly with renewable generators, bypassing EVN as the sole off-taker. This unlocks significant pent-up corporate demand for renewable energy to meet sustainability targets and mitigate price volatility, attracting a new wave of primarily foreign and large domestic investment. Simultaneously, the government is developing competitive auction mechanisms (expected details imminently) for large-scale solar and wind projects, replacing FiTs to drive down costs and ensure efficient resource allocation. This regulatory evolution, while complex and requiring continuous refinement (particularly concerning bankability, grid access guarantees, and standardized contracts), is essential for sustaining growth beyond initial subsidies. Future demand hinges critically on the successful scaling and refinement of these mechanisms – DPPAs for C&I and auctions for utility-scale – creating a transparent, bankable, and liquid market that attracts diverse capital and efficiently connects supply with sophisticated demand.

The unprecedented renewable capacity addition (over 21,000 MW of solar and wind since 2019) has starkly exposed the limitations of Vietnam's transmission and distribution infrastructure, creating a major bottleneck for future growth. Congestion, particularly in high-potential renewable regions like Ninh Thuan and Binh Thuan, has led to significant curtailment, undermining project economics. Recognizing this as the single largest constraint, PDP8 prioritizes massive grid investment, requiring an estimated $15-20 billion over the next decade for thousands of kilometers of new high-voltage lines, substation upgrades, and enhanced grid control systems. Crucially, this modernization extends beyond capacity expansion to embrace smart grid technologies, advanced forecasting, and flexible resource integration (like BESS and demand response) essential for managing the inherent variability of renewables at scale. Future renewable demand growth is intrinsically linked to the pace and effectiveness of this grid transformation. Success requires not only substantial capital investment managed efficiently by EVN and potentially private partners but also robust regulatory frameworks incentivizing flexibility and ensuring fair access, ultimately determining how much new renewable capacity the system can reliably absorb and deliver to load centers.

Vietnam Renewable Energy Market Industry Segmentation:

Type Insights:

- Wind

- Solar

- Hydro

- Others

End User Insights:

- Industrial

- Residential

- Commercial

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=19771&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302