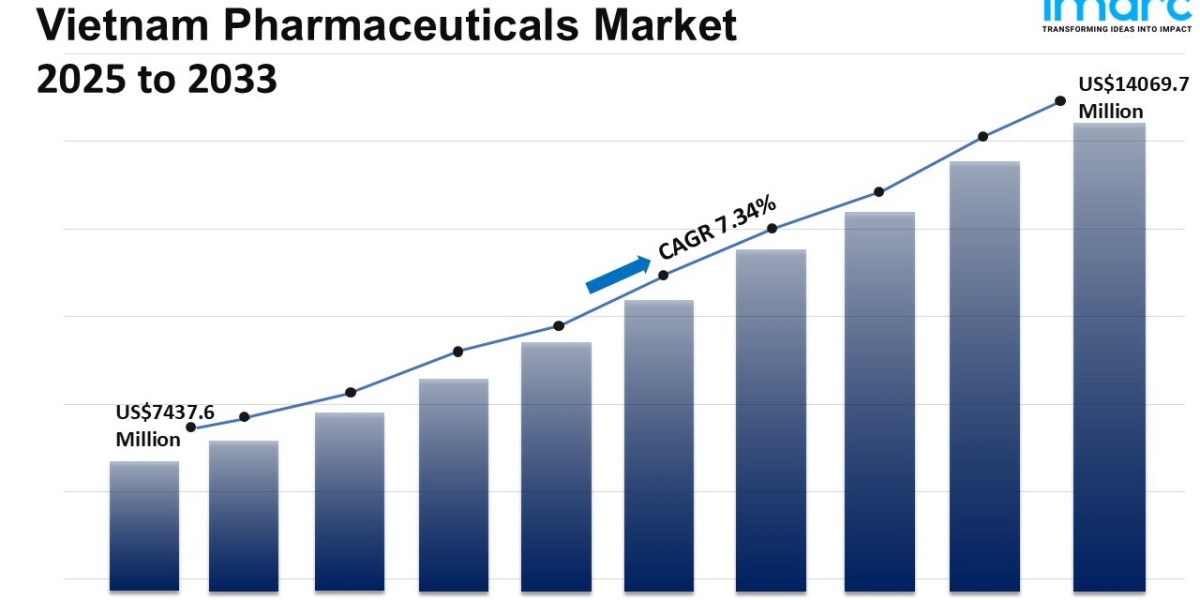

Vietnam Pharmaceuticals Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 7,437.6 Million

Market Forecast in 2033:USD 14,069.7 Million

Market Growth Rate (2025-33): 7.34%

The Vietnam pharmaceuticals market size reached USD 7,437.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 14,069.7 Million by 2033, exhibiting a growth rate (CAGR) of 7.34% during 2025-2033. Key factors driving the market include the growing collaboration between pharmaceutical companies to manufacture enhanced pharmaceutical products, the increasing geriatric population, the rising prevalence of various infectious diseases caused by novel viruses, and the high burden of chronic diseases, with cardiovascular diseases (CVDs) causing over 100,000 deaths and affecting approximately 1.6 million people in Vietnam. These factors collectively contribute to the expansion of the pharmaceutical market in Vietnam.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-pharmaceuticals-market/requestsample

Vietnam Pharmaceuticals Market Trends and Drivers:

The Vietnamese pharmaceutical market is going through a major transformation, fueled by strategic regulatory changes and trade liberalization. The government is dedicated to enhancing its regulatory framework, heavily influenced by international agreements like the EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). This commitment is driving a sector-wide uplift in standards. A key development is the gradual adoption of Good Manufacturing Practice (GMP) standards that align with those of the PIC/S (Pharmaceutical Inspection Co-operation Scheme), moving beyond the basic WHO-GMP guidelines. This shift isn’t just about compliance; it’s a strategic move that’s pushing local manufacturers to consolidate while also creating a clearer and more predictable environment for multinational corporations (MNCs) to launch new drugs. As a result, the market is experiencing a dual dynamic: there’s a strong push for high-value, innovative medicines from abroad, alongside a growing demand for improved local manufacturing capacity and quality. This regulatory evolution is directly speeding up market growth, attracting more foreign direct investment in advanced production facilities, and raising the overall quality and safety of the domestic drug supply. Ultimately, this benefits patient outcomes and positions Vietnam as an increasingly important player in the ASEAN pharmaceutical scene.

The rapid rise of digital health technologies is shaking up the traditional ways we think about pharmaceutical distribution and how patients engage with their healthcare. In the wake of the pandemic, telemedicine and e-pharmacy platforms have moved from being just niche options to becoming essential parts of Vietnam's healthcare landscape. This digital transformation is driven by the widespread use of smartphones, government initiatives pushing for a national digital shift, and a growing desire among consumers for convenience and easy access. For pharmaceutical companies, this means they need to shift gears from focusing solely on products to adopting a more comprehensive, patient-centered approach. This includes embracing digital therapeutics, apps that help with medication adherence, and services for remote patient monitoring. The growth of e-pharmacies is ramping up competition, pushing traditional pharmacies to step up their game, often by blending in new hybrid models. This wave of digitalization is creating a treasure trove of real-world data, providing valuable insights into treatment trends and patient behaviors that can guide future research, development, and personalized marketing efforts. Companies that can effectively harness data analytics and build strategic partnerships with tech startups and telehealth providers will be in the best position to thrive in this new, digitally-focused market.

The shift in our health landscape towards non-communicable diseases (NCDs) is a major long-term driver of growth, fueling a steady demand for pharmaceuticals and influencing national health policies. With an aging population, urbanization, and changes in diet, we've seen a significant rise in conditions like diabetes, heart disease, hypertension, and cancer. This transition has moved our focus from treating acute infectious diseases to managing chronic conditions over the long haul, which has led to a greater need for ongoing medication and advanced treatment options. In response, the Vietnamese government is actively fostering the growth of a strong domestic pharmaceutical sector through initiatives like "Project Vietnam Pharma 2030." This project aims to boost self-sufficiency and lessen the heavy dependence on imported medications. It includes substantial investment incentives for local companies to develop their expertise in producing complex generics, biosimilars, and essential active pharmaceutical ingredients (APIs). The current landscape is a competitive one, with multinational corporations providing cutting-edge, often pricier, innovative treatments, while local manufacturers are stepping up to deliver quality generics and biopharmaceuticals that meet the high-volume demands of the public health insurance system, ensuring that a growing number of patients can access affordable care.

Vietnam Pharmaceuticals Market Industry Segmentation:

Drug Type Insights:

- Generic Drugs

- Branded Drugs

Product Type Insights:

- Prescription Drugs

- Over-The-Counter Drugs

Application Insights:

- Cardiovascular

- Metabolic Disorder

- Oncology

- Anti-infective

- Musculoskeletal

- Others

Distribution Channel Insights:

- Retail Pharmacy

- Hospital Pharmacy

- E-Pharmacy

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=16820&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302