India E-Cigarette Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

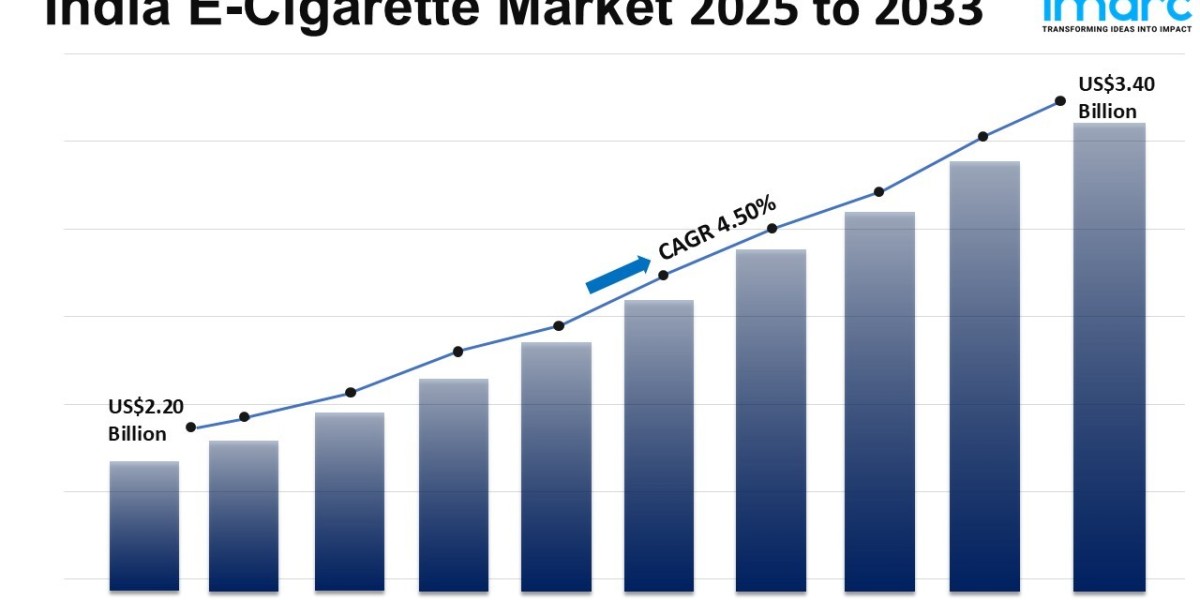

Market Size in 2024: USD 2.20 Billion

Market Forecast in 2033: USD 3.40 Billion

Market Growth Rate (2025-2033): 4.50%

The India e-cigarette market size reached USD 2.20 Billion 2024 in . Looking forward, IMARC Group expects the market to reach USD 3.40 Billion by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is driven by increased health consciousness, growing demand for alternatives to tobacco smoking, and rising disposable incomes. Additionally, the trend toward smoke-free living, government regulations on tobacco products, and social media campaigns are also contributing significantly to the India e-cigarette market growth.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/india-e-cigarette-market/requestsample

India E-Cigarette Market Trends and Drivers:

The India e-cigarette market is experiencing rapid expansion, fueled by shifting consumer preferences and evolving regulatory landscapes. A growing awareness of harm reduction compared to traditional tobacco products is encouraging smokers to explore vaping alternatives. Urbanization and rising disposable incomes are further amplifying demand, particularly among younger demographics seeking modern, tech-driven smoking solutions. Additionally, the proliferation of online retail platforms is making e-cigarettes more accessible, bypassing traditional distribution challenges. Companies are capitalizing on this trend by introducing innovative, user-friendly devices and flavored e-liquids tailored to local tastes. While regulatory uncertainties persist, the market’s potential remains robust, with manufacturers focusing on compliance and consumer education to foster long-term adoption.

Technological advancements are playing a pivotal role in shaping the India e-cigarette market, with manufacturers investing in sleek, high-performance devices that enhance user experience. Features such as longer battery life, customizable nicotine levels, and leak-proof designs are gaining traction among discerning consumers. The rise of pod-based systems and disposable vapes is particularly noteworthy, offering convenience and affordability to first-time users. Furthermore, strategic collaborations between global vaping brands and Indian distributors are accelerating market penetration, ensuring a steady supply of premium products. Social media and influencer marketing are also contributing to heightened visibility, normalizing vaping culture among urban millennials. As innovation continues to drive product differentiation, the market is poised for sustained growth, supported by a burgeoning ecosystem of vape shops and online communities.

Another critical driver of the India e-cigarette market is the increasing emphasis on smoking cessation and wellness-oriented lifestyles. Health-conscious consumers are turning to vaping as a transitional tool to reduce tobacco dependency, spurred by mounting evidence of its relative safety compared to combustible cigarettes. Medical professionals and public health advocates are gradually acknowledging its role in harm reduction, creating a more favorable perception. Simultaneously, local entrepreneurs are entering the space, developing indigenous e-liquid brands that cater to regional flavor preferences, such as paan and cardamom. This localization strategy is bridging the gap between global trends and domestic demand, fostering a more inclusive market. With rising investments in R&D and consumer awareness campaigns, the sector is set to unlock new growth avenues, positioning India as a promising hub for the vaping industry in the coming years.

India E-Cigarette Market Industry Segmentation:

Product Insights:

- Modular e-cigarettes

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

Flavor Insights:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

Mode of Operation Insights:

- Automatic E-Cigarette

- Manual E-Cigarette

Distribution Channel Insights:

- Specialist E-Cig Shops

- Online

- Supermarkets and Hypermarkets

- Tobacconist

- Others

Regional Insights:

- North India

- South India

- East India

- West India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=31072&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145