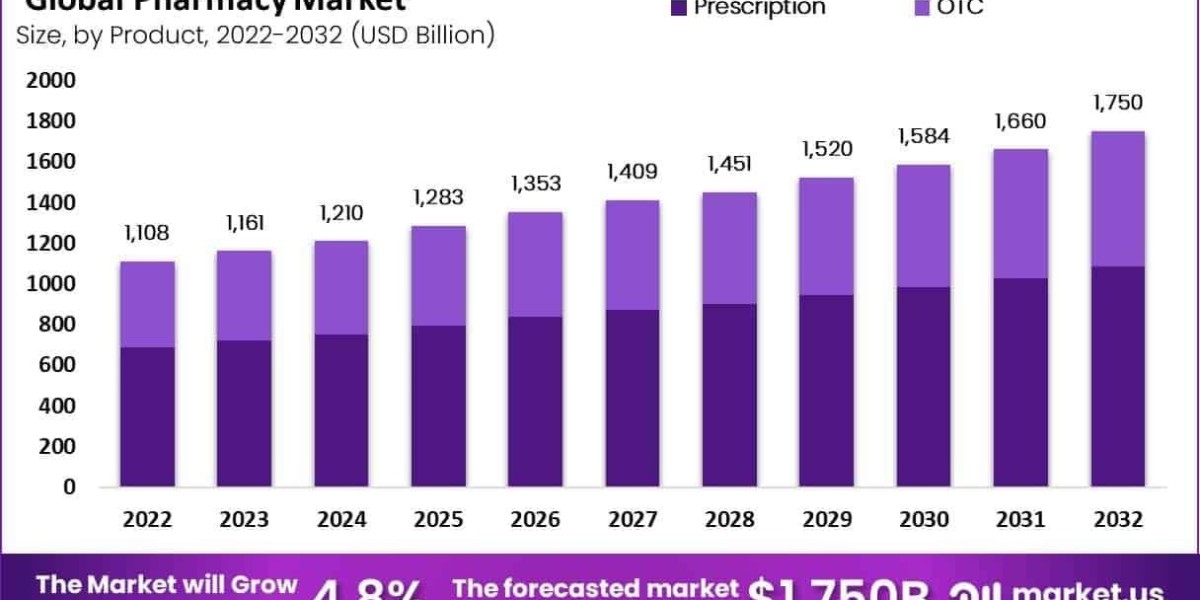

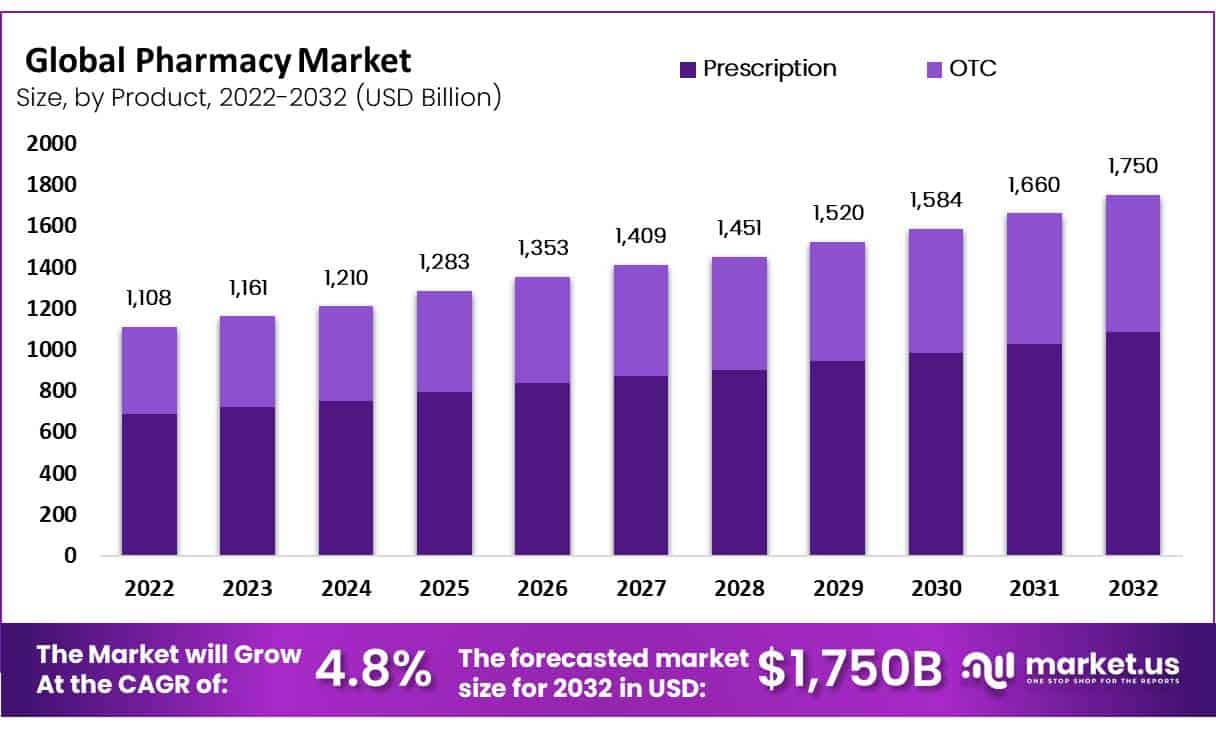

The global pharmacy market size is expected to be worth around USD 1,750 billion by 2032 from USD 1,108 billion in 2022, growing at a CAGR of 4.8% during the forecast period from 2022 to 2032.

By 2025, the Pharmacy Market is embracing specialty pharmacy services and value-based care models. Pharmacies are now qualifying as hubs for dispensing high-cost biologics, oncology support, and rare disease therapies, including comprehensive patient education, financial counseling, and adherence management. Analytics platforms are being used to monitor outcomes, support prior authorizations, and ensure therapy persistence.

Collaborative care agreements between specialist physicians and pharmacies streamline complex medication regimens. Payers are implementing outcomes-based contracts where reimbursement hinges on patient response metrics. With rising specialty drug use and pressure to control costs, pharmacies are evolving into critical strategic partners in value-based care delivery.

Click here for more information: https://market.us/report/pharmacy-market/

Emerging Trends

- Expansion of specialty pharmacy infrastructure for biologics and infusion therapies.

- Outcomes-based reimbursement agreements tied to patient adherence and health outcomes.

- Integrated patient support programs, including financial navigation and side-effect management.

- Data-driven prior authorization and formulary optimization systems within pharmacy platforms.

Use Cases

- A specialty pharmacy coordinates home infusion for an autoimmune biologic, tracking adherence through telephonic check-ins.

- A payer–pharmacy partnership reimburses only when HIV viral loads stay suppressed at 12 weeks.

- A patient receiving oncology therapy accesses side-effect support tools via pharmacist-led mobile app notifications.

- An internally developed dashboard flags delays in medication pickups, prompting pharmacist outreach to resolve barriers.